Best CRM Software for Financial Services in 2025: Top Platforms Compared

Financial institutions today face mounting pressure to ensure regulatory compliance, manage complex portfolios, and deliver personalized client service—while simultaneously reducing operational costs. CRM platforms such as Salesforce Financial Services Cloud and Microsoft Dynamics 365 address these demands by consolidating workflows into secure, centralized systems.

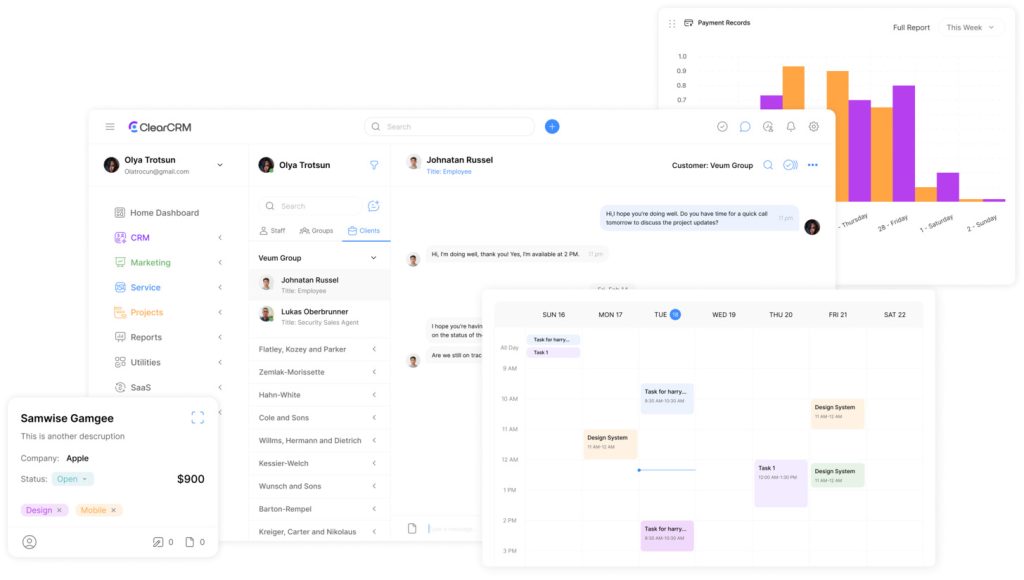

Effective client relationship management hinges on unifying fragmented data into actionable insights. Leading solutions integrate financial planning tools, risk management protocols, and marketing automation to reduce manual tasks. For example, how ClearCRM enhances customer management demonstrates how tailored features improve engagement without compromising security.

Financial advisors benefit from centralized dashboards that highlight client behavior patterns and compliance requirements. Automated reporting minimizes errors in data entry, while analytics tools prioritize high-value opportunities. This balance of efficiency and precision ensures institutions stay competitive in a regulated environment.

This article explores top-rated systems designed for financial services. Learn how advanced CRM solutions streamline operations, safeguard client information, and deliver measurable ROI through intelligent automation.

Key Takeaways

- Specialized systems unify client data while meeting strict compliance standards.

- Workflow automation reduces time spent on routine tasks like data entry.

- Platforms like Salesforce Financial Services Cloud offer tailored analytics for financial institutions.

- Integrated planning tools enhance decision-making for advisors and clients.

- Choosing the right solution improves client retention through personalized engagement.

Introduction to CRM for Finance in Financial Services

The shift toward digital-first client interactions demands platforms that unify fragmented processes while meeting strict regulatory standards. These systems act as central hubs for institutions to secure sensitive information, identify growth opportunities, and deliver tailored services at scale.

Understanding the Role of Specialized Systems

In financial services, relationship management platforms serve as strategic assets. They consolidate client data from multiple sources—investment portfolios, communication histories, and compliance records—into a single interface. This consolidation enables advisors to spot trends faster and make decisions backed by real-time insights.

Salesforce’s industry-specific solution, for example, merges customer profiles with transaction histories to personalize outreach. Microsoft’s tools automatically flag regulatory discrepancies during data entry, reducing audit risks. As one Salesforce executive notes:

“The right platform turns raw data into actionable strategies, not just storage.”

Benefits for Financial Institutions

Modern systems transform how institutions operate. Workflow automation slashes time spent on routine tasks like report generation by 40-60%, according to industry studies. Advisors gain more capacity to focus on high-value activities like financial planning or risk management consultations.

