CRM Finance Industry – ClearCRM’s Smart Solution for Modern Teams

ClearCRM was built specifically to address these challenges, offering financial teams a unified platform where client relationships and financial operations seamlessly converge. Whether you’re a wealth management firm, insurance agency, or financial advisory service, ClearCRM provides the structure and automation you need to excel in today’s competitive market.

Ready to transform your financial operations?

See how ClearCRM can streamline your client relationships and financial workflows.

The Challenge: Why Traditional CRMs Fall Short in Finance

Financial institutions face unique challenges that generic CRM solutions simply weren’t designed to address. The specialized nature of financial services demands more than basic contact management—it requires tools that understand the intricacies of client financial data, compliance requirements, and complex service offerings.

Key Pain Points in Financial Client Management

Fragmented Client Information

Client data scattered across multiple systems creates blind spots in relationship management. When financial advisors can’t access complete client profiles, opportunities are missed and service quality suffers.

Compliance Complexity

Financial services operate under strict regulatory requirements. Without proper documentation and tracking systems, firms risk costly compliance violations and damaged client trust.

Inefficient Workflows

Manual processes for client onboarding, document management, and financial planning waste valuable time and introduce errors that can damage client relationships.

Limited Visibility Between Teams

When sales, service, and financial teams work in silos, communication breaks down. This creates a disjointed client experience and prevents the cross-selling opportunities that drive growth.

These challenges aren’t just operational headaches—they directly impact your bottom line. Without a specialized CRM for financial services, firms struggle to deliver the personalized, responsive service that today’s clients expect.

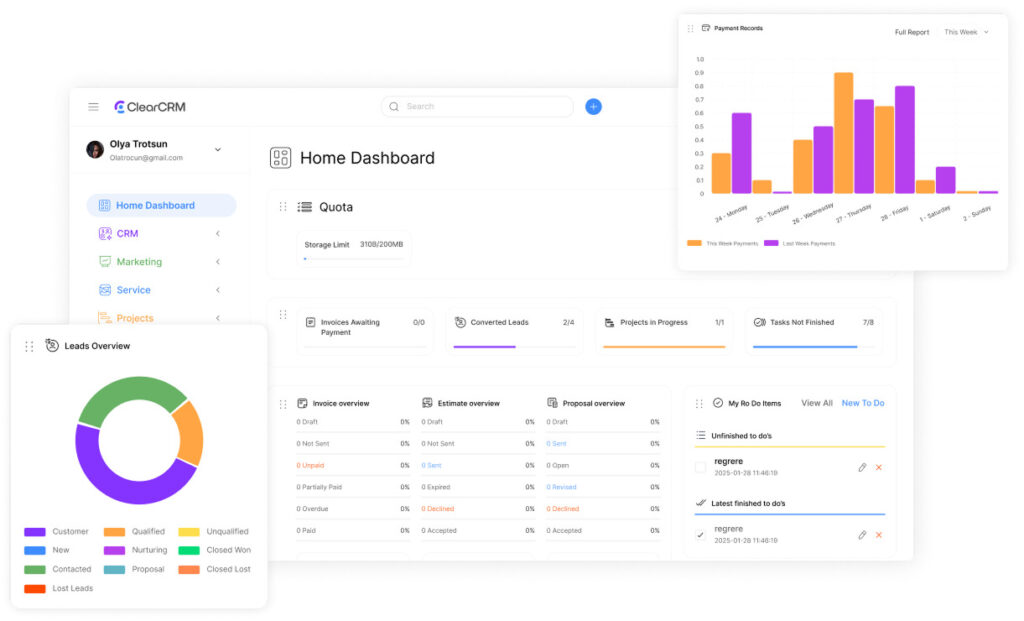

How ClearCRM Transforms Financial Client Management

ClearCRM was built from the ground up with financial services in mind. Our platform bridges the gap between client relationship management and financial operations, creating a seamless workflow that enhances productivity and client satisfaction.

