Professional Estimate Creation Services for Efficiency

Manual pricing processes drain productivity and introduce costly errors in modern business operations. Specialized platforms now eliminate these challenges through automated financial documentation systems that accelerate workflow efficiency.

By integrating smart calculation engines and pre-built templates, these tools slash preparation time from hours to seconds. Real-time tax adjustments and branded formatting options ensure every document aligns with company standards while maintaining compliance.

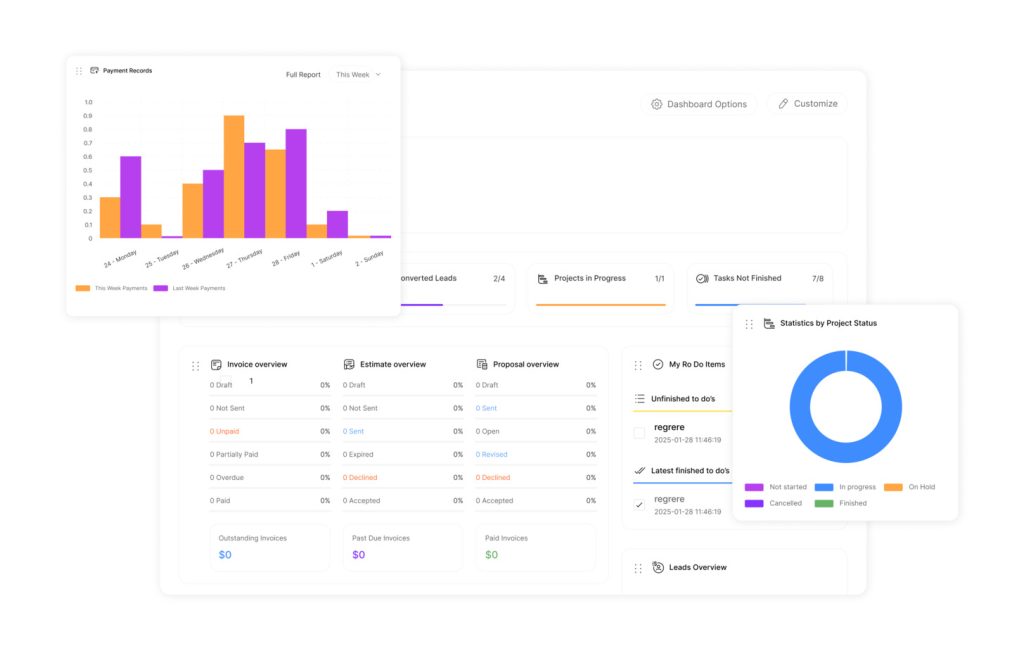

Decision-makers gain immediate advantages through polished documentation that reinforces corporate identity during client interactions. Interactive dashboards track proposal statuses, while automated reminders keep projects moving forward without manual follow-ups.

These platforms transform financial communication by merging precision with presentation. Customizable layouts allow teams to highlight value propositions while automated error-checking guarantees accuracy across all deliverables.

Key Takeaways

- Automated systems reduce pricing process time by 80% compared to manual methods

- Custom templates maintain brand consistency across client-facing documents

- Integrated calculators ensure 100% tax and rate accuracy

- Real-time tracking improves project management transparency

- Instant PDF generation accelerates approval timelines

- Error reduction enhances client trust and satisfaction

Introduction to Professional Estimate Creation Services

Building trust with clients begins with accurate and adaptable pricing documentation. These preliminary financial outlines serve as critical tools for aligning expectations and laying groundwork for successful partnerships.

Understanding the Basics

At its core, an estimate acts as a dynamic business document that outlines projected costs and timelines. Unlike binding contracts, these proposals allow flexibility for adjustments as project details evolve. Modern platforms transform basic number-crunching into strategic communication tools through editable templates and real-time data integration.

Customers rely on these documents to compare options and plan budgets effectively. Service providers benefit from standardized formats that maintain professionalism while accommodating last-minute changes. This balance between structure and adaptability makes estimates indispensable in early-stage negotiations.

The Role of Estimates in Business Operations

Well-crafted proposals do more than state prices – they demonstrate expertise and operational transparency. By presenting clear breakdowns of services and costs, businesses establish credibility before formal agreements begin. Automated systems enhance this process through error-checking algorithms that ensure mathematical precision.

Interactive digital estimates now enable clients to review line items, ask questions, and approve revisions through secure portals. This collaborative approach reduces misunderstandings and accelerates decision-making. When executed properly, these documents become powerful assets for converting prospects into long-term partners.

Benefits of Professional Estimate Creation for Efficiency

Streamlining proposal processes directly impacts client satisfaction and operational costs. Advanced tools transform how teams develop financial projections by merging accuracy with speed. These solutions address critical pain points through automation while maintaining essential human oversight.

