Insurance Broker CRM With Comprehensive CRM

The Challenge for Insurance Brokers

Running an insurance brokerage comes with unique challenges that generic business tools simply can’t address. Without a specialized Insurance Broker CRM, these pain points can severely limit your growth potential.

Missed Renewal Opportunities

When tracking policy renewals manually, it’s easy for critical dates to slip through the cracks. Each missed renewal isn’t just a lost commission – it’s a damaged client relationship that’s difficult to repair.

Disorganized Client Information

Storing client data across spreadsheets, emails, and paper files makes it nearly impossible to get a complete view of your client relationships. This fragmented approach leads to repetitive questions, overlooked details, and a frustrating experience for both you and your clients.

Inefficient Workflows

Without automation, insurance brokers spend hours on administrative tasks like data entry, document creation, and follow-up reminders. This manual approach is not only error-prone but also prevents you from focusing on revenue-generating activities.

Limited Scalability

As your brokerage grows, managing an expanding client base becomes increasingly difficult without proper systems in place. Many brokers hit a growth ceiling simply because their operational processes can’t scale efficiently.

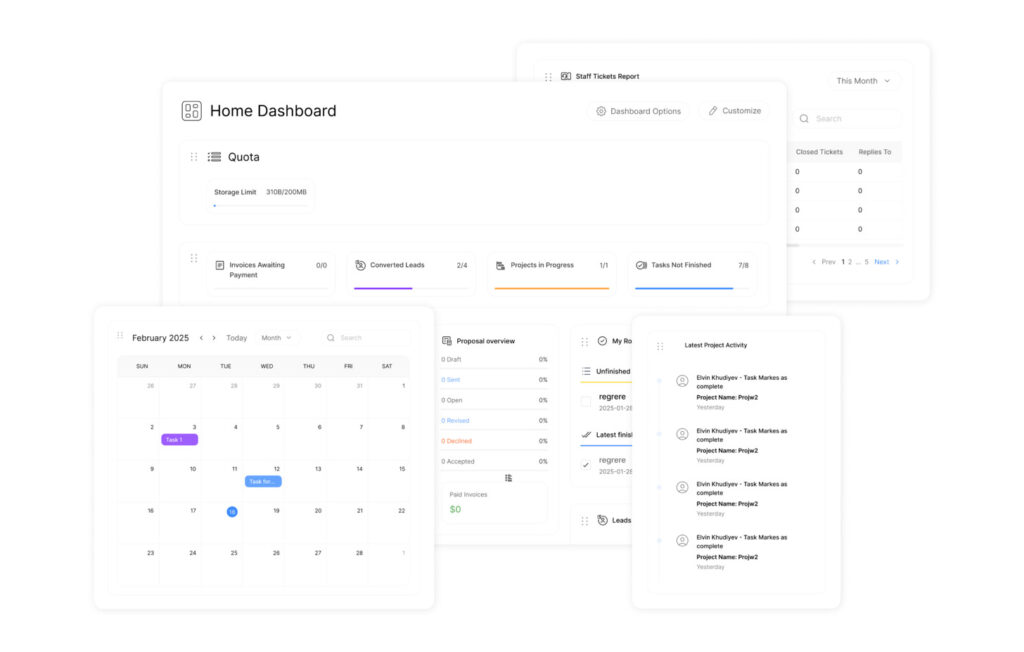

How ClearCRM Transforms Insurance Brokerages

ClearCRM isn’t just another generic CRM system – it’s built specifically for insurance brokers, with features designed to address the unique challenges of the insurance industry.

