The Ultimate Guide to Invoice Management: Best Practices and Tips

Efficient financial operations form the backbone of thriving organizations. As high-volume invoice processing and invoicing processes put pressure on teams, businesses increasingly invest in modern invoice management systems and automated invoice solutions to ensure accuracy, reduce errors, and improve financial control.

Forward-thinking companies now recognize optimized workflows as strategic assets. Structured systems slash approval cycles by up to 60% while reducing errors that strain supplier partnerships. Automated solutions particularly demonstrate value, transforming chaotic paper trails into organized digital records accessible across departments.

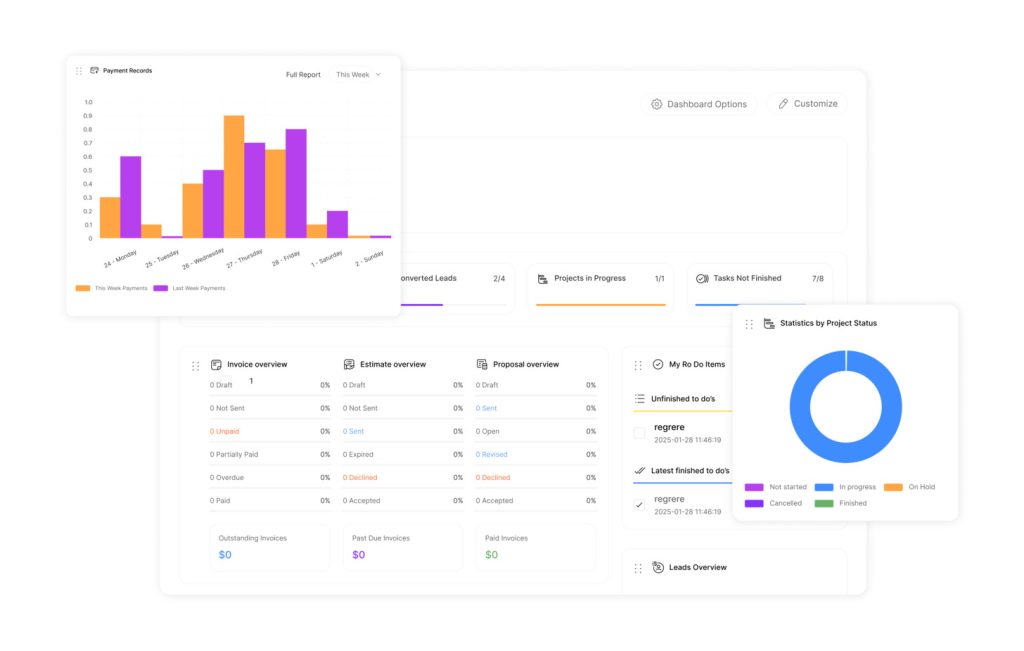

The evolution from manual methods to intelligent platforms reshapes financial ecosystems. Organizations adopting these tools report 45% faster month-end closures and improved cash flow visibility. These advancements enable teams to focus on analysis rather than data entry, driving smarter resource allocation.

This guide explores practical methods to overhaul financial operations. From selecting appropriate technologies to establishing error-proof approval chains, it provides actionable steps for sustainable improvement. Decision-makers will discover how integrated systems eliminate repetitive tasks while strengthening compliance frameworks.

Key Takeaways

- Automated financial workflows reduce processing time by over 50% compared to manual methods

- Centralized systems improve payment accuracy and vendor satisfaction rates

- Digital solutions provide real-time visibility into cash flow and liabilities

- Proper implementation cuts compliance risks by standardizing approval processes

- Integration with existing software eliminates duplicate data entry tasks

Understanding Invoice Management: The Basics

Accurate handling of vendor transactions is at the core of effective invoice management systems. Modern organizations rely on structured platforms to manage the invoicing process, verify payment requests, and maintain transparent records that reduce the risk of errors and improve regulatory compliance.

Core Principles of Transaction Verification

Effective invoice processing systems handle financial documents through five critical stages. Teams first confirm receipt details match purchase orders and delivery confirmations, ensuring the amount invoiced aligns precisely with goods or services received. Automated validation then cross-checks amounts, tax calculations, and vendor credentials against company databases.

| Stage | Key Actions | Outcome |

|---|---|---|

| Document Intake | Capture paper/electronic submissions | Centralized tracking |

| Data Review | Match purchase orders | Error reduction |

| Approval Routing | Assign stakeholder tasks | Faster clearance |

Essential Stages in Payment Handling

Approved transactions move through secure payment channels with digital audit trails. Finance teams prioritize methods that sync with accounting software, eliminating manual reconciliation. Final documentation includes timestamps, approver IDs, and compliance certifications for future reference.

