Lost Opportunity Reason Tracking: A Practical Guide

Lost Opportunity Reason Tracking helps sales teams understand why deals fall through. Business leaders often celebrate closed deals while overlooking a critical growth driver: analyzing why prospects walk away. Jan Solecki, CRM expert at SoftwareSupp, states: “Understanding losses reveals more about market shifts than wins ever could.” This approach transforms setbacks into actionable intelligence for strategic pivots.

Forward-thinking organizations now treat lost deals as diagnostic tools. By systematically examining why clients choose alternatives, companies uncover patterns in pricing concerns, feature gaps, or service shortcomings. These insights directly inform product roadmaps and sales strategies.

The process requires disciplined tracking and honest evaluation. Teams must document specific reasons for each lost prospect while resisting defensive reactions. When implemented consistently, this methodology becomes an early warning system for emerging industry trends and evolving customer expectations.

Companies that master this practice gain three advantages: sharper competitive positioning, proactive market adaptation, and improved resource allocation. The data reveals hidden revenue potential by highlighting underserved market segments and operational weaknesses needing attention.

Key Takeaways

- Analyzing lost deals exposes market trends winning metrics often miss

- Documenting client exit reasons improves product development priorities

- Systematic tracking helps predict industry shifts before competitors react

- Revenue growth stems from addressing recurring loss patterns

- Effective implementation requires non-defensive team collaboration

Introduction to Lost Opportunity Reason Tracking

Progressive organizations now recognize untapped value in deals that never close. This practice goes beyond tallying failures — it deciphers the hidden narratives behind customer choices. By systematically examining why clients select alternatives, businesses gain critical insights into market shifts and operational gaps.

Understanding the Concept and Its Importance

Effective analysis combines numerical patterns with contextual feedback. Quantitative data might show 40% of prospects cite pricing concerns, while qualitative details reveal specific feature comparisons with rival solutions. Together, they form a diagnostic toolkit for strategic improvements.

Companies that implement this approach often discover:

- Recurring service gaps affecting client retention

- Emerging competitor strategies in specific markets

- Mismatches between sales messaging and buyer priorities

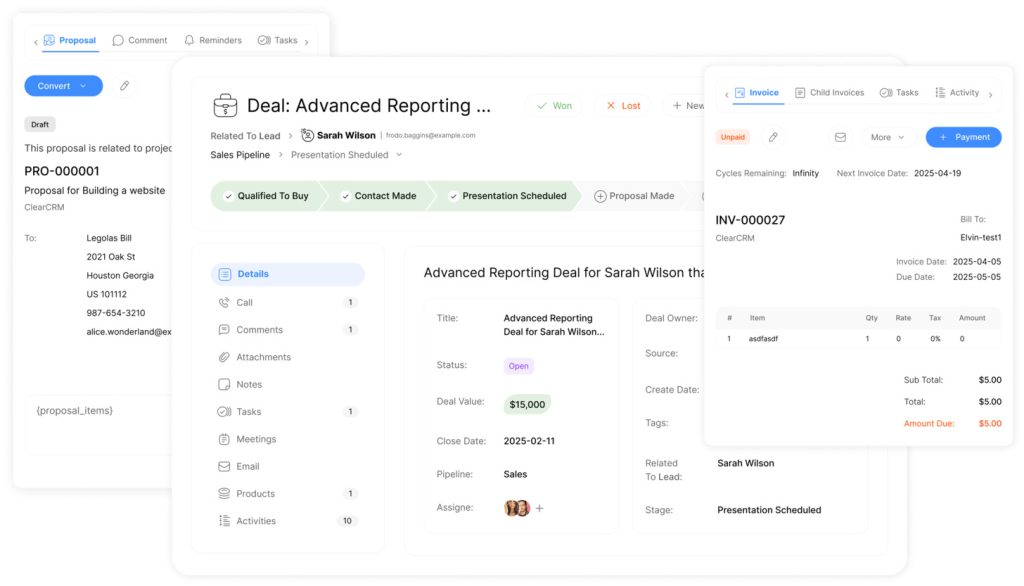

Lost Opportunity Reason Tracking identifies recurring issues, allowing teams to address weaknesses.

Lost Opportunity Reason Tracking provides insights to improve future strategies and close rates. Customer expectations now change faster than ever. A 2023 Gartner study found 68% of B2B buyers alter decision criteria mid-sales cycle. Tracking lost deals helps organizations spot these shifts early, like sudden demand for AI integrations or flexible payment terms.

The methodology also separates temporary setbacks from systemic issues. While budget constraints might explain some losses, consistent feedback about implementation support signals deeper process flaws. This distinction enables smarter resource allocation and product development.

