Ultimate Guide to Expense Tracking: Strategies for Business Success

Running a company without proper expense tracking is like navigating unknown terrain without a map. For entrepreneurs and corporate leaders alike, organized financial oversight forms the backbone of sustainable operations. Systematic analysis of outgoing funds helps organizations maintain control over budgets while identifying growth opportunities.

Effective financial management transforms raw numbers into strategic roadmaps. Decision-makers gain real-time visibility into cash flow trends, enabling smarter resource allocation. Modern tools automate data collection and categorization, replacing manual processes with precision-driven workflows.

Businesses that prioritize spending analysis achieve three critical advantages: reduced operational risks, improved budget accuracy, and stronger compliance. These systems uncover hidden inefficiencies while ensuring every dollar contributes to organizational objectives. Leaders can then redirect savings toward innovation or market expansion.

Sophisticated platforms now offer predictive analytics and customizable reporting features. These solutions eliminate time-consuming spreadsheet management while providing actionable intelligence. Companies using these tools report faster decision cycles and improved stakeholder confidence in financial planning.

Key Takeaways

- Organized financial oversight creates clear visibility into cash flow patterns

- Automated systems replace error-prone manual processes with reliable data

- Strategic analysis identifies cost optimization opportunities without sacrificing quality

- Real-time reporting enhances compliance and investor communication

- Data-driven insights support confident budgeting and resource allocation

Introduction to Effective Expense Management

Clear financial oversight separates thriving companies from those flying blind. When organizations understand exactly where funds move, they transform reactive budgeting into strategic resource optimization. Modern systems convert chaotic financial data into actionable patterns, revealing hidden opportunities.

Understanding Financial Visibility

Systematic monitoring eliminates guesswork about operational costs. A marketing team might discover they’re allocating 30% more to digital ads than projected through regular reviews. This clarity helps leaders reallocate funds before shortages occur.

Three critical benefits emerge from organized oversight:

- Fraud detection: Unusual transactions surface during weekly audits

- Tax readiness: Categorized records simplify deduction claims

- Budget accuracy: Real-time data prevents overspending

| Aspect | Manual Methods | Automated Systems |

|---|---|---|

| Error Rate | 12-18% | Under 2% |

| Compliance | Partial | Full audit trails |

| Processing Time | 8 hrs/week | 45 mins/week |

Data-Driven Operational Control

Accurate records empower smarter decisions about vendor contracts and resource distribution. Companies analyzing quarterly spending often find 15-20% savings through supplier negotiations. These funds then fuel innovation or market expansion.

Regular analysis also strengthens investor communications. Detailed reports demonstrate fiscal responsibility, building trust in leadership decisions. Teams gain confidence to pursue growth initiatives knowing their financial foundation remains solid.

What Is Expense Tracking? Breaking Down the Process

Financial clarity begins with methodical documentation of every business transaction. This systematic approach converts chaotic spending data into organized insights, forming the backbone of strategic resource management. Modern organizations rely on three pillars: capturing financial activities, grouping them logically, and interpreting patterns for growth.

Recording Transactions and Receipts

Accurate documentation forms the foundation of financial oversight. Businesses must log every purchase, from office pens to client dinners, with precise timestamps. Digital tools now automate this process, capturing receipts via mobile scans and syncing data across platforms.

Key advantages emerge from structured documentation:

- Audit readiness: Instant access to transaction records during compliance checks

- Tax optimization: Clear proof of deductible business costs

- Dispute resolution: Timestamped evidence for vendor disagreements

| Method | Error Rate | Time Investment |

|---|---|---|

| Paper Receipts | 22% | 6 hours weekly |

| Digital Systems | 3% | 1.5 hours weekly |

Categorizing and Analyzing Business Expenses

Grouping transactions into logical categories reveals operational truths. Marketing campaigns might consume 40% of budgets, while travel costs stay under 15%. These insights help leaders renegotiate contracts or shift funds to high-impact areas.

“Proper categorization turns financial data into boardroom strategy.”