Businesses using standardized protocols report 38% fewer payment disputes. Cross-departmental coordination ensures tax codes and contract terms align during each phase. This systematic approach creates opportunities for strategic automation while maintaining regulatory adherence.

The Critical Role of Invoice Processing in Business

Behind every thriving enterprise lies an unseen engine – streamlined financial workflows. When optimized, these systems become silent profit drivers, influencing everything from supplier trust to quarterly forecasts. Research shows companies with refined payment operations achieve 23% higher liquidity than industry peers.

Impact on Accounting and Data Accuracy

Precision in financial documentation shapes organizational success. Automated validation tools catch discrepancies before they escalate, maintaining 98.6% data accuracy rates in leading enterprises. This vigilance prevents costly mistakes – one manufacturing firm saved $1.2 million annually by eliminating duplicate payments through improved verification.

Modern accounting teams depend on error-free records. “Flawless financial data isn’t optional – it’s the foundation of strategic planning,” notes a Fortune 500 CFO. Digital audit trails now replace paper-based systems, enabling real-time spending analysis and compliance tracking.

Three measurable benefits emerge from robust systems:

- 45% faster month-end reporting cycles

- 34% reduction in vendor payment disputes

- 62% improvement in tax compliance scores

Organizations prioritizing these upgrades gain unmatched cash flow visibility. This advantage allows proactive negotiations with suppliers and informed budget allocations – critical factors in today’s volatile markets.

Challenges and Limitations of Traditional Invoicing Processes

Outdated financial workflows create hidden costs that erode profit margins. Paper-based systems consume 18% more staff hours than digital alternatives, according to APQC research. These legacy approaches struggle to meet modern demands for speed and precision.

Issues with Manual Data Entry

Human-led processing creates costly bottlenecks. Businesses spend $12-$60 per transaction verifying details across multiple systems. Staff often re-enter identical information five times before final approval.

Error rates skyrocket in manual environments. One logistics company reported 14% of payments required corrections due to typos or miscalculations. Recovery efforts for misplaced documents drain budgets – retrieval costs hit $200 per incident in paper-heavy operations.

Risks of Duplicate Payments and Compliance Errors

Without automated checks, organizations risk paying vendors twice. A healthcare provider discovered $860,000 in duplicate transactions during a routine audit. These oversights often go unnoticed until tax season.

Paper trails complicate regulatory adherence. “Manual systems can’t keep pace with evolving tax codes,” warns a financial compliance officer. Multiple document handlers increase exposure to data breaches – 63% of fraud cases originate from internal process gaps.

Modernizing with Automated Invoice Solutions

Digital transformation reshapes how businesses handle financial obligations. Leading organizations now deploy intelligent tools that convert chaotic paperwork into strategic assets. These systems process 80% of payment documents without manual input, freeing teams to focus on value-driven tasks.