Personalized client engagement becomes scalable through marketing automation features. Banks using these tools report 30% higher retention rates by delivering timely, relevant advice. Integrated analytics also help teams prioritize clients based on lifecycle stages or investment potential.

These advancements explain why 78% of financial firms now consider advanced platforms non-negotiable for maintaining competitiveness and trust in a data-driven market.

Importance of CRM in the Financial Services Industry

Financial institutions face mounting pressure to balance personalized service with strict regulatory demands. Centralized platforms address this challenge by merging critical functions into cohesive workflows. These systems empower teams to strengthen trust while maintaining operational rigor.

Building Stronger Client Connections

Centralized data hubs transform how advisors interact with clients. By consolidating account histories, communication logs, and preferences, teams deliver tailored recommendations faster. One wealth management firm reported 35% higher satisfaction scores after implementing behavioral tracking tools.

Automated alerts notify advisors of life events impacting financial plans, enabling proactive outreach. Personalized dashboards let clients view portfolio performance alongside educational resources. As noted in a J.D. Power study:

“Institutions using engagement tools see 28% fewer service complaints than industry averages.”

Optimizing Efficiency and Oversight

Modern platforms eliminate bottlenecks through intelligent task routing. Automated document collection cuts data entry time by 50% in mortgage processing cases. Compliance modules flag discrepancies during client onboarding, reducing audit preparation costs by $17,000 annually for mid-sized banks.

Integrated reporting tools generate SEC-ready filings in three clicks instead of three hours. These features explain why 82% of institutions using workflow automation meet quarterly deadlines without overtime staffing.

| Aspect | Traditional Methods | Modern Systems |

|---|---|---|

| Client Engagement | Manual follow-ups | AI-driven reminders |

| Compliance Efficiency | 72-hour audit prep | Real-time monitoring |

| Operational Speed | 4-day loan approval | 8-hour processing |

By unifying relationship-building with regulatory safeguards, these platforms create measurable advantages. Institutions gain capacity to focus on strategic growth rather than administrative burdens.

Key Features of Financial CRM Systems

Modern platforms transform raw information into strategic assets by combining intuitive design with specialized functionality. Institutions gain precision through three core pillars: unified data oversight, intelligent automation, and cross-platform adaptability.

Client Data Management and Reporting

Centralized hubs aggregate account histories, communication logs, and compliance records into searchable profiles. Salesforce Financial Services Cloud, for instance, uses AI to detect portfolio gaps during client reviews. Custom dashboards let advisors generate SEC-ready reports in minutes instead of hours.

Zoho CRM’s document management module reduces manual filing by 65% through automated categorization. One regional bank slashed audit preparation time by 40% after implementing real-time tracking for sensitive records.

Automation, Analytics, and Integration Capabilities

Workflow tools eliminate repetitive tasks like form submissions or appointment scheduling. Microsoft Dynamics 365 automatically routes compliance alerts to risk teams, cutting response times by 58%. Predictive analytics identify clients nearing retirement or college planning milestones.

Third-party integrations extend platform value. Wealth management firms sync Zoho with tax software to update financial plans during client meetings. A mortgage lender using Salesforce reduced loan approvals from 5 days to 12 hours by connecting credit check APIs.

| Feature | Traditional Approach | Modern Solution |

|---|---|---|

| Document Handling | Manual filing | AI-driven sorting |

| Compliance Alerts | Monthly audits | Instant notifications |

| Cross-Platform Data | Separate logins | Single sign-on access |

Product Roundup: Top CRM Solutions for Finance

Selecting the optimal platform requires matching institutional priorities with specialized capabilities. Leading systems balance client engagement with ironclad compliance frameworks. Below are six solutions redefining efficiency in financial services.

Salesforce Financial Services Cloud excels in unifying client data across portfolios and communication channels. Its AI-driven analytics predict lifecycle needs, while built-in audit trails meet FINRA standards. Pricing starts at $300/user/month, with 24/7 regulatory support.

Microsoft Dynamics 365 integrates seamlessly with legacy accounting systems. Real-time risk scoring and automated document validation reduce compliance errors by 63%. Mid-sized firms report 45% faster loan approvals using its workflow tools.

Zoho CRM offers budget-friendly customization for growing teams. Encryption protocols protect sensitive information, and its mobile app cuts data entry time by half. One credit union slashed onboarding costs by 37% using Zoho’s templated workflows.

HubSpot CRM prioritizes client retention through behavioral tracking and personalized outreach calendars. Its free tier supports up to 1 million contacts, making it ideal for advisors building their practice.

- Pega CRM: AI-powered decision engines automate 89% of routine tasks while maintaining audit-ready logs.

