Best CRM for Financial Services in 2025: Complete Comparison Guide

Why Financial Services Need Specialized CRM Solutions

The financial services industry demands more from a CRM than generic solutions can provide. With sensitive client data, complex financial products, and strict regulatory requirements, financial professionals need tools specifically designed to handle these unique challenges.

Key Challenges in Financial Services

- Managing detailed client financial information

- Tracking complex portfolios and investment histories

- Maintaining regulatory compliance and documentation

- Coordinating team efforts across different financial products

- Automating follow-ups for time-sensitive financial opportunities

Benefits of Financial-Focused CRMs

- 360-degree view of client financial relationships

- Streamlined compliance documentation and reporting

- Automated workflows designed for financial processes

- Integrated tools for quotes, invoicing, and financial planning

- Secure data management meeting financial industry standards

Ready to transform your financial practice?

Start managing client relationships more effectively with a CRM built for financial services.

CRM Comparison: ClearCRM vs. Top Competitors

We’ve analyzed the leading CRM solutions for financial services to help you make an informed decision. See how ClearCRM stacks up against Jobber, Housecall Pro, and ServiceTitan across key features that matter most to financial professionals.

| Features | ClearCRM | Jobber | Housecall Pro | ServiceTitan |

| Lead Tracking | Advanced with unlimited pipelines | Basic lead management | Limited pipeline customization | Advanced but complex |

| Quotes & Invoicing | Comprehensive with financial templates | Strong but lacks financial specifics | Basic functionality | Advanced but expensive |

| Scheduling & Dispatching | Appointment scheduling with automation | Excellent but field-service focused | Strong scheduling tools | Comprehensive but complex |

| Mobile Team Coordination | Team chat and collaboration tools | Limited team collaboration | Basic team management | Advanced but steep learning curve |

| Automated Follow-ups | Comprehensive workflow automation | Basic automation | Limited automation capabilities | Advanced but requires setup |

| Financial Services Features | Built-in financial tools and templates | Limited financial focus | Minimal financial capabilities | Some financial tools but not specialized |

| Ease of Use | Intuitive interface with quick setup | Moderate learning curve | User-friendly but limited | Complex interface |

| Starting Price | $0 (Free plan) / $19/month paid | $49/month | $65/month | $250+/month |

ClearCRM offers the best value for financial services

Get all the features you need at a fraction of the cost of competitors.

ClearCRM: The Best CRM for Financial Services

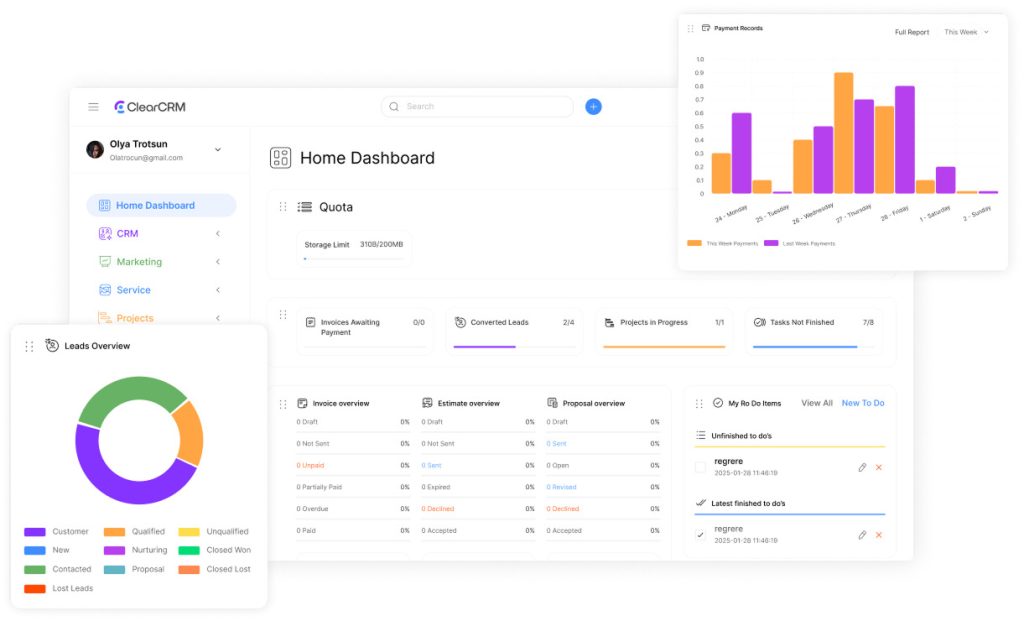

ClearCRM stands out as the ideal solution for financial services professionals seeking a powerful yet affordable customer relationship management system. With its comprehensive feature set specifically designed for financial workflows, ClearCRM helps you manage client relationships, streamline operations, and grow your business.

Key Features for Financial Services

Lead Management

Track potential clients from first contact through conversion with unlimited customizable pipelines. Assign leads automatically and never miss a follow-up opportunity.

