Free CRM for Financial Advisors

Additionally, picture this: You’re a financial advisor juggling dozens of client portfolios, upcoming meetings, and follow-up tasks. An important client calls asking about their retirement plan update you promised last week—but you have no record of this conversation. Sound familiar? For many financial advisors, managing client relationships without a proper system leads to missed opportunities, forgotten follow-ups, and ultimately, lost business. That’s where a dedicated Financial Advisor CRM comes in—specifically, ClearCRM’s free solution designed for advisors like you.

The Challenge for Small Financial Advisory Practices

Finally, small financial advisory firms face unique challenges when it comes to client management. Without the right tools, these challenges can quickly become roadblocks to growth and client satisfaction.

Missed Follow-Ups and Opportunities

Also, when client information is scattered across emails, spreadsheets, and sticky notes, important follow-ups fall through the cracks. A recent study found that financial advisors lose an average of 15% of potential revenue due to poor follow-up systems.

Disorganized Client Data

Nevertheless, client financial information is sensitive and complex. When it’s not properly organized, you waste valuable time searching for documents and risk making errors in your financial planning recommendations. This disorganization makes scaling your practice nearly impossible.

Inefficient Workflows

Therefore, manual data entry, repetitive tasks, and constant switching between different tools drain your productive hours. For solo advisors or small teams, this inefficiency means less time for what matters most—serving clients and growing your business.

Limited Scalability

Ultimately, as your client base grows, so does the complexity of managing relationships. Without a scalable system, many advisors hit a ceiling where adding more clients actually decreases service quality rather than increasing revenue.

How ClearCRM Solves These Challenges

Then, ClearCRM was built specifically for financial advisors who need a powerful yet simple solution to manage client relationships. Unlike generic CRMs that require extensive customization, ClearCRM comes pre-configured for financial advisory workflows.

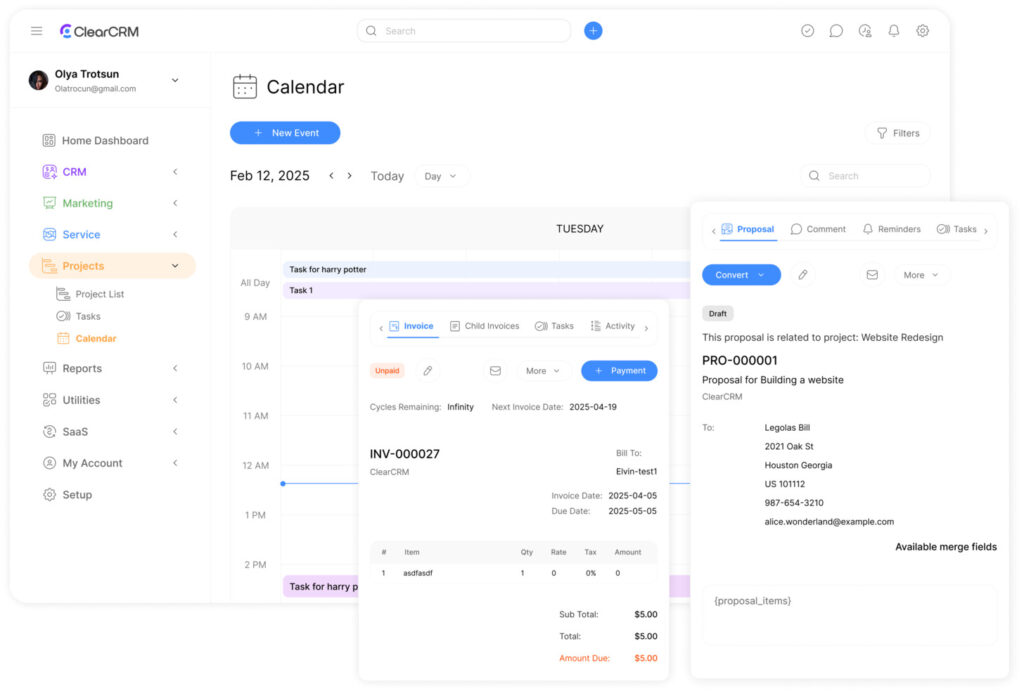

Centralized Client Profiles

In addition, store all client information in one place—contact details, meeting notes, financial documents, goals, and communication history. Access everything you need about a client in seconds, not minutes.