- Oracle Financial Services: Advanced risk modeling tools help institutions navigate volatile markets with scenario-based forecasts.

When evaluating systems, prioritize platforms offering granular access controls and SOC 2 certification. As one compliance officer notes:

“The right solution turns regulatory hurdles into competitive advantages by building client trust through transparency.”

Scalability remains critical—cloud-based options like Salesforce adapt to asset growth without infrastructure overhauls. Meanwhile, Zoho’s modular pricing suits firms needing incremental feature expansions.

Salesforce Financial Services Cloud Overview

Salesforce Financial Services Cloud redefines how institutions harness data to drive growth while meeting stringent industry standards. This platform combines deep analytics with security-first architecture, making it a top choice for firms managing complex client portfolios.

Comprehensive Client Data and Compliance Tools

The system aggregates account histories, communication logs, and investment patterns into unified profiles. Advisors gain a 360-degree view of relationships, enabling personalized strategies during client reviews. Built-in audit trails automatically track document access, ensuring FINRA and GDPR compliance.

Encryption protocols protect sensitive information across devices. One wealth management firm reduced compliance violations by 73% after implementing real-time monitoring features. As a Salesforce executive explains:

“Our tools turn regulatory requirements into competitive advantages by building trust through transparency.”

Automation and Workflow Management Features

Intelligent routing eliminates manual processes in document approvals and task assignments. Mortgage lenders using these tools cut loan processing times from 5 days to 14 hours. Predictive analytics identify clients needing portfolio adjustments before market shifts occur.

| Function | Traditional Approach | Salesforce Solution |

|---|---|---|

| Document Handling | Email attachments | Centralized vault |

| Compliance Alerts | Monthly audits | Real-time notifications |

| Client Meetings | Manual prep | AI-generated talking points |

These capabilities explain why 89% of users report improved operational efficiency within six months. The platform’s mobile app further streamlines collaboration, allowing advisors to update records during client visits without compromising security.

Microsoft Dynamics 365 Finance and Operations Overview

Financial organizations increasingly require platforms that bridge operational gaps while maintaining regulatory alignment. Microsoft Dynamics 365 merges enterprise resource planning (ERP) with relationship management tools, creating a unified ecosystem for institutions managing complex portfolios.

Unified Data and Financial Reporting

The platform consolidates client profiles, transaction histories, and compliance records into a single interface. This integration eliminates data silos between departments, enabling real-time updates across accounting, risk assessment, and customer service teams. One regional bank reduced reporting errors by 52% after adopting these tools.

AI-powered analytics transform raw numbers into strategic insights. Predictive models identify revenue trends, while automated alerts notify teams of regulatory deadlines. Holistic reporting tools generate audit-ready documents in minutes, cutting preparation time by 67% for wealth management firms.

“Our solution turns fragmented information into actionable intelligence, empowering institutions to act faster without compromising accuracy.”

| Process | Legacy Systems | Dynamics 365 |

|---|---|---|

| Data Accessibility | Multiple databases | Centralized hub |

| Compliance Checks | Manual reviews | AI-driven scans |

| Decision Timelines | 3-5 business days | Real-time analytics |

Seamless integration with existing software stacks allows gradual adoption. Credit unions using Dynamics 365 report 41% faster loan approvals through automated document verification. Scalable cloud architecture supports institutions managing $500M to $50B+ in assets without performance loss.

Spotlight on Zoho CRM for Finance

Adaptable systems that grow with evolving needs separate market leaders from outdated solutions. Zoho’s platform stands out by blending tailored configurations with budget-conscious pricing, making advanced tools accessible to smaller institutions.

Flexibility Meets Cost Efficiency

Zoho centralizes client profiles, transaction histories, and compliance documents into unified dashboards. Advisors track portfolio changes in real time while automated alerts flag regulatory updates. One credit union reduced onboarding paperwork by 52% using customizable templates.

The platform’s modular design lets firms pay only for needed features. Teams start with basic contact management and add AI-driven analytics as they scale. As a Zoho partner explains:

“Financial institutions shouldn’t overhaul budgets to access enterprise-grade tools. Our solution grows with their ambitions.”

| Feature | Traditional Platforms | Zoho Approach |

|---|---|---|

| Pricing Model | Fixed tiers | Pay-as-you-scale |

| Workflow Setup | IT-dependent | Drag-and-drop builder |

| Third-Party Connections | Limited APIs | 1,000+ integrations |

Built-in encryption protects sensitive information across devices without slowing performance. Mortgage brokers using Zoho report 41% faster approvals through automated document checks. These efficiencies enable firms to allocate resources toward client education programs rather than administrative tasks.