Client Data Management

Store and access secure client information, including investment preferences, KYC documents, and previous communications.

Financial Tools

These built-in financial tools eliminate the need for external platforms and ensure accurate billing, proposals, and client-facing documents.

Workflow Automation

Automate repetitive tasks with triggers and automated emails. Enable marketing automation to nurture leads with educational content, financial tips, and timely service updates.

Team Collaboration

Enhance team productivity with built-in chat, file sharing, and collaborative tools designed for financial teams.

Reporting & Analytics

Gain valuable insights with pre-built reports and dashboards specifically designed for financial services metrics.

ClearCRM Advantages

- Unlimited deals, contacts, and leads on paid plans

- Unlimited sales pipelines for different financial products

- Advanced lead assignment and routing

- Comprehensive workflow automation

- Affordable pricing starting at just $19/month

- Free forever plan available for startups

- White label branding with your own logo

- No hidden fees or complex pricing structure

Limitations

- Free plan limited to 200 CRM records

- Some advanced features only available on higher plans

- Newer to market than some competitors

- Third-party integrations coming soon

Experience ClearCRM for yourself

No credit card required. Get started with all premium features free.

Jobber: Field Service Management with CRM Features

Jobber is primarily designed for field service businesses but offers CRM functionality that some financial services firms might find useful, particularly those with on-site client visits or service components.

Key Features for Financial Services

Strengths

- Strong scheduling and appointment management

- Good mobile app for field representatives

- Client portal for self-service

- Solid quoting and invoicing capabilities

- GPS tracking for on-site financial consultations

Limitations

- Limited financial services-specific features

- Lacks specialized tools for portfolio management

- Higher starting price than ClearCRM

- Field service focus may include unnecessary features

- Limited customization for financial workflows

Jobber Advantages

- Excellent scheduling capabilities

- Strong mobile experience

- Good client communication tools

- Reliable quoting and invoicing

- Client portal for document sharing

Limitations

- Not designed specifically for financial services

- Higher price point starting at $49/month

- Limited pipeline customization

- Lacks financial portfolio tracking

- Missing specialized compliance features

Housecall Pro: Service Business CRM with Basic Financial Tools

Housecall Pro focuses on service businesses but includes some CRM functionality that could be adapted for certain financial services operations, particularly those with scheduling needs.

Key Features for Financial Services

Strengths

- User-friendly interface with minimal learning curve

- Solid scheduling and dispatch capabilities

- Basic client management features

- Mobile app for on-the-go access

- Online booking options for client appointments

Limitations

- Very limited financial services-specific features

- Basic pipeline management capabilities

- Limited customization options

- Minimal automation for financial workflows

- Higher price point than ClearCRM

Housecall Pro Advantages

- Easy to learn and use

- Good scheduling functionality

- Decent mobile experience

- Basic client management

- Online booking capabilities

Limitations

- Not designed for financial services

- Limited pipeline and lead management

- Basic automation capabilities

- Expensive starting at $65/month

- Lacks financial-specific reporting

ServiceTitan: Enterprise-Level CRM with Robust Features

ServiceTitan offers a comprehensive but complex CRM solution that larger financial services organizations might consider, though it comes with a steep learning curve and high price point.

Key Features for Financial Services

Strengths

- Comprehensive feature set for large organizations

- Advanced reporting and analytics

- Robust automation capabilities

- Strong integration options

- Detailed client management

Limitations

- Extremely high price point

- Steep learning curve

- Complex implementation process

- Overkill for small to medium financial firms

- Not specifically designed for financial services

ServiceTitan Advantages

- Enterprise-grade capabilities

- Comprehensive reporting

- Advanced automation options

- Detailed client tracking

- Robust security features

Limitations

- Prohibitively expensive (starting at $250+/month)

- Overwhelming complexity for most users

- Requires significant training

- Not tailored to financial services

- Resource-intensive implementation

CRM Pricing Comparison for Financial Services

Cost is a major consideration when choosing a CRM for your financial services business. Below, we compare the pricing structures of ClearCRM and its competitors to help you understand the total investment required.

ClearCRM

- Free Plan: $0 forever (2 users, 200 records)

- Starter: $19/month ($9/month yearly)

- Growth: $39/month ($19/month yearly)

- Scale: $79/month ($39/month yearly)

- Free Trial: Yes, no credit card required

- Per-User Pricing: Yes, affordable scaling

- Hidden Fees: None

Jobber

- Core: $49/month (1 user)

- Connect: $129/month (up to 7 users)

- Grow: $249/month (up to 30 users)

- Free Trial: 14 days

- Per-User Pricing: Tiered user limits

- Hidden Fees: Additional costs for add-ons

- Annual Discount: Yes

Housecall Pro

- Basic: $65/month (1 user)

- Essentials: $169/month (up to 5 users)

- Max: $349/month (unlimited users)

- Free Trial: 14 days

- Per-User Pricing: Tiered user limits

- Hidden Fees: Some features cost extra

- Annual Discount: Yes

ServiceTitan

- Starting Price: $250+/month

- Enterprise: Custom pricing

- Free Trial: Demo only

- Per-User Pricing: Yes, expensive

- Hidden Fees: Implementation costs

- Annual Contract: Required

- Setup Fees: Yes, significant

ClearCRM Value Advantage

- Cost Savings: 60-80% lower than competitors

- No Setup Fees: Zero implementation costs

- Free Forever Option: Great for startups

- All Features Included: No nickel-and-diming

- Flexible Scaling: Pay only for what you need

- No Long-Term Contracts: Monthly flexibility

- Transparent Pricing: No surprises

Save up to 80% with ClearCRM

Get all the features you need at a fraction of the cost. No credit card required to start.