Implementing Lost Opportunity Reason Tracking for Business Growth

Modern enterprises thrive by decoding customer decisions. The most effective approach merges numerical trends with narrative insights, creating a dual-lens view of market dynamics. This method transforms raw information into strategic fuel for sales optimization.

Mixing Quantitative and Qualitative Data Approaches

High-performing teams use blended analysis to uncover hidden patterns. Quantitative metrics reveal frequency trends – like pricing objections in 32% of cases – while qualitative details expose specific competitor advantages. Together, they form a complete diagnostic toolkit.

Key implementation steps include:

- Building standardized categories for quick pattern recognition

- Capturing deal-specific context through structured feedback fields

- Aligning data collection with existing CRM workflows to ensure consistency

Sales managers gain actionable insights when combining these methods. For example, quantitative analysis might show increased losses in healthcare verticals, while qualitative notes highlight compliance feature gaps. This dual perspective drives precise strategy adjustments.

Regular review cycles turn findings into results. Teams that analyze combined datasets monthly see 19% faster response to market shifts according to recent SaaS industry benchmarks. The approach also identifies training needs – like negotiation skills for complex deals – through recurring loss themes.

Strategic Best Practices for Analyzing Lost Opportunities

Successful organizations treat every unsuccessful deal as a diagnostic tool for growth. By systematically examining why prospects choose alternatives, teams uncover actionable patterns that drive smarter decisions.

Building Effective Categorization Frameworks

Clear classification systems turn scattered feedback into strategic assets. Top performers use tiered categories like:

- Price sensitivity (when quotes exceed market benchmarks)

- Feature gaps compared to rival solutions

- Process breakdowns in sales follow-ups

Salesforce CRM architect Mara Lin notes: “Teams that update categories quarterly spot market shifts 37% faster than static systems.” This approach prevents analysis paralysis while maintaining relevance.

Turning Competitor Insights Into Action

Benchmarking requires more than tracking who wins deals. Smart teams document:

- Specific advantages cited by prospects

- Emerging competitor tactics per industry

- Pricing strategies that resonate in target markets

When 42% of losses stem from feature comparisons (2024 Gong.io data), product teams gain clear upgrade priorities. Sales leaders adjust playbooks to address recurring weaknesses – like adding demo comparisons for key differentiators.

Quarterly strategy reviews convert findings into results. Training programs targeting identified skill gaps improve win rates by 19% within six months. The process creates continuous improvement cycles where every lost deal fuels future success.

Lost Opportunity Reason Tracking turns lost deals into actionable learning opportunities.

Forward-thinking sales teams now treat pricing conversations as strategic assets rather than obstacles. This shift enables organizations to address cost concerns head-on while demonstrating tangible value throughout buyer interactions.

Benefits of Early Price Disclosure and Follow-Up Strategies

Companies with premium pricing achieve 23% higher conversion rates when disclosing costs early, according to recent SaaS industry data. This approach transforms potential objections into value discussions by giving sales professionals time to contextualize pricing within broader business outcomes.

Effective implementation requires two complementary tactics:

- Positioning price differentials as investments in superior results

- Providing customized ROI projections during discovery calls

Structured follow-up protocols prevent stalled deals through milestone tracking. Teams using automated reminder systems see 41% faster deal progression than those relying on manual processes. Regular check-ins maintain momentum while respecting client decision timelines.

Key performance improvements emerge when organizations:

- Train staff to identify decision-makers within first meetings

- Develop consensus-building playbooks for complex sales cycles

- Analyze follow-up frequency patterns in closed-won deals

Consultative selling techniques prove critical in premium markets. Sales professionals who focus on strategic outcomes rather than product specs achieve 19% higher client retention. This approach aligns pricing with measurable business impacts, turning cost conversations into partnership discussions.

Conclusion

Smart organizations now view unanswered customer decisions as growth catalysts. Systematic analysis of unsuccessful deals provides actionable insights that refine sales tactics and product strategies. Companies embracing this approach build competitive edge by addressing recurring patterns rather than isolated incidents.

Effective implementation demands honest self-reflection. Teams must confront areas where offerings fall short of market needs while celebrating lessons learned. This disciplined evaluation transforms temporary setbacks into permanent improvements across client interactions and service delivery.

Businesses committed to regular review cycles see measurable results. Addressing root causes – whether feature gaps or pricing misalignment – leads to 22% higher conversion rates within six months. The process creates self-correcting systems that adapt to evolving buyer priorities faster than competitors.

Long-term success stems from treating every client interaction as market intelligence. Organizations that institutionalize this practice gain clearer understanding of decision drivers, positioning themselves as solution partners rather than vendors. This strategic shift unlocks sustainable growth through continuous operational refinement and customer-centric innovation.