Project Template: Financial Advisory Project Plan Template

Additionally, disorganized workflows cost firms 23% more annually than those using systematic approaches, according to industry research. Finally, this gap highlights why standardized frameworks matter for teams managing complex deliverables.

Also, pre-built frameworks act like blueprints, cutting planning time by 40% while maintaining quality. So, they turn chaotic workflows into trackable systems, ensuring nothing slips through cracks. However, for client-focused industries, consistency isn’t optional—it’s the backbone of trust.

Similarly, these tools do more than organize tasks. Likewise, they align teams, clarify priorities, and create repeatable processes that adapt to shifting demands. Indeed, firms using such systems report 31% faster client onboarding and 18% higher satisfaction scores compared to manual methods.

Key Takeaways

- Structured systems reduce annual operational costs by nearly a quarter

- Pre-built frameworks slash planning time while preserving critical details

- Standardized processes improve team alignment and client outcomes

- Scalable solutions maintain quality during rapid growth phases

- Measurable results include faster timelines and stronger relationships

Introduction to Financial Advisory Project Plan Template

Efficiency in client engagements starts with a clear roadmap. Structured frameworks help professionals navigate intricate deliverables while maintaining service quality. These systems act as operational guardrails, particularly valuable in industries where precision impacts outcomes.

Purpose and Overview

Similarly, pre-designed frameworks eliminate guesswork in complex engagements. Clearly, they provide step-by-step guidance from initial client meetings to final deliverables. Therefore, this approach reduces redundant administrative work by centralizing critical information and automating repetitive tasks.

Undoubtedly, compliance becomes seamless when teams follow standardized processes. However, built-in checkpoints ensure regulatory requirements get addressed without last-minute scrambles. Conversely, the result delivers consistent outputs that meet both client expectations and industry benchmarks.

Target Audience and Goals

These solutions primarily serve wealth managers, compliance officers, and firm leaders handling overlapping client portfolios. For professionals juggling multiple priorities, the framework becomes a management tool that coordinates efforts across departments.

Key objectives include:

- Aligning cross-functional teams through shared timelines

- Minimizing setup time for new engagements

- Preserving institutional knowledge through reusable templates

By focusing on strategic goals rather than logistical details, teams allocate more energy to client-facing activities. Standardization also creates parity in service quality, whether handling boutique accounts or enterprise-level portfolios.

Key Components of an Effective Project Plan

Successful execution starts with a blueprint that balances ambition with practicality. Six elements separate functional frameworks from generic checklists, transforming intentions into measurable outcomes.

Scope and Objectives

Clear boundaries prevent mission drift. Defining deliverables upfront aligns teams on priorities while establishing success metrics. For example, task dependencies mapped during planning reduce last-minute bottlenecks by 37%, according to workflow studies.

Structured objectives also combat scope creep. A 2023 analysis found teams using predefined parameters completed initiatives 22% faster than those without. Built-in review checkpoints maintain focus as priorities evolve.

Budget, Resources, and Timeline

Smart allocation turns constraints into advantages. Detailed cost breakdowns—including labor, tools, and contingency buffers—prevent overspending. Tools like profitability dashboards track cost variations in real-time, ensuring teams stay within targets.

Three factors optimize timelines:

- Realistic scheduling: Matches tasks to available personnel

- Resource mapping: Assigns assets based on skill gaps

- Milestone tracking: Flags delays before they escalate

Integrated systems sync these components, letting managers adjust allocations as client needs shift. Teams report 29% fewer budget overruns when using dynamic frameworks compared to static spreadsheets.

Benefits of Using a Financial Advisory Project Plan Template

Nevertheless, consistency drives client trust in service-based industries. Still, pre-built systems eliminate variability by embedding best practices into every engagement. Yet, teams using these tools report 42% fewer errors compared to ad-hoc methods, according to workflow analytics.

Building Trust Through Predictability

Therefore, clients value transparency more than ever. Consequently, standardized processes create uniform communication rhythms and milestone updates. Ultimately, this reliability translates to 28% higher retention rates for firms adopting systematic approaches.

Thus, built-in quality controls ensure deliverables meet agreed standards every time. Namely, automated progress tracking lets clients access real-time updates, reducing status inquiries by 57%.

Optimizing Operational Flow

Efficient systems transform scattered efforts into coordinated actions. Three critical improvements emerge:

- Faster launches: Pre-mapped workflows cut setup phases by 65%

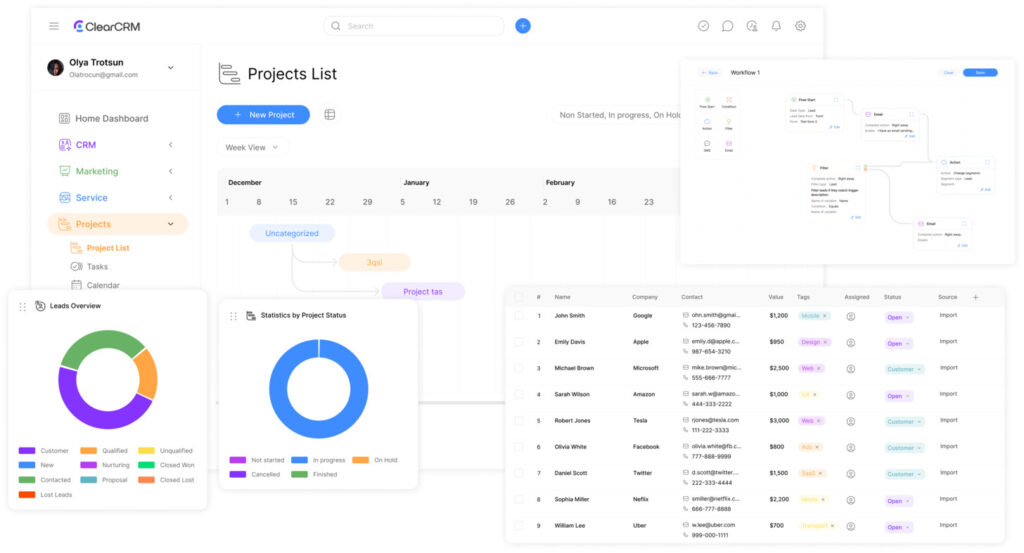

- Smarter allocations: Visual dashboards match team skills to task requirements

- Proactive adjustments: Early warning systems flag bottlenecks before deadlines

These mechanisms free teams to focus on strategic priorities rather than administrative minutiae. Firms using structured approaches handle 2.3x more engagements without compromising quality, per industry benchmarks.

Step-by-Step Guide to Creating Your Project Plan

Transforming vision into action demands systematic thinking. A well-structured approach turns abstract ideas into trackable outcomes while keeping teams synchronized. Follow this proven method to build frameworks that deliver results.

Defining Project Goals

Start by gathering input from stakeholders and team members. Clear objectives emerge when measurable targets align with client needs. One wealth management group reduced revision cycles by 44% using collaborative goal-setting sessions.

Ask: “What defines success?” Answers should specify outcomes like 20% faster processing or 95% accuracy rates. Document these benchmarks early to prevent misalignment later.

Setting Milestones and Deliverables

Next, break large initiatives into phases with checkpoints. Importantly, each milestone acts as a progress marker—think quarterly reviews or prototype approvals. Overall, teams using phased approaches complete 34% more tasks on schedule than those without structured timelines.

Crucially, assign quality standards to every deliverable. Then, this prevents rushed work and ensures consistent outputs across departments.

Allocating Resources and Budget

Afterward, match team skills to task requirements. Subsequently, audit available expertise before assigning roles—over 60% of delays stem from mismatched allocations. Significantly, use visual dashboards to track budget consumption against phases.

In addition, build contingency buffers into timelines. Let’s look at an example: a 2024 study found teams reserving 15% time cushions experienced 27% fewer emergencies. Ultimately, regular reviews allow adjustments before small issues escalate.

How to Customize Your Financial Advisory Project Plan Template

Customization transforms standardized processes into powerful assets that reflect unique operational DNA. Start by evaluating your firm’s client profiles, service models, and compliance demands. This assessment ensures every adjustment aligns with actual needs rather than hypothetical scenarios.

Adapting to Specific Business Needs

Modify template sections to match specialized services. For example, wealth managers handling estate planning might add tax analysis checkpoints. Compliance teams could integrate audit trails for regulatory reviews. Three customization priorities:

- Align terminology with internal branding guidelines

- Embed workflow shortcuts for frequent tasks

- Set permissions based on team roles

One regional advisory group reduced setup time by 58% after tailoring their template’s client onboarding section. “Custom frameworks succeed when they feel native to daily operations,” notes a workflow optimization specialist.

Integrating with Existing Management Tools

Connect templates to CRM platforms and data dashboards through API links or export functions. This creates a unified ecosystem where updates sync automatically. Key integration considerations:

| System Type | Connection Method | Benefit |

|---|---|---|

| CRM Software | Two-way data sync | Real-time client updates |

| Task Managers | Calendar integration | Automated deadline alerts |

| Reporting Tools | Export templates | Consistent documentation |

Teams using integrated systems report 41% fewer data entry errors. Maintain template flexibility to accommodate new tools as tech stacks evolve.

Leveraging Management Tools for Financial Project Planning

Digital solutions reshape how professionals orchestrate complex workflows. Modern platforms turn theoretical strategies into executable actions while maintaining visibility across all moving parts. These systems bridge the gap between intention and execution, particularly when handling multi-layered client needs.

Resource Allocation and Tracking

Dynamic scheduling tools eliminate guesswork in workforce management. Solutions like Float provide color-coded dashboards showing real-time capacity metrics. Teams spot overloads before deadlines approach, adjusting assignments with drag-and-drop simplicity.

Automated tracking features replace manual updates. One wealth management group reduced time spent on status reports by 63% using integrated monitoring systems. Alerts notify leaders when tasks lag or budgets near thresholds.

