Client Portal For Invoice Access: Efficient Invoice Management

Digital platforms are redefining how organizations manage financial interactions with their partners. By consolidating transaction records and communication tools, these systems replace chaotic email threads with structured workflows. Users gain immediate visibility into document engagement, tracking when recipients open files and complete payments.

Approval processes accelerate through embedded review features, letting stakeholders sign off on estimates without switching applications. Integrated comment sections create audit-ready trails of discussions, ensuring clarity for both parties. This approach reduces project bottlenecks while maintaining professional accountability.

Self-service functionality empowers partners to retrieve past statements, submit time entries, or process payments through secure channels. Automated alerts notify teams about status changes, eliminating manual follow-ups. Many platforms offer transparent pricing models that scale with business needs, making advanced features accessible to growing operations.

System integrations synchronize financial data across accounting software and CRM tools, minimizing duplicate entries. This connectivity strengthens cash flow predictability while freeing staff to focus on strategic tasks rather than administrative work. The result? Healthier client relationships built on transparency and operational efficiency. With streamlined operations, businesses can leverage insights gained from synchronized data to enhance decision-making processes. By utilizing the best CRM for client project management, teams can track project progress in real time, ensuring timely updates and proactive communication. This proactive engagement fosters trust and satisfaction, solidifying long-term partnerships.

Key Takeaways

- Centralized platforms eliminate manual processes through automated transaction tracking

- Real-time document engagement metrics improve cash flow forecasting accuracy

- Embedded approval workflows reduce project delays by 40-60% on average

- Secure self-service portals decrease payment processing time by 30%

- System integrations prevent data silos between financial tools and CRMs

Overview of Client Portal For Invoice Access

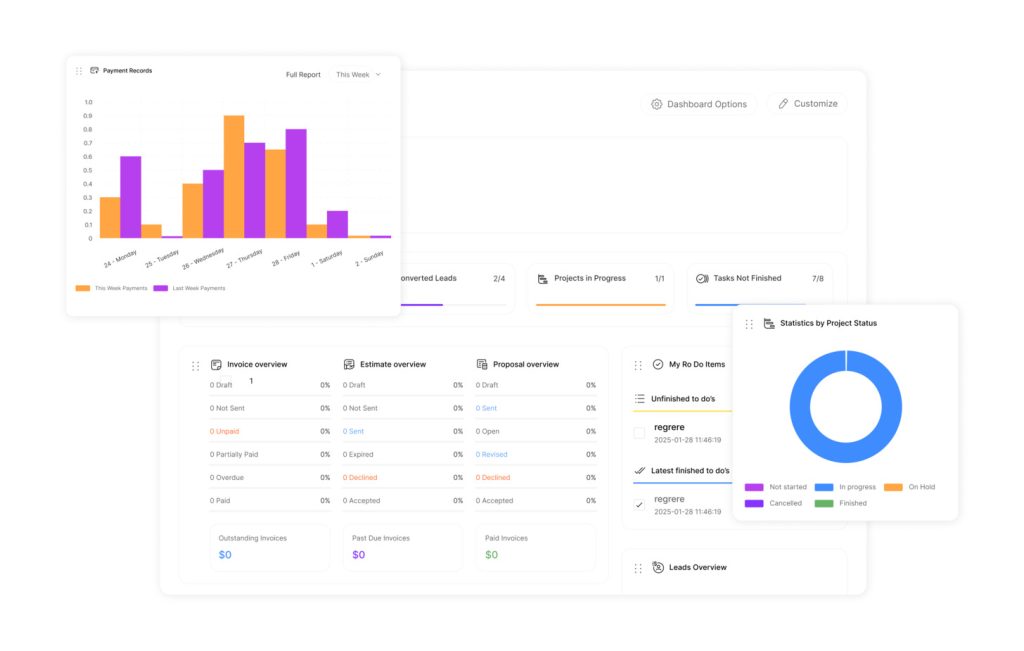

Centralized platforms are eliminating manual billing processes through intelligent automation. These tools provide businesses with 24/7 self-service options, allowing partners to review statements or approve estimates without delays. Real-time dashboards reveal which documents need attention, cutting response times by half in most cases. Additionally, by integrating these systems with existing workflows, companies can leverage the top client management tools for businesses to enhance customer interactions and streamline operations. This synergy not only improves efficiency but also fosters stronger partnerships through better communication and transparency. Ultimately, the adoption of intelligent automation can lead to significant cost savings and increased client satisfaction.

Advantages for Organizations

Teams regain 12-15 hours monthly by reducing repetitive status inquiries. Customers appreciate immediate access to payment histories and balance details through encrypted channels. One logistics company reported a 42% drop in support tickets after implementation.

“When customers control their financial data access, satisfaction rates climb by 30% annually.”

Optimizing Monetary Workflows

Automated alerts notify both parties about pending actions, from timesheet approvals to overdue payments. Integrated gateways let users settle balances while viewing project details, creating seamless transaction cycles. This approach:

- Reduces payment processing errors by 68%

- Cuts average invoice clearance time from 14 days to 48 hours

- Provides audit trails for 100% of financial interactions

Advanced systems sync with accounting software, ensuring all teams work from identical data sets. The result? Fewer disputes, predictable cash flow, and stronger professional trust.