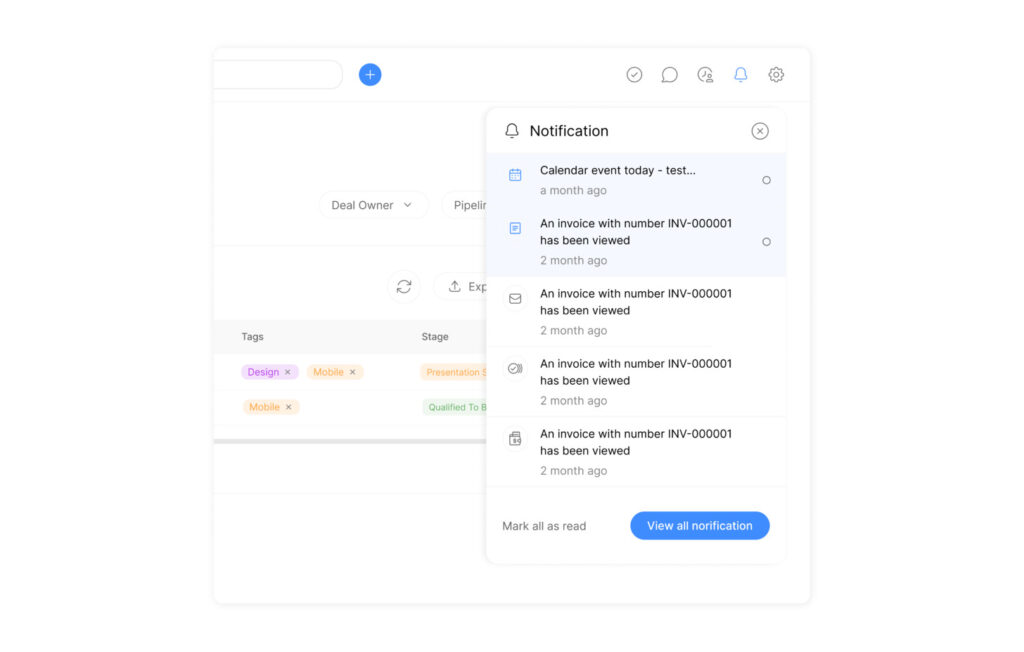

Automated Reminders

What’s more, never miss a follow-up again. ClearCRM automatically schedules reminders for client reviews, document updates, and important milestones like retirement dates or portfolio rebalancing.

Financial Planning Integration

As a result, seamlessly connect your financial planning tools with client management. Track progress toward goals, document recommendations, and maintain a complete history of advice provided.

Ready to streamline your client management?

Join thousands of financial advisors who’ve transformed their practice with ClearCRM’s free version.

Real-World Success: How Advisors Use ClearCRM

Smith Wealth Advisors: From Chaos to Clarity

James Smith, a solo financial advisor with 45 clients, was struggling to keep up with client communications and follow-ups. Important tasks were falling through the cracks, and he was spending hours each week just trying to organize his workflow.

The Challenge

- Missing 20% of scheduled follow-ups with clients

- Spending 12+ hours weekly on administrative tasks

- Client documents scattered across email, desktop, and paper files

- No systematic way to track lead generation efforts

The ClearCRM Solution

- Implemented centralized client profiles with all information in one place

- Set up automated follow-up reminders for every client interaction

- Created standardized workflows for client onboarding and reviews

- Established lead tracking system integrated with email marketing

The Results

- Reduced missed follow-ups by 95%

- Cut administrative time by 60% (saving 7+ hours weekly)

- Increased client satisfaction scores by 40%

- Added 15 new clients in six months without feeling overwhelmed

“ClearCRM transformed my practice. I’m serving more clients with less stress, and the best part is I started with the free version to make sure it worked for my business before investing further.”

Benefits That Deliver Measurable Results

Financial advisors who implement ClearCRM see tangible improvements in their practice efficiency and client relationships. Here’s what you can expect:

Save 10+ Hours Every Week

To sum up, ClearCRM automates repetitive tasks like data entry, follow-up scheduling, and client communications. Advisors report saving an average of 10-15 hours weekly—time they can reinvest in client meetings or business development.

Increase Client Retention by 35%

Moving on, with systematic follow-ups and better service delivery, advisors using ClearCRM report a 35% increase in client retention. The system ensures no client feels forgotten, even as your practice grows.

Grow Your Practice Without Adding Staff

Turning to, ClearCRM’s automation and efficiency tools allow you to manage 40% more clients without hiring additional support staff. This directly improves your bottom line and practice profitability.

Enhance Compliance Documentation

With that in mind, automatically track and document client interactions, recommendations, and decisions. This creates a compliance audit trail that protects your practice while reducing the administrative burden of documentation.