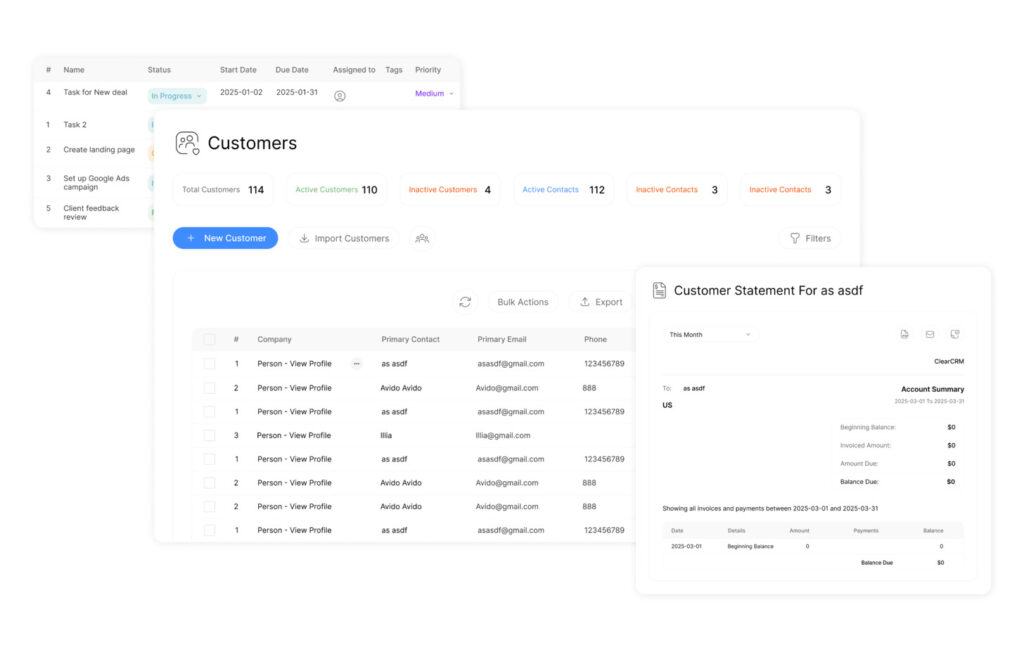

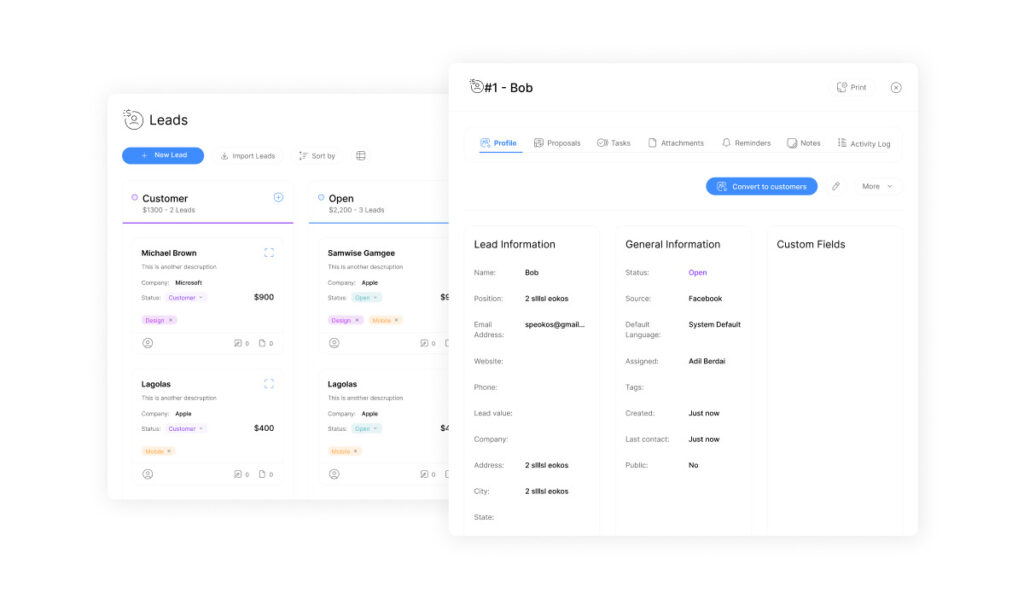

Centralized Client Management

Store all client information, policy details, communication history, and documents in one secure location. Get a complete 360-degree view of each client relationship at a glance, allowing for more personalized service and stronger relationships.

Automated Policy Tracking

Never miss a renewal again with automated alerts and reminders for upcoming policy expirations. The system proactively notifies you of renewal opportunities, allowing you to prepare quotes and reach out to clients at the perfect time.