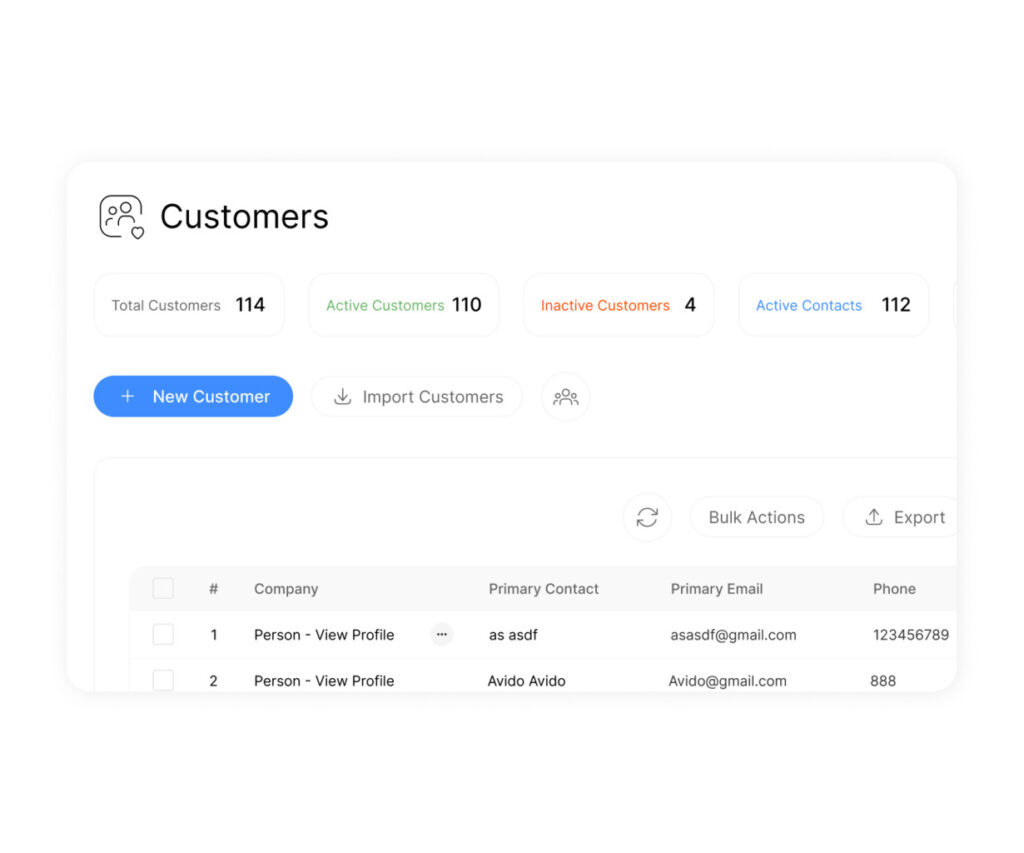

Unified Client Profiles That Tell the Complete Story

ClearCRM provides a 360-degree view of each client relationship, bringing together contact information, interaction history, financial documents, and portfolio details in one accessible location. This comprehensive view enables financial professionals to:

- Access complete client financial histories with a single click

- Track every touchpoint across all communication channels

- Store and organize financial documents with version control

- Monitor client milestones and life events that trigger financial needs

By centralizing client data, ClearCRM eliminates the information gaps that lead to missed opportunities and service failures. Your team gains the context they need to provide truly personalized financial guidance.