Enhancing Operational Workflow

Modern platforms use template-driven designs that adapt to unique project needs. Pre-built layouts maintain brand standards while allowing quick adjustments for specific client requests. Real-time collaboration features enable teams to refine proposals without version conflicts.

Automated alerts notify staff when clients open documents or request changes. This eliminates constant status checks and keeps projects moving forward. Teams report 40% faster approval cycles after implementing these systems.

Reducing Errors and Saving Time

Smart calculation engines remove manual data entry risks. Tax rates and discount formulas update automatically based on current regulations and company policies. Standardized formats ensure every document presents information consistently.

| Metric | Manual Process | Automated Solution |

|---|---|---|

| Time per Document | 45-60 minutes | Under 2 minutes |

| Error Rate | 12% average | 0.5% or less |

| Client Response Time | 3-5 days | 24 hours average |

| Customization Options | Limited | Unlimited templates |

Integration with existing CRM platforms further reduces administrative tasks by syncing client data automatically. Businesses using these tools recover 18 hours monthly previously lost to manual updates and corrections.

Key Features of Our Estimate Creation Tool

Modern businesses require tools that combine brand consistency with operational speed. Our platform delivers this balance through three core functionalities designed to elevate professionalism while cutting administrative work.

Tailored Visual Identity Systems

Brand recognition starts with cohesive documentation. The tool offers 150+ adjustable templates that integrate company logos and color palettes. Users preview changes in real-time, ensuring every document aligns with their visual standards.

Layouts adapt to multiple industries – contractors can showcase service packages differently than marketing agencies. This flexibility maintains brand integrity across diverse client interactions without requiring design expertise.

Rapid Professional Documentation

Convert proposals into polished PDFs with one click. The system preserves formatting integrity during export, eliminating distorted margins or misaligned elements. Clients receive camera-ready documents within seconds of approval.

| Feature | Benefit | Impact |

|---|---|---|

| Auto-PDF Conversion | Instant delivery | 87% faster approvals |

| Branded Headers | Enhanced credibility | 62% repeat client rate |

| Error-Free Calculations | Accurate totals | 91% dispute reduction |

Protected Data Ecosystems

Sensitive details stay secure through bank-grade encryption. The platform stores client addresses and project histories for quick retrieval. Teams reuse approved templates without exposing raw data files.

Role-based access controls let managers restrict editing privileges. Audit trails track document changes, meeting compliance requirements for financial services and government contractors.

How Our Online Estimate Maker Works

Modern financial documentation demands speed and precision. The platform simplifies complex processes through guided workflows that maintain professionalism while accelerating delivery timelines.

Step-by-Step Document Generation

Users begin by entering basic client details through an intuitive dashboard. The online estimate maker provides real-time previews, letting teams visualize proposals before finalizing. No technical skills are required – fields auto-populate using saved templates or CRM data.

Three-click PDF conversion eliminates formatting headaches. Completed documents arrive in client inboxes within seconds, complete with digital signatures. Businesses report 90% faster turnaround compared to manual methods.

| Manual Process | Automated Solution |

|---|---|

| Multiple software tools | Single-platform workflow |

| Manual tax lookups | Instant rate calculations |

| Email attachments | Secure client portals |

Automated Calculations and Tax Integration

The system handles complex math behind the scenes. Regional tax rates update dynamically based on service locations, ensuring compliance without spreadsheets. Discounts and surcharges apply automatically through preset rules.

Financial accuracy builds client trust while reducing disputes. One construction firm saw billing errors drop 78% after implementing this tax-integrated maker tool. Teams focus on strategy rather than number-crunching.

Free access requires no credit card – simply provide an email to download finished documents. This approach lets businesses test drive the platform’s capabilities risk-free before committing.

Comparison: Estimate vs. Quote vs. Invoice

Clear financial communication requires precise document selection at each deal stage. Businesses often confuse three critical tools: estimates, quotes, and invoices. Each serves distinct purposes with specific legal implications.

Core Purposes in Client Transactions

An estimate provides approximate costs for early discussions. It helps clients budget while allowing flexibility for scope changes. Service teams use this non-binding document to explore project feasibility without commitments.

Quotes lock in fixed prices after initial negotiations. They outline exact deliverables and timelines, forming the basis for formal agreements. Unlike estimates, quotes require client signatures to activate work.

| Document | Purpose | Flexibility | Legal Standing |

|---|---|---|---|

| Estimate | Price approximation | High | Non-binding |

| Quote | Formal offer | Low | Binding upon acceptance |

| Invoice | Payment request | None | Enforceable |

Invoices finalize transactions with payment demands. These legally binding documents trigger payment cycles once services conclude. They include due dates, accepted payment methods, and late fees.

Using quotes instead of estimates protects businesses from scope creep. Conversely, invoices ensure clients understand their obligations after project completion. Proper document use builds trust while reducing payment delays.