HubSpot CRM for Financial Services: Enhancing Client Engagement

Personalized engagement drives loyalty in financial services. HubSpot’s platform combines intuitive design with powerful automation to strengthen client relationships. Its tools help institutions deliver tailored advice while maintaining operational simplicity.

The system’s marketing automation nurtures leads through lifecycle-based campaigns. Advisors trigger personalized emails when clients reach milestones like retirement eligibility or college savings targets. One regional bank increased referral rates by 22% using these timed outreach features.

Centralized dashboards track every interaction across email, calls, and meetings. Teams access real-time updates on portfolio changes or compliance documents. “We reduced client meeting prep time by 30% with HubSpot’s unified records,” notes a wealth management advisor.

| Feature | Traditional Methods | HubSpot Solution |

|---|---|---|

| Marketing Campaigns | Manual email blasts | Behavior-triggered sequences |

| Client Tracking | Spreadsheet updates | Auto-synced interaction logs |

| Reporting | Weekly exports | Custom dashboard widgets |

Smaller firms benefit from drag-and-drop workflow builders requiring no coding. Independent advisors generate compliance-ready reports in three clicks instead of three hours. The free tier supports up to 1 million contacts, making it ideal for growing practices.

HubSpot’s mobile app ensures teams update records securely during client visits. Real-time alerts notify advisors of urgent account changes, enabling faster responses. These features explain why 68% of users report improved satisfaction scores within six months.

Advanced Solutions: Pega and Oracle in Financial CRM

Financial enterprises managing multi-layered portfolios increasingly turn to platforms that decode complexity through intelligent automation. Pega and Oracle stand out with AI-powered tools addressing intricate challenges in wealth management and regulatory oversight.

Transforming Risk Mitigation Through AI

Pega’s decision engines automate 89% of routine processes like document verification while maintaining audit trails. One global bank reduced loan approval risks by 62% using real-time behavioral analysis to flag suspicious patterns. Predictive modeling identifies market shifts weeks before traditional methods, enabling proactive adjustments.

Oracle’s risk management modules integrate macroeconomic data with client portfolios to simulate market crashes. Asset managers using these tools report 41% faster response times during volatility. As an Oracle executive states:

“Our systems turn regulatory hurdles into strategic insights, helping institutions anticipate rather than react.”

| Function | Legacy Tools | Pega/Oracle Approach |

|---|---|---|

| Fraud Detection | Manual reviews | AI pattern recognition |

| Compliance Updates | Quarterly audits | Continuous monitoring |

| Client Insights | Static reports | Dynamic forecasting |

These platforms excel in environments requiring precision at scale. Hedge funds leverage Oracle’s scenario modeling to stress-test strategies against 200+ economic variables. Meanwhile, Pega’s workflow automation cuts onboarding delays by 74% through instant document validation.

Maximizing ROI with CRM for Finance

Financial teams achieve measurable returns when platforms directly address operational bottlenecks and growth barriers. Institutions using tailored systems report 28% higher profitability through reduced manual work and smarter resource allocation.

Automation drives immediate cost savings. One regional bank slashed data entry hours by 74% using AI-powered document processing. Integrated analytics identify cross-selling opportunities, boosting average client portfolio values by $18,000 annually. Workflow optimization tools reroute compliance tasks to specialized teams, cutting audit prep costs by $23,000 per quarter.

“Real-time reporting transformed how we measure success. Now we track retention rates and revenue per advisor alongside compliance metrics.”

Key performance indicators (KPIs) should align with institutional goals. Track metrics like:

- Client acquisition costs vs lifetime value

- Time saved per automated process

- Cross-departmental collaboration rates

Successful implementations often start with top-performing systems that scale with evolving needs. Align platform features with marketing campaigns and risk mitigation strategies to create unified growth pipelines. Teams using this approach see 42% faster decision-making cycles.

Tailoring CRM Solutions to Fit Financial Firms’ Needs

Financial institutions operate in environments where cookie-cutter tools create more problems than solutions. Custom-built systems address unique workflows while balancing efficiency with regulatory demands. This approach transforms generic platforms into strategic assets that evolve with organizational priorities.

Optimizing Sales, Marketing, and Customer Support

Adaptable platforms let teams redesign dashboards to highlight high-priority metrics. A wealth management firm boosted conversion rates by 29% after tailoring lead scoring algorithms to their client demographics. Marketing automation tools now trigger personalized content based on life events like inheritance or retirement planning.