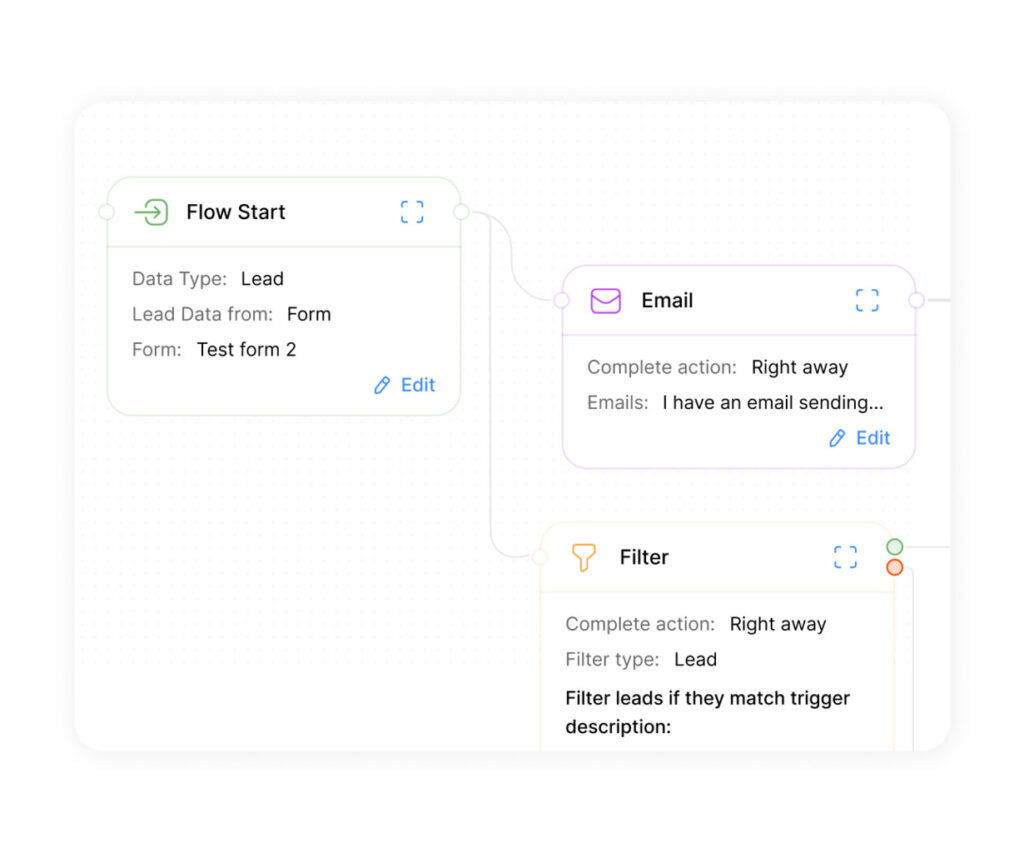

Intelligent Workflow Automation That Saves Time

Manual processes drain productivity and introduce errors. ClearCRM’s workflow automation capabilities streamline key financial processes:

Client Onboarding

Automate the collection and verification of client information, document signatures, and account setup to reduce onboarding time by up to 70%.

Document Management

Automatically organize, tag, and store financial documents with intelligent categorization and version control for easy retrieval.

Compliance Tracking

Set up automated reminders for regulatory requirements, document renewals, and client reviews to ensure nothing falls through the cracks.

Financial Planning

Streamline the creation and delivery of financial plans with templates, automated data population, and approval workflows.

By automating routine tasks, ClearCRM frees your team to focus on what matters most: building meaningful client relationships and providing strategic financial guidance.

Automate your financial workflows

Stop wasting time on manual processes. Let ClearCRM handle the routine so you can focus on client relationships.