Advanced systems automatically tag transactions using machine learning, reducing human error. Teams then generate visual reports showing monthly trends across departments. This visibility helps identify wasteful practices and duplicate services across teams.

Expense Tracking Best Practices for Business Success

Businesses that refine their financial practices unlock operational excellence and growth. Strategic approaches to fiscal management combine disciplined processes with modern solutions, turning fragmented data into cohesive insights. Leaders gain control over cash flow while building scalable systems.

Implementing Proven Tracking Strategies

Separating professional and personal finances through dedicated banking accounts creates audit-ready records. This practice simplifies tax preparation and strengthens vendor relationships. Digital receipt management systems using mobile apps eliminate lost paperwork while enabling instant categorization.

| Process | Manual Approach | Automated Solution |

|---|---|---|

| Receipt Capture | Physical filing (18% loss rate) | Mobile scanning (99% accuracy) |

| Policy Enforcement | Retroactive checks | Real-time compliance alerts |

| Travel Cost Control | Post-trip approvals | Pre-set spending limits |

Integrating Automation Tools for Efficiency

Advanced platforms sync corporate card transactions with accounting software, reducing manual entry by 80%. Employees submit costs through intuitive interfaces, accelerating approvals. “Automation transforms financial oversight from reactive chore to strategic advantage,” notes a FinTech industry report.

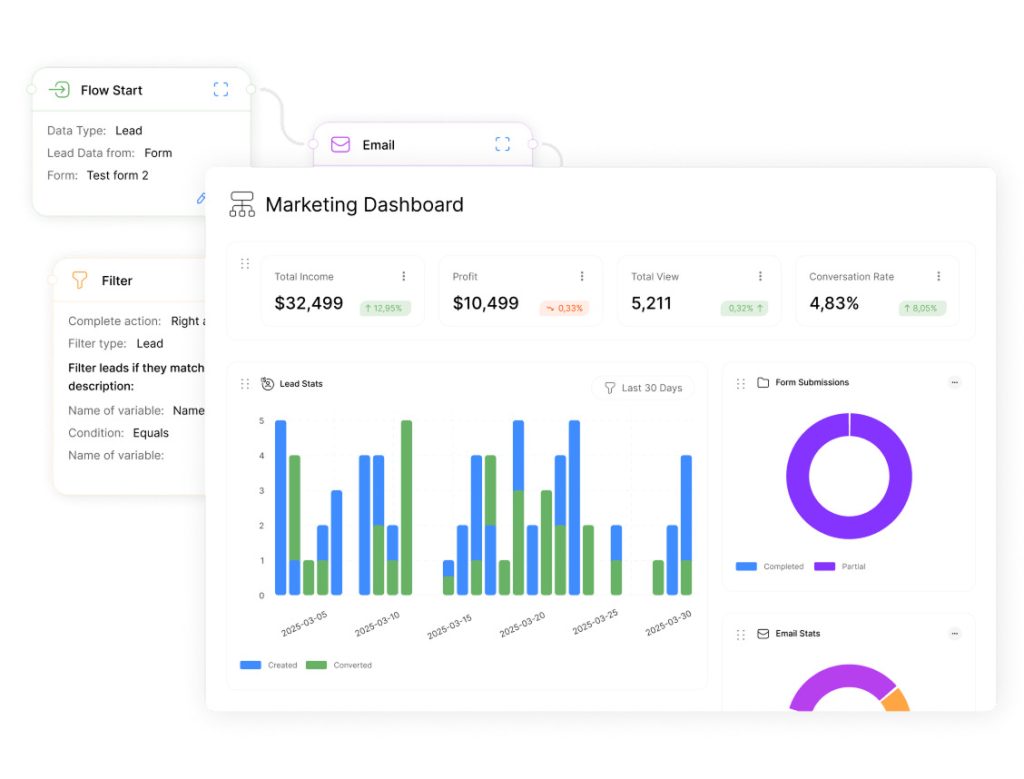

Regular audits powered by AI detect anomalies 3x faster than manual reviews. Integrated systems provide dashboards showing real-time budget consumption across departments. This visibility enables swift adjustments before minor issues escalate.