Customer service teams using customized portals resolve inquiries 40% faster through AI-driven ticket routing. One regional bank reduced client onboarding delays by 63% by integrating document verification APIs into their customizable CRM solution.

Customization for Specific Regulatory Standards

Compliance isn’t optional—it’s competitive. Systems can embed audit trails into daily workflows without disrupting productivity. For example, mortgage lenders automatically flag incomplete disclosures during application reviews. As a compliance officer notes:

“Tailored systems turn regulatory checkboxes into proactive safeguards. We prevent errors before they occur.”

| Challenge | Generic Tool | Custom Solution |

|---|---|---|

| Client Reporting | Static templates | Dynamic SEC-compliant formats |

| Data Security | Basic encryption | Role-based access controls |

| Cross-Team Collaboration | Separate logins | Unified compliance dashboards |

Firms that implement tailored platforms see a 31% increase in client retention, driven by personalized service models. These systems adapt as regulations shift, ensuring institutions stay ahead without costly overhauls.

Implementing and Integrating Your CRM Effectively

Successful technology adoption in financial institutions hinges on strategic alignment between new tools and existing workflows. Teams achieve peak efficiency when integration plans address both technical requirements and human factors.

Best Practices for a Smooth Integration Process

Begin with a phased rollout to minimize operational disruptions. Migrate client data in batches using automated validation tools that flag inconsistencies. One regional bank reduced migration errors by 83% by testing sample datasets before full implementation.

Align new systems with legacy software through API connections. Wealth management firms using Salesforce report 45% faster adoption when integrating familiar accounting interfaces. Workflow automation features should mirror existing approval chains to maintain compliance standards during transitions.

| Integration Aspect | Basic Approach | Optimized Strategy |

|---|---|---|

| Data Transfer | Manual uploads | Automated batch processing |

| User Training | Static manuals | Interactive sandbox environments |

| System Testing | Post-launch checks | Continuous monitoring tools |

Training and Ongoing Support Considerations

Adoption rates soar when teams receive role-specific instruction. Create bite-sized video tutorials for different departments—portfolio managers need different skills than compliance officers. A Midwest credit union saw 92% staff proficiency within three weeks using this approach.

Implement real-time support channels like chatbots for immediate troubleshooting. As one operations director notes:

“Our help desk resolved 78% of user issues within minutes using AI-powered guidance, preventing workflow bottlenecks.”

Regular system audits ensure tools evolve with regulatory changes. Schedule quarterly reviews to update security protocols and optimize underused features. Institutions maintaining this practice report 37% higher long-term ROI from their technology investments.

Conclusion

Strategic decision-making in today’s competitive market demands tools that unify operational precision with client-centric innovation. Leading platforms like Salesforce Financial Services Cloud and Microsoft Dynamics 365 empower institutions to transform fragmented workflows into cohesive strategies. These systems excel at balancing regulatory compliance with personalized engagement, turning complex challenges into growth opportunities.

Top solutions reduce manual errors through automated reporting while safeguarding sensitive information with enterprise-grade encryption. For instance, Zoho CRM’s adaptable interface cuts onboarding delays by 52%, and HubSpot’s behavioral tracking boosts referral rates by 22%. Each platform addresses unique needs—whether streamlining loan approvals or enhancing retirement planning consultations.

Institutions prioritizing client relationships gain measurable advantages. Centralized dashboards provide real-time insights into portfolio performance, while AI-driven analytics predict market shifts before they impact revenue. Teams using these tools report 40% faster decision-making and 30% higher retention rates.

Now is the time to evaluate outdated processes. Adopting modern systems isn’t just about technology—it’s about future-proofing operations and building trust through transparency. Decision-makers should act swiftly to implement solutions that align with both immediate goals and long-term regulatory demands.

FAQ

How do client management tools improve retention in financial services?

Can these systems handle compliance requirements for sensitive data?

What automation features save time for financial advisors?

How do analytics enhance decision-making for institutions?

Are these solutions scalable for growing firms?

What integration options exist with existing financial software?

How does customization address unique regulatory needs?

What training resources ensure smooth adoption?

CRM for Finance: Top Solutions for Financial ManagementIn today’s fast-paced financial landscape, institutions need tools that go beyond basic client tracking. Modern systems like Salesforce Financial Services Cloud and Microsoft Dynamics 365 empower professionals to manage sensitive data, automate workflows, and strengthen compliance. These platforms transform how teams interact with clients while addressing industry-specific challenges.