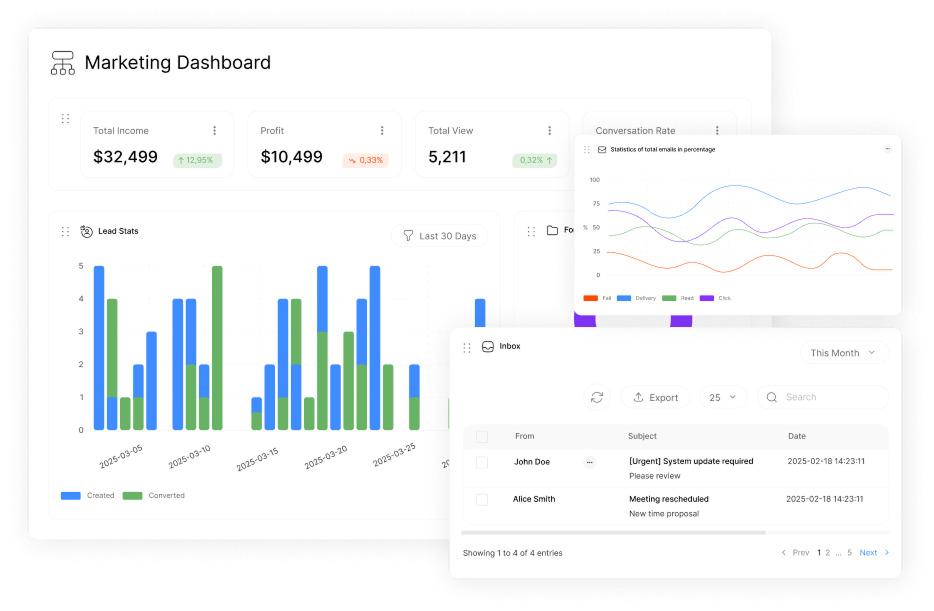

Actionable Insights That Drive Growth

Data is only valuable when it leads to action. ClearCRM transforms your client data into actionable insights that help you identify opportunities, anticipate needs, and make informed decisions:

- Client segmentation tools to identify your most valuable relationships

- Opportunity scoring to prioritize high-potential prospects

- Revenue forecasting based on pipeline and historical performance

- Relationship health indicators to proactively address at-risk accounts

- Cross-sell recommendations based on client profiles and behavior patterns

These insights enable financial teams to take a proactive approach to client management, identifying needs before clients even express them and delivering truly personalized service.

Real Results: How Alpine Financial Advisors Transformed Their Practice

Alpine Financial Advisors, a boutique wealth management firm with 12 advisors, was struggling to scale their practice while maintaining their reputation for personalized service. Client information was scattered across spreadsheets, email, and paper files, making it difficult to provide consistent service and identify growth opportunities.

The Challenge

Alpine’s team was spending over 15 hours per week on administrative tasks like data entry, document management, and manual reporting. Client onboarding took an average of 3 weeks, and advisors lacked visibility into the complete client relationship, leading to missed opportunities and occasional service gaps.

The ClearCRM Solution

After implementing ClearCRM, Alpine consolidated all client information into unified profiles and automated key workflows. The results were immediate and significant:

- Reduced client onboarding time from 3 weeks to just 4 days

- Decreased administrative work by 68%, freeing advisors to focus on client relationships

- Increased assets under management by 22% through improved cross-selling and referrals

- Achieved 100% compliance with regulatory documentation requirements

“ClearCRM has transformed how we serve our clients,” says Sarah Chen, Managing Partner at Alpine. “We now have a complete view of each relationship and can provide truly personalized service without the administrative burden. Our clients notice the difference, and our business has grown as a result.”

Benefits That Matter: Why Financial Teams Choose ClearCRM

Time Savings

Reduce administrative work by up to 70% through intelligent automation of routine tasks like data entry, document management, and reporting.

Enhanced Client Experience

Deliver faster response times and more personalized service by having complete client information at your fingertips, exactly when you need it.

Improved Compliance

Maintain regulatory compliance with automated documentation, audit trails, and scheduled reviews that ensure nothing falls through the cracks.

Team Collaboration

Break down silos between departments with shared client views and collaborative tools that keep everyone aligned and informed.

Revenue Growth

Identify cross-selling opportunities and nurture prospects more effectively with data-driven insights and relationship tracking.

Scalable Operations

Grow your financial practice without proportionally increasing administrative overhead through efficient, automated workflows.

These benefits translate into tangible business outcomes: higher client retention, increased referrals, more efficient operations, and ultimately, stronger financial performance for your firm.

Why ClearCRM Stands Apart in the Finance Industry

While many CRM solutions claim to serve the financial industry, ClearCRM was built specifically for financial teams, with features and workflows designed around your unique needs.

ClearCRM vs. Generic CRM Solutions

ClearCRM

- Purpose-built for financial services with industry-specific workflows

- Unified platform that combines CRM and financial operations

- Built-in compliance features for financial regulations

- Financial document management with version control

- Portfolio tracking and financial planning tools

- Intuitive interface designed for financial professionals

Generic CRMs (Insightly, Pipedrive)

- General-purpose design requires extensive customization

- Separate systems for CRM and financial operations

- Limited compliance capabilities

- Basic document storage without financial context

- No native financial planning capabilities

- Complex interfaces with steep learning curves

ClearCRM vs. Financial-Adjacent Solutions

ClearCRM

- All-in-one platform for client management and financial operations

- Intuitive automation builder for custom financial workflows

- Unlimited scalability to grow with your practice

- Seamless integration with popular financial tools

- Regular updates based on financial industry feedback

- Dedicated support team with financial industry expertise

Financial-Adjacent CRMs (Flowlu, Asana)