Companies adopting these methods report 23% faster month-end closures and 15% higher compliance scores. The right tools create frictionless workflows while maintaining rigorous financial control.

Managing Fixed, Variable, and Indirect Expenses

Controlling costs requires understanding three financial pillars: predictable commitments, activity-driven fluctuations, and operational necessities. Businesses that master these distinctions gain precise budget control while maintaining agility. Strategic categorization helps leaders allocate resources where they deliver maximum impact.

Differentiating Fixed vs Variable Costs

Fixed costs remain unchanged regardless of production levels. Rent, insurance premiums, and salaried staff wages fall into this category. These predictable obligations form the foundation of cash flow planning.

Variable costs shift with operational activity. Raw materials and utility bills often rise during peak seasons. Flexible budgeting tools help teams adapt to these changes without compromising quality.

| Fixed Costs | Variable Costs |

|---|---|

| Consistent monthly amounts | Scale with production volume |

| Long-term contractual agreements | Short-term adjustments possible |

| Examples: leases, software licenses | Examples: shipping fees, packaging |

Understanding Operating and Capital Expenditures

Day-to-day operational costs keep businesses running smoothly. Office supplies, marketing campaigns, and team training sessions represent recurring investments. These expenses directly influence quarterly performance metrics.

Capital expenditures fuel long-term growth. Purchasing manufacturing equipment or upgrading IT infrastructure creates lasting value. “Strategic capex decisions separate market leaders from followers,” observes a McKinsey financial analysis.

| Operating Expenses | Capital Expenditures |

|---|---|

| Immediate operational impact | Multi-year depreciation |

| Tax-deductible annually | Amortized over asset lifespan |

| Examples: advertising, repairs | Examples: vehicles, patents |

Indirect costs like administrative salaries and facility maintenance require separate tracking. Though not tied to specific products, these overhead expenses significantly affect profit margins. Comprehensive classification systems reveal optimization opportunities across all cost categories.

Streamlining Receipt and Travel Expense Management

Modern financial operations demand precision in handling documentation and travel costs. Innovative tools now eliminate paper-based chaos, replacing it with streamlined workflows that boost accuracy and save time. These systems turn scattered receipts into organized data while ensuring compliance with corporate policies.

Digital Receipt Organization Strategies

Mobile apps transform how teams capture transaction details. Employees snap photos of receipts, which software automatically scans for dates, amounts, and vendor data. This process reduces manual entry errors by 92% compared to traditional methods.

| Process | Manual Approach | Digital Solution |

|---|---|---|

| Data Entry Time | 8 minutes/receipt | 22 seconds/receipt |

| Error Frequency | 1 in 5 entries | 1 in 200 entries |

| Audit Prep Time | 3 hours monthly | 18 minutes monthly |

Integrated systems match digital receipts with corporate card transactions instantly. Finance teams reconcile accounts 67% faster while maintaining full audit trails. “Automation lets us focus on strategic analysis instead of data entry,” notes a CFO survey respondent.

Optimizing Travel Cost Oversight

Clear travel policies prevent budget overruns without stifling employee productivity. Pre-approved spending limits and real-time alerts keep costs aligned with company goals. Mobile apps enable instant submission of hotel bills and meal receipts during trips.

- Policy enforcement: GPS verification ensures charges match trip locations

- Speed: 83% faster reimbursement cycles via mobile submissions

- Analytics: Identify preferred vendors with best negotiated rates

Companies using these methods report 31% reductions in unauthorized travel spending. Detailed reports reveal patterns to negotiate better rates with airlines and hotels, turning oversight into profit protection.

Using Budgeting and Reporting to Enhance Financial Clarity

Financial roadmaps separate thriving enterprises from struggling competitors. Strategic budgeting converts vague financial goals into measurable milestones, while detailed reports expose hidden patterns in resource allocation. This combination gives leaders control over where money goes and why.