Implementation and Ease of Use Comparison

The best CRM for financial services should be easy to implement and use daily. Here’s how these solutions compare in terms of setup time, learning curve, and user experience.

| CRM | Setup Time | Learning Curve | Mobile Experience | User Interface | Training Required |

| ClearCRM | 1-3 days | Low | Excellent | Intuitive, modern | Minimal |

| Jobber | 3-7 days | Moderate | Good | Field-service focused | Moderate |

| Housecall Pro | 2-5 days | Low-Moderate | Good | Simple but limited | Some |

| ServiceTitan | 2-4 weeks | High | Complex | Feature-rich but overwhelming | Extensive |

Why ClearCRM Wins on Ease of Use

ClearCRM was designed with user experience as a priority, making it the easiest CRM to implement for financial services teams. With intuitive navigation, clear workflows, and minimal training requirements, your team can be up and running quickly without disrupting your business operations.

Quick Setup Process

- Simple account creation with guided onboarding

- Pre-built templates for financial services

- Easy data import from spreadsheets

- Ready-to-use pipelines for financial workflows

- No technical expertise required

User-Friendly Interface

- Clean, intuitive dashboard design

- Logical navigation and workflow organization

- Customizable views for different team roles

- Comprehensive yet uncluttered client profiles

- Mobile-responsive design for on-the-go access

What Financial Professionals Say About ClearCRM

“ClearCRM transformed how we manage client relationships. The unlimited pipelines let us track different financial products separately, and the automation saves hours each week on follow-ups.”

“After trying several expensive CRMs, ClearCRM was a breath of fresh air. It’s intuitive, affordable, and has all the features we need without the complexity of enterprise solutions.”

“The free plan was perfect for getting started, and upgrading was seamless as we grew. The customization options let us tailor everything to our specific financial services workflows.”

Frequently Asked Questions About CRMs for Financial Services

What makes a CRM suitable for financial services?

The best CRM for financial services should offer secure client data management, compliance features, customizable pipelines for different financial products, and automation tools specific to financial workflows. It should also provide comprehensive reporting for tracking client portfolios and team performance.

How does ClearCRM handle financial data security?

ClearCRM prioritizes data security with robust measures including encryption, secure user permissions, two-factor authentication options, and compliance with industry standards. The platform ensures your sensitive financial client data remains protected while still being accessible to authorized team members.

Can ClearCRM integrate with other financial tools?

ClearCRM offers integration capabilities with essential financial tools and services. While third-party integrations are coming soon, the platform already provides comprehensive native features for most financial service needs, including invoicing, quotes, and client management.

Is ClearCRM suitable for small financial advisory firms?

Absolutely! Built for financial advisors, ClearCRM supports customized pipelines for investment tracking, estate planning, and client lifecycle management. The free forever plan supports up to 2 users and 200 CRM records, making it perfect for startups. As your firm grows, affordable paid plans scale with your needs without the enterprise-level pricing of competitors.

How long does it take to implement ClearCRM?

Most financial services teams can implement ClearCRM in 1-3 days. The intuitive interface, guided setup process, and pre-built templates for financial workflows make onboarding quick and painless. Unlike complex enterprise solutions that require weeks of implementation, ClearCRM gets you up and running fast.

Why ClearCRM Is the Best Choice for Financial Services in 2025

After comparing the leading CRM solutions for financial services, ClearCRM emerges as the clear winner, offering the perfect balance of powerful features, ease of use, and affordability. With its financial-focused tools, unlimited customization options, and straightforward pricing, ClearCRM provides everything financial professionals need to manage client relationships effectively.

ClearCRM Advantages Summary:

- Comprehensive Financial Tools: Everything you need to manage client relationships, from lead capture to invoicing

- Unlimited Customization: Tailor pipelines, fields, and workflows to your specific financial processes

- Powerful Automation: Save time with automated follow-ups, task assignments, and client communications

- Unbeatable Value: Get enterprise-level features at a fraction of the cost of competitors

- Easy Implementation: Be up and running in days, not weeks, with minimal training required

Ready to transform your financial services business?

Join thousands of financial professionals who trust ClearCRM to manage their client relationships. Get started today with our free forever plan or try all premium features with no risk.

No credit card required. Cancel anytime.