- Project management tools with limited CRM capabilities

- Rigid workflows that don’t adapt to financial processes

- Performance issues with larger client databases

- Limited integration with financial software

- Generic updates not tailored to financial needs

- General support without financial industry knowledge

ClearCRM combines the best of both worlds: the robust relationship management capabilities of a dedicated CRM with the specialized features and workflows that financial teams need. The result is a platform that feels tailor-made for your business, without the complexity and cost of custom development.

Experience the ClearCRM difference

See why financial teams are switching to the CRM built specifically for their needs.

Key Features of ClearCRM for Financial Services

Client Relationship Management

- Unified client profiles with financial history

- Interaction tracking across all channels

- Relationship mapping for complex client structures

- Life event tracking and opportunity alerts

Financial Operations

- Portfolio management and tracking

- Financial document management

- Proposal and financial plan generation

- Fee and commission tracking

Workflow Automation

- Visual workflow builder for custom processes

- Automated client onboarding sequences

- Document approval workflows

- Scheduled review and follow-up reminders

Compliance Management

- Regulatory documentation tracking

- Automated compliance reminders

- Audit trails for all client interactions

- Secure data handling with role-based access

Analytics and Reporting

- Client segmentation and analysis

- Revenue forecasting and pipeline tracking

- Performance dashboards for teams and individuals

- Custom report builder for specific metrics

Integration Capabilities

- Seamless connection with financial planning tools

- Email and calendar integration

- Document signing and processing

- Open API for custom integrations

These features work together to create a comprehensive platform that addresses the unique needs of financial services firms. Whether you’re a small advisory practice or a mid-sized financial institution, ClearCRM scales to support your specific requirements.

Enterprise-Grade Security for Sensitive Financial Data

In the financial industry, data security isn’t just a feature—it’s a fundamental requirement. ClearCRM was built with security at its core, providing the robust protections that financial institutions need to safeguard sensitive client information.

How ClearCRM Protects Your Data

- End-to-end encryption for all data, both in transit and at rest

- Role-based access controls to ensure information is only available to authorized users

- Multi-factor authentication to prevent unauthorized access

- Regular security audits and penetration testing

- Compliance with industry standards including SOC 2, GDPR, and financial regulations

- Detailed audit logs tracking all system access and changes

With ClearCRM, you can assure your clients that their sensitive financial information is protected by industry-leading security measures, building trust while meeting regulatory requirements.

Seamless Implementation and Adoption

Implementing a new CRM doesn’t have to be disruptive. ClearCRM offers a structured onboarding process designed to get your team up and running quickly while ensuring a smooth transition from your existing systems.

Our Implementation Approach

1. Discovery and Planning

We work with your team to understand your specific workflows, data needs, and objectives to create a tailored implementation plan.

2. Data Migration

Our specialists handle the secure transfer of your client data and documents from existing systems, ensuring nothing is lost in the transition.

3. Configuration and Customization

We configure ClearCRM to match your specific processes and requirements, creating a familiar environment for your team.

4. Training and Support

Comprehensive training ensures your team can leverage all of ClearCRM’s capabilities, with ongoing support as you grow.

Most financial teams are fully operational with ClearCRM within 2-4 weeks, with minimal disruption to their daily operations. Our phased approach ensures you can start seeing benefits quickly while building toward full implementation.

Transform Your Financial Practice with ClearCRM

In today’s competitive financial landscape, the quality of your client relationships directly impacts your bottom line. ClearCRM provides the specialized tools and workflows that financial teams need to deliver exceptional service while operating efficiently.

By unifying client data, automating key workflows, and providing actionable insights, ClearCRM empowers your team to focus on what matters most: building meaningful client relationships and delivering valuable financial guidance.

Whether you’re a small advisory practice looking to scale or an established financial institution seeking to modernize your client management approach, ClearCRM offers the flexibility, security, and industry-specific features you need to succeed.

Ready to elevate your client relationships?

Join the financial firms that are transforming their practices with ClearCRM.