Developing a Structured Budgeting Process

Effective budgets start with mapping all revenue streams and obligations. Businesses analyze recurring costs like software subscriptions alongside seasonal fluctuations in production expenses. This dual focus creates adaptable frameworks that withstand market shifts.

| Budget Element | Traditional Approach | Modern Solution |

|---|---|---|

| Revenue Forecasting | Static Spreadsheets | AI-Powered Projections |

| Cost Monitoring | Monthly Reviews | Real-Time Dashboards |

| Contingency Funds | 5% Allocation | Dynamic Risk-Based Adjustments |

Allocating 10-15% for unexpected costs prevents operational disruptions when emergencies arise. Automated tools track budget adherence daily, sending alerts when departments approach limits. “Visibility into every dollar’s journey transforms financial planning from guesswork to science,” states a Deloitte financial strategist.

Analyzing Trends to Optimize Spending

Quarterly expense reports reveal which initiatives deliver ROI and which drain resources. Marketing teams might discover webinar costs yield 3x more leads than trade shows. These insights enable swift reallocation of funds to high-impact areas.

Three critical benefits emerge from trend analysis:

- Cost predictability: Identify seasonal spikes in shipping or utilities

- Waste reduction: Flag underused subscriptions or duplicate services

- Strategic alignment: Shift budgets to support growth objectives

Companies using these methods achieve 18% faster budget adjustments during economic shifts. Clear visualizations show exactly where money goes, empowering teams to defend critical expenditures during stakeholder reviews.

Leveraging Advanced Tools & Technology in Expense Tracking

Modern financial management thrives on precision tools that turn complex data into clear strategies. Cutting-edge solutions now eliminate manual workflows while delivering real-time visibility into fiscal health. These innovations empower teams to focus on growth rather than administrative tasks.

Exploring Top Financial Management Apps

Leading platforms automate receipt capture through mobile scans and SMS submissions. Real-time credit card sync with Visa/Mastercard networks instantly categorizes transactions. AI-driven analytics engines answer natural language queries like “Show marketing costs last quarter” through conversational interfaces.

Key capabilities distinguish top-tier solutions:

- Policy enforcement engines blocking non-compliant submissions

- Duplicate detection algorithms saving 14 hours monthly

- Customizable dashboards visualizing spending trends

Accounting System Integration Essentials

Seamless connections with platforms like QuickBooks and Xero eliminate data re-entry. Transactions flow directly into general ledgers, reducing reconciliation errors by 78%. Cloud synchronization ensures accessibility across devices and locations.

| Integration Feature | Traditional Approach | Modern Solution |

|---|---|---|

| Data Transfer Speed | 24-48 hours | Instant sync |

| Error Rate | 12% | 0.5% |

| Mobile Access | Limited | Full functionality |

“Unified systems cut our month-end close from 10 days to 72 hours,” reports a CFO survey respondent.

Customizable approval workflows accelerate reimbursements while maintaining compliance. Teams gain instant visibility into budget consumption through interactive heatmaps and forecasting tools.

Conclusion

Mastering financial clarity transforms operational hurdles into strategic advantages. Organizations that implement systematic oversight gain precise control over cash flow while aligning spending with growth targets. Regular reviews of financial data uncover optimization opportunities often hidden in daily transactions.

Effective categorization methods – whether analyzing fixed versus variable costs or separating essential from discretionary spending – create actionable frameworks. These systems help leaders redistribute resources toward high-impact initiatives. Modern solutions automate data collection, turning complex records into visual dashboards for swift decision-making.

Small business owners particularly benefit from establishing consistent review cycles. Quarterly analyses reveal patterns in vendor relationships and operational efficiencies. This practice builds tax-ready documentation while maintaining budget discipline during market shifts.

Proactive financial management ultimately serves as both shield and catalyst. Companies strengthen compliance while freeing capital for innovation. The right combination of tools and processes turns fiscal responsibility into competitive advantage, ensuring every dollar fuels sustainable success.