Benefits of Automation

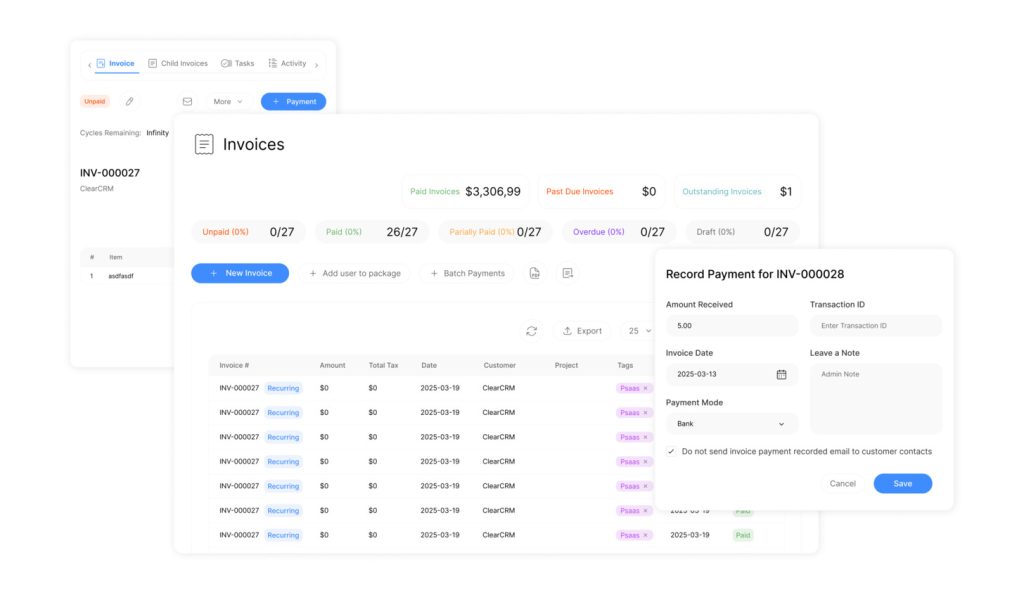

Advanced software slashes processing costs by 60% while accelerating payment cycles. Real-time data validation eliminates duplicate payments and calculation errors. Exception flagging ensures approvers only review documents needing attention, cutting approval delays by 73%.

| Process Stage | Traditional Approach | Automated Solution |

|---|---|---|

| Data Capture | Manual entry (5+ minutes per document) | AI extraction (20 seconds) |

| Approval Routing | Physical handoffs (3-7 days) | Digital workflows (4 hours) |

| Audit Preparation | File cabinet searches | Instant report generation |

Optimizing Approval Chains

Cloud-based platforms enable managers to authorize payments from any device. Role-based permissions ensure compliance while maintaining audit trails. One retail chain reduced approval bottlenecks by 68% using dynamic routing rules.

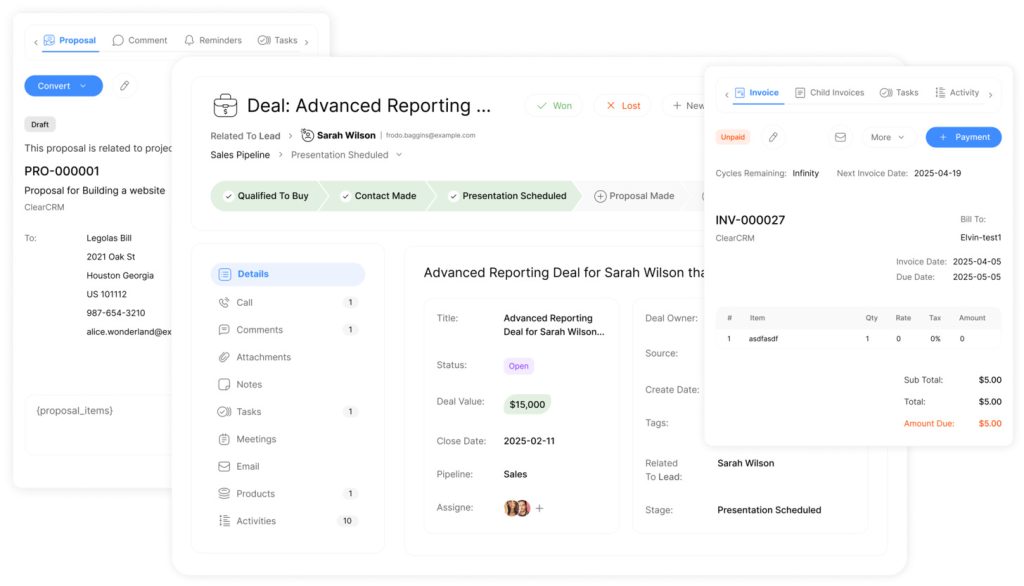

Integrated systems automatically sync with accounting platforms, erasing data silos. This connectivity provides live cash flow visibility – critical for negotiating early-payment discounts. Scalable solutions handle volume spikes without staffing increases, future-proofing operations.

Selecting the Right Invoice Management System

Choosing financial tools requires balancing technical needs with operational realities. Forward-thinking teams prioritize platforms that simplify vendor interactions while maintaining data integrity. Leading solutions now offer supplier portals – secure interfaces where partners submit payment details directly. This eliminates PDF attachments and email chains, particularly useful for repeat transactions with trusted suppliers.

Evaluating Software and Integration Options

Effective system selection starts with compatibility checks. Teams must verify how new tools connect to existing ERP and accounting software. Three-way matching between purchase orders, delivery receipts, and payment requests becomes effortless when platforms share real-time data.

Security protocols and user permissions rank high in evaluation criteria. Cloud-based systems often outperform on-premise solutions with automatic updates and remote access. Look for intuitive interfaces that minimize training time across departments.