Experience these benefits for yourself

Join over 5,000 financial advisors already using ClearCRM to transform their practice.

Why ClearCRM Outperforms Other Financial Advisor CRM Options

Not all CRM systems are created equal, especially for financial advisors. Here’s how ClearCRM compares to other popular options:

| Features | ClearCRM | Salesforce Financial Services | Redtail CRM |

| Financial Planning Integration | Included | Requires add-ons | Limited |

| Setup Time | Under 1 hour | Days to weeks | Several hours |

| Learning Curve | Minimal | Steep | Moderate |

| Client Portal | Included | Premium add-on | Not included |

ClearCRM Advantages

- Truly free version with no time limitations

- Purpose-built for financial advisors (no customization needed)

- Intuitive interface designed for advisors, not tech experts

- Seamless integration with popular financial planning tools

- Compliance-focused documentation and audit trails

- Scalable from solo advisors to multi-advisor practices

Limitations to Consider

- Free version limited to 100 clients (paid plans for larger practices)

- Some advanced features require paid upgrade

- Newer platform with fewer third-party integrations than established players

- Mobile app currently in beta testing

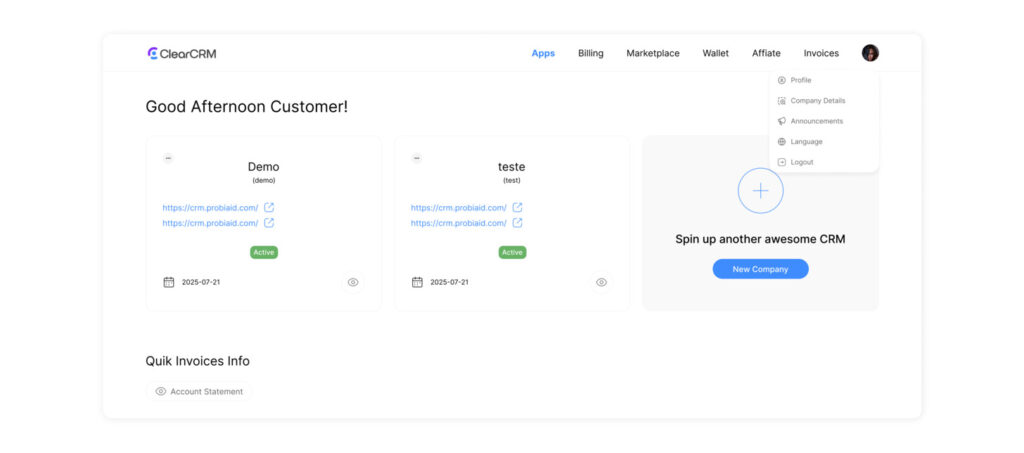

What Makes ClearCRM Different?

To be more specific, unlike generic CRMs that require extensive customization or financial industry CRMs with steep learning curves, ClearCRM was designed by former financial advisors who understand your daily challenges. The system focuses on what matters most: easy client management, efficient workflows, and practice growth—without the complexity or high costs.

Frequently Asked Questions

Is ClearCRM really free, or is it just a trial?

Without a doubt, ClearCRM offers a genuinely free version that you can use indefinitely. The free version includes all core features and supports up to 100 clients. There are no hidden fees or forced upgrades. For growing practices, paid plans start at /month and add advanced features and higher client limits.

How long does it take to set up ClearCRM?

For instance, most financial advisors can set up ClearCRM in under an hour. The system comes pre-configured for financial advisory workflows, so there’s minimal customization needed. We also offer free data import assistance to help you transfer existing client information quickly.

What financial planning tools does ClearCRM integrate with?

ClearCRM integrates with popular financial planning software including MoneyGuide Pro, eMoney, RightCapital, and more. It also connects with email platforms, calendar systems, and document storage solutions to create a seamless workflow.

Is ClearCRM secure enough for sensitive financial data?

Absolutely. ClearCRM uses bank-level encryption, multi-factor authentication, and regular security audits to protect your clients’ sensitive financial data. The platform is fully compliant with financial industry regulations regarding data security and privacy.

Transform Your Financial Advisory Practice Today

Managing client relationships shouldn’t be the most challenging part of being a financial advisor. With ClearCRM’s free Financial Advisor CRM, you can streamline your practice, deliver exceptional client service, and focus on what you do best—providing valuable financial guidance.

Stop losing potential clients to disorganization. Stop wasting hours on administrative tasks. Stop worrying about missed follow-ups and opportunities.

Ready to transform your practice?

Join thousands of financial advisors who’ve discovered the power of efficient client management with ClearCRM.