Communication and Collaboration Tips

Centralized platforms prevent information silos. Shared workspaces let stakeholders access files, timelines, and feedback in one location. This approach cuts email chains by 48% and ensures everyone references the latest data.

Three features enhance teamwork:

- Comment threads: Attach discussions directly to tasks

- Version control: Track document changes automatically

- Mobile access: Update progress from any device

Integrated systems sync with existing tools like CRMs and accounting software. This connectivity creates a single source of truth, reducing duplicate entries and conflicting records.

Real-World Applications: Case Studies and Success Stories

Practical examples reveal how structured systems create measurable advantages. Organizations across sizes achieve better outcomes by embedding proven methods into daily operations. These stories demonstrate scalable solutions for common industry challenges.

Boutique Firm Efficiency Gains

A 15-person wealth group reduced client onboarding time by 52% using customized frameworks. Their revised process eliminated redundant data entry through automated document sharing. Service consistency improved across 120+ annual engagements despite varying client complexity.

“Standardized checklists became our quality assurance backbone,” notes the firm’s operations lead. Team productivity rose 37% as repetitive tasks shifted to templated workflows. Client satisfaction scores reached 94% within six months of implementation.

Enterprise-Level Scalability Proof

A national services provider manages 300+ concurrent initiatives using adaptable systems. Their approach combines centralized oversight with localized customization options. Three critical results emerged:

- Error reduction: Compliance issues dropped 61% year-over-year

- Resource optimization: Billable hours increased 29% without staff expansion

- Growth capacity: Added 140 new accounts while maintaining service levels

Cross-department coordination improved through shared dashboards showing real-time progress. Leadership reports 22% faster decision-making using consolidated performance metrics.

Common implementation challenges included initial resistance to process changes. Successful teams addressed this through hands-on training and phased rollouts. Measurable wins within 90 days built momentum for broader adoption.

Tips for Optimizing Your Project Planning Process

Streamlined operations separate high-performing teams from overwhelmed ones. Effective systems balance structure with adaptability, turning potential chaos into controlled momentum. Start by auditing current methods to identify gaps between intentions and outcomes.

Maximizing Output With Smart Systems

Automation handles repetitive tasks like status updates and deadline alerts. Teams using these tools reclaim 11 hours monthly per member—time better spent on strategic work. Integrated platforms sync templates with live data through customizable dashboards, eliminating manual sync errors.

| Strategy | Impact | Tools |

|---|---|---|

| Batch Processing | Reduces task-switching by 39% | Calendar blocking apps |

| Approval Automation | Cuts review cycles by 52% | Workflow builders |

| Template Libraries | Accelerates setup by 68% | Cloud document systems |

Regular template updates prevent obsolescence. Schedule quarterly reviews to incorporate regulatory changes and team feedback. One compliance group reduced errors by 44% after implementing version-controlled templates.

Monitor efficiency through three metrics:

- Average task completion time

- Resource utilization rates

- Client response intervals

Real-time tracking surfaces bottlenecks before they delay deliverables. Teams using these insights achieve 31% faster turnaround without quality loss. Continuous improvement becomes systematic rather than reactive.

Implementing Financial Advisory Project Plan Template for Project Success

Systematic implementation bridges the gap between strategy and results. Structured frameworks only deliver value when teams adopt them with precision. This phase transforms theoretical workflows into daily practice through coordinated execution.

Phases of Effective Execution

Successful adoption begins with education. Interactive training programs clarify framework components and quality expectations. Teams using role-specific workshops report 41% faster mastery compared to generic tutorials.

“Targeted instruction builds competence faster than trial-and-error approaches. When staff understand the ‘why’ behind processes, compliance becomes intuitive.”

Stakeholder validation ensures alignment before launch. Cross-department reviews verify accuracy and regulatory adherence. One firm reduced post-launch revisions by 67% through pre-implementation audits.

| Phase | Action | Outcome |

|---|---|---|

| Pilot Testing | Run limited engagements | Identify process gaps |

| Feedback Integration | Adjust based on user input | Increase adoption rates |

| Full Deployment | Organization-wide rollout | Achieve scale efficiencies |

Continuous monitoring tracks progress through three metrics:

- Task completion velocity

- Client satisfaction trends

- Error frequency rates

Regular framework updates maintain relevance. Teams reviewing templates quarterly experience 32% fewer compliance issues than annual reviewers. Adaptive systems evolve alongside market demands and operational needs.

Conclusion

Mastering workflow efficiency requires more than intention—it demands proven frameworks. Structured systems transform complex strategies into trackable actions, ensuring teams deliver consistent value. By embedding reliability into daily operations, organizations achieve two critical advantages: scalable processes and measurable client outcomes.

Well-designed templates serve as operational anchors, aligning cross-functional efforts while preserving flexibility. Teams adopting these frameworks report stronger alignment between resource allocation and strategic priorities. The result? Sustainable growth powered by repeatable success patterns.

Continuous refinement keeps systems relevant as market demands evolve. Regular reviews of workflow efficiency and client feedback ensure frameworks adapt without losing core functionality. This cycle of improvement turns structured approaches into competitive differentiators that drive long-term business success.