Ensuring Seamless ERP and Accounting Connectivity

Integration depth determines operational efficiency. “Disconnected systems create reconciliation nightmares,” observes a fintech integration specialist. Optimal platforms sync transaction details instantly with general ledgers, preventing manual data transfers.

Prioritize solutions offering customizable dashboards and export-ready reports. These features empower finance leaders to track vendor performance and cash flow trends. Scalable architectures ensure the system grows with business needs without costly overhauls.

Successful implementations share common traits:

- Pre-built connectors for major accounting software

- Role-based access controls for compliance

- Mobile approval workflows for decision-makers

Invoice Management: Best Practices for Modern Businesses

Building reliable supplier networks requires more than timely payments – it demands strategic collaboration. Progressive organizations now leverage structured financial workflows to transform vendor interactions into competitive advantages. When executed effectively, these systems foster trust while unlocking mutual growth opportunities.

Strategies for Enhancing Vendor Relationships

Standardized approval chains create predictable timelines that suppliers value. Automated alerts keep partners updated at every stage – from document receipt to payment processing. Three-way matching between orders, deliveries, and payment requests reduces discrepancies by 89% in high-performing teams.

Key tactics for sustained partnership growth:

- Dynamic discount programs rewarding early settlements

- Centralized portals showing real-time payment statuses

- Quarterly performance reviews aligning business goals

Companies excelling in payment processes maintain detailed supplier profiles tracking preferences and historical data. “Transparency builds loyalty,” notes a procurement director at a Fortune 500 manufacturer. Automated scorecards help identify top-performing partners for priority collaboration.

Forward-thinking teams implement these practices:

- Digitize contract terms for instant access during validations

- Establish escalation paths for urgent approvals

- Share quarterly performance reports with key suppliers

Organizations adopting these methods report 41% faster dispute resolutions and 27% improvement in vendor retention rates. The result? Stronger alliances that withstand market fluctuations while driving cost efficiencies.

Enhancing Process Efficiency with Technology Trends

Emerging technologies are revolutionizing how businesses handle financial documentation, turning tedious tasks into strategic opportunities. Cutting-edge tools now automate repetitive workflows while introducing unprecedented levels of accuracy and speed.

Next-Generation Transaction Handling

| Process Stage | Traditional Approach | Tech-Driven Solution |

|---|---|---|

| Data Capture | Manual typing from paper/PDFs | OCR scanning with 99.2% accuracy |

| Approval Routing | Email chains with attachments | Automated workflow triggers |

| Error Detection | Visual cross-checking | AI-powered discrepancy alerts |

| Compliance Checks | Monthly audit sampling | Blockchain-enabled real-time tracking |

Mobile-enabled platforms let managers approve payments during business travel or remote work. Cloud collaboration tools eliminate email clutter by centralizing discussions and document versions. One logistics firm reduced approval delays by 79% using geo-tagged authorization features.

Artificial intelligence transforms validation processes. Machine learning algorithms analyze historical patterns to flag unusual charges automatically. “Our systems now catch errors humans routinely miss,” reports a financial controller at a national retail chain.

Blockchain integration creates tamper-proof audit trails for complex supply chains. Predictive analytics tools forecast cash flow needs 30 days in advance, helping businesses optimize payment timing. These innovations enable:

- 92% reduction in manual data entry

- 68% faster dispute resolution

- Real-time vendor performance tracking

Future advancements include self-executing smart contracts that release payments upon delivery confirmation. Automated vendor onboarding will further streamline supplier partnerships, completing setup processes in minutes rather than days.

Conclusion

Effective invoice management systems redefine how organizations process invoices. Transitioning from outdated methods unlocks operational efficiency and strengthens supplier partnerships. The real challenge lies not in implementation complexity, but in overcoming resistance to change within established workflows.

Automated tools slash processing time by 50-70%, allowing teams to focus on strategic priorities. Businesses gain real-time visibility into cash flow while reducing compliance risks through standardized protocols. These time savings translate to faster decision-making cycles, directly impacting profitability.

Modern solutions require careful planning but deliver measurable returns. Businesses prioritizing seamless integration with existing software see faster adoption rates and minimal workflow disruptions. Early adopters report 40% fewer payment disputes within the first quarter of deployment.

The path forward is clear: delayed action risks falling behind competitors. Proactive management of financial workflows ensures organizations stay agile. With proven technologies available, operational transformation becomes an achievable goal rather than a distant ideal.