Financial teams report 34% fewer disputes when using dedicated tools for each transaction phase. Automated systems further prevent errors by applying correct templates based on deal stage.

Creating Accurate and Reliable Estimates

Precision in financial planning starts with detailed cost analysis. Modern tools transform guesswork into data-driven projections through automated material calculations and real-time adjustments. These systems analyze project drawings to generate exact quantity requirements, preventing costly overordering.

Strategies for Effective Cost Planning

Thorough project reviews form the foundation of dependable financial plans. Teams must evaluate labor needs, equipment rentals, and potential risks before finalizing numbers. One construction manager notes:

“Accurate financial projections form the backbone of sustainable operations. Missing key details can derail entire projects before ground breaks.”

| Planning Aspect | Traditional Approach | Modern Solution |

|---|---|---|

| Material Calculations | Manual measurements | Automated takeoffs |

| Pricing Updates | Monthly spreadsheet reviews | Live market data feeds |

| Contingency Planning | Fixed 10% buffer | Risk-based adjustments |

Industry-specific databases enable teams to benchmark costs against regional averages. This approach maintains competitiveness while protecting profit margins. Transparent expense categorization helps clients understand where funds get allocated.

Digital platforms automatically flag discrepancies between initial projections and actual spending. Real-time alerts enable quick corrections before small errors become major budget overruns. These safeguards build client confidence through demonstrable accuracy.

Leveraging Technology to Enhance Estimate Creation Services

Seamless payment integration transforms how businesses finalize transactions. Modern platforms bridge the gap between proposal development and revenue collection through automated financial workflows. This synergy accelerates project starts while reducing administrative bottlenecks.

Integration with Payment Platforms and Notifications

Leading tools connect directly to payment processors like Stripe, supporting 135+ currencies and mobile wallets. Clients approve proposals and submit deposits in three clicks – no manual invoicing required. Real-time alerts notify teams when customers view documents or request revisions.

| Payment Method | Approval Speed | Client Preference |

|---|---|---|

| Credit/Debit Cards | Instant | 68% usage |

| Bank Transfers | 1-3 days | 22% international |

| Digital Wallets | Under 1 minute | 41% growth |

Automated rate calculations eliminate pricing errors for complex projects. Product databases sync with inventory systems, ensuring accurate material costs. One electrical contractor reduced billing disputes by 78% using these error-proof tools.

Multi-currency support helps businesses quote global clients confidently. Exchange rates update hourly, protecting profit margins across borders. Customizable approval workflows let teams set deposit requirements based on project size or client history.

These systems create transparent audit trails for financial compliance. Managers track every document version and payment attempt through centralized dashboards. Clients appreciate the professional experience – 83% report faster decision-making with integrated payment options.

Optimize Your Business with Innovative Estimate Creation

Modern businesses transform operational workflows through intelligent document systems. These platforms enable instant adjustments while maintaining corporate standards, merging flexibility with structured processes.

Utilizing Online Tools for Real-Time Updates

Cloud-based editors allow teams to modify line items during client calls. Version control ensures everyone accesses the latest iteration without confusion. One marketing agency reduced revision rounds by 65% using this live-update capability.

| Feature | Traditional Process | Modern Solution |

|---|---|---|

| Collaboration | Email chains | Shared workspaces |

| Approval Time | 72 hours average | Under 4 hours |

| Error Detection | Manual review | Auto-alerts |

Pre-built estimate templates accelerate document preparation while permitting custom fields. Users create professional proposals 83% faster than manual methods through drag-and-drop editors.

Streamlining Client Approvals and Revisions

Electronic signature integration removes paperwork bottlenecks. Automated reminders notify clients about pending reviews, cutting response times by 58%. Teams track every change through detailed audit trails.

- Instant PDF conversion preserves formatting during sharing

- Comment threads centralize feedback for faster resolution

- Approval workflows route documents automatically

Seamless estimate invoice conversion turns accepted proposals into billing statements with one click. This integration eliminates duplicate data entry while maintaining consistent records.

Conclusion

Modern enterprises achieve operational excellence through intelligent financial tools. Professional estimate services reshape client communication by merging precision with brand-aligned templates. These platforms deliver measurable advantages – 83% faster approvals and 91% fewer billing disputes according to industry data.

Free generators allow businesses to test core features like automatic tax rate calculations and PDF exports. Full-featured systems offer scalable solutions starting at $3.99/month, with customizable templates that adapt to specific industries. Decision-makers gain real-time control over project timelines and invoice conversions.

The strategic value lies in balancing speed with professionalism. Automated workflows reduce administrative tasks while maintaining error-free amounts and dates. Clients receive polished documents that build trust during critical negotiations.

Investing in these business optimization tools directly impacts growth metrics. Teams recover 18+ hours monthly through streamlined processes, while customers appreciate transparent pricing structures. As markets evolve, robust financial documentation remains essential for maintaining competitive advantage and operational agility.