Lead Automation Tools

Convert more prospects into clients with automated lead nurturing sequences. Track lead sources, manage follow-ups, and implement proven conversion strategies – all while maintaining a personal touch in your communications.

Ready to transform your insurance brokerage?

Join thousands of insurance professionals who have streamlined their operations with ClearCRM.

Real-World Success: How ABC Insurance Agency Transformed Their Business

ABC Insurance Agency was struggling with client management and policy tracking before implementing ClearCRM. Their team of five brokers was spending over 20 hours per week on administrative tasks, and they were losing clients due to missed renewal opportunities.

The Challenge

- Missed 15% of policy renewals due to manual tracking

- Spent 4+ hours per broker each week on data entry

- Client information scattered across multiple systems

- Limited visibility into sales pipeline and performance

The ClearCRM Solution

- Implemented centralized client management system

- Set up automated policy renewal reminders

- Created standardized workflows for new clients

- Established performance dashboards for visibility

The Results

40% Reduction

in missed policy renewals within the first 90 days

15+ Hours Saved

per week on administrative tasks across the team

28% Increase

in overall revenue within six months

“ClearCRM has completely transformed how we operate. Our team spends less time on paperwork and more time building relationships with clients. The automated renewal reminders alone have saved us countless hours and helped us retain more clients.”

Benefits That Deliver Real Results

Implementing ClearCRM doesn’t just organize your data – it transforms how your entire brokerage operates, delivering tangible benefits that impact your bottom line.

Enhanced Productivity

Automate repetitive tasks like data entry, follow-up emails, and document generation. Insurance brokers using ClearCRM report saving an average of 15+ hours per week on administrative work, freeing them to focus on client relationships and sales.

Improved Client Retention

With automated renewal reminders and a complete view of client history, you can provide more personalized service. ClearCRM users experience a 30% reduction in client churn due to missed renewals and improved relationship management.

Accelerated Growth

Scale your brokerage without proportionally increasing administrative overhead. ClearCRM’s workflows and automation allow you to handle more clients with the same team, significantly improving your profit margins as you grow.

See these benefits in your own brokerage

Join thousands of insurance professionals who have transformed their business with ClearCRM.

Why ClearCRM Outperforms Other Insurance CRM Solutions

Not all CRM systems are created equal, especially when it comes to the specialized needs of insurance brokers. Here’s how ClearCRM compares to other popular options:

| Features | ClearCRM | Generic CRM X | Insurance Tool Y |

| Insurance-Specific Templates | ✓ Comprehensive library | ✗ Generic only | ✓ Limited options |

| Policy Renewal Tracking | ✓ Automated with alerts | ✗ Manual setup required | ✓ Basic tracking |

| Marketing Automation | ✓ Built-in | ✓ Requires add-ons | ✗ Not available |

| Client Portal | ✓ Included | ✗ Extra cost | ✓ Basic version |

| Implementation Support | ✓ Insurance-specific | ✓ General support | ✓ Limited hours |

Key Advantages of ClearCRM

- Built for Insurance: Designed specifically for insurance brokers, with industry-specific workflows and templates

- All-in-One Solution: No need for multiple tools – includes CRM, marketing automation, and client management

- Unlimited Projects: Scale without restrictions as your brokerage grows

- Intuitive Interface: Minimal training required – most teams are up and running in days, not weeks

- Comprehensive Support: Insurance-specific onboarding and ongoing support from industry experts

- Regular Updates: Continuous improvements based on feedback from insurance professionals

Transform Your Insurance Brokerage Today

In today’s competitive insurance landscape, the right tools can make all the difference between struggling to keep up and confidently growing your business. ClearCRM provides insurance brokers with the specialized features they need to streamline operations, improve client relationships, and boost revenue.

Stop wasting time on manual processes and disjointed systems. Join thousands of insurance professionals who have transformed their brokerages with ClearCRM’s comprehensive Insurance Broker CRM solution.

Ready to take your brokerage to the next level?

Get started with ClearCRM today and see the difference a specialized Insurance Broker CRM can make.