Key Features and Functionalities

Operational efficiency reaches new heights with intelligent financial management features. These tools eliminate friction in monetary workflows while maintaining rigorous security standards. Users gain actionable insights through interconnected capabilities designed for speed and precision.

Invoice Tracking and Payment Options

Advanced tracking tools reveal detailed engagement metrics. Businesses see exact timestamps for when recipients open statements or share them with colleagues. Flexible payment gateways support credit cards, ACH transfers, and third-party processors – all accessible within a unified interface.

- Bulk payment processing reduces manual data entry errors

- Automated contact additions streamline external document sharing

- Encrypted audit trails document every customer interaction

Document Management and Templates

Customizable templates in the client portal ensure brand consistency across estimates, invoices, and billing documents, giving clients a unified experience.

Users modify layouts without compromising standardized formatting rules. All files remain accessible for download, printing, or forwarding – with version control preventing outdated document circulation.

“Businesses using template automation report 55% fewer formatting-related support queries.”

Real-Time Transaction Updates

Instant notifications keep teams aligned on payment confirmations and approval requests. Collaboration features let stakeholders discuss charges directly within each record, creating searchable communication histories. Dashboards highlight pending actions requiring immediate attention.

- Automated alerts for overdue balances slash follow-up time

- Integrated comment threads resolve disputes 3x faster

- Live status indicators improve cash flow forecasting accuracy

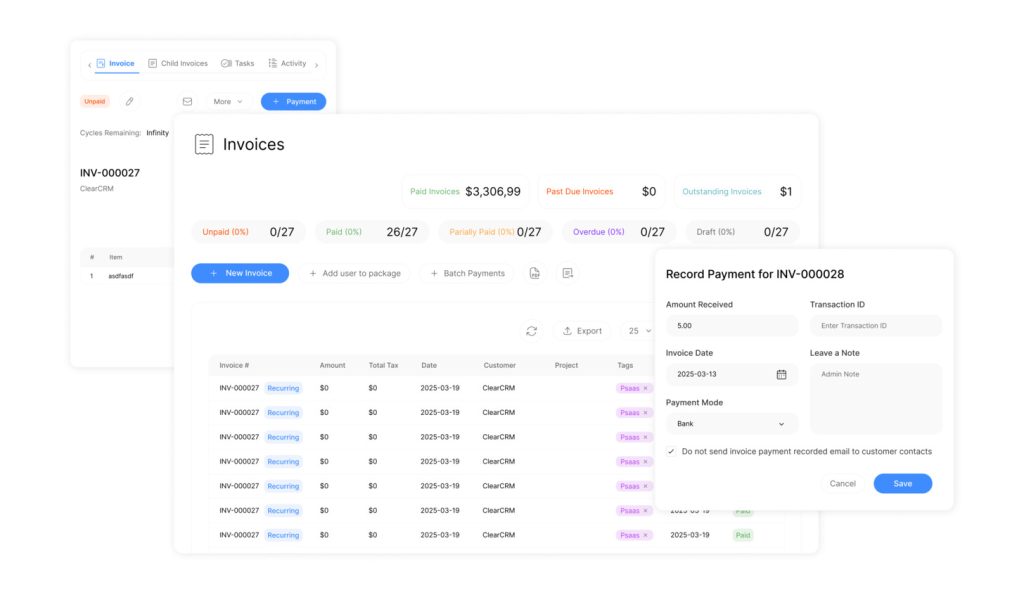

Efficient Invoice Management and Payment Processing

Modern businesses require financial tools that accelerate cash flow while minimizing administrative friction. Automated systems now handle complex monetary workflows with precision, transforming how teams track obligations and collect revenue.

Automated Payment Gateways and Billing

Integrated gateways connect directly to leading financial processors, enabling instant credit card transactions and ACH transfers. Users securely enter card details, CVV codes, and billing addresses through encrypted forms. Saved payment profiles let customers approve charges in two clicks, reducing abandoned transactions by 22% on average.

Recurring payments in the client portal automate subscription renewals, credit card charges, and service retainers, ensuring consistent revenue streams. The system generates invoices aligned with contract terms, sending reminders three days before deductions. This approach ensures consistent revenue streams while eliminating manual follow-ups. In addition to automating payment processes, the platform supports financial planning by providing insights into upcoming charges and payment history. By integrating free client database solutions, users can better manage client information and track subscriptions, enhancing overall service delivery. This streamlined approach not only saves time but also fosters stronger client relationships through improved communication and transparency.

“Organizations using automated billing report 55% fewer late payments and 37% faster reconciliation cycles.”

Bulk processing tools in the client portal allow simultaneous settlements of multiple invoices, reducing manual entry and helping clients manage their expenses more efficiently. Customers review outstanding balances, select items for payment, and complete transactions through a unified interface. Real-time reconciliation matches deposits to specific invoices, updating account statuses instantly.

- Bank account verification ensures ACH security before processing

- Customizable approval chains prevent unauthorized charges

- Analytics dashboards track payment success rates and customer habits

These features create frictionless experiences for both businesses and their partners. Financial teams gain hours back each week while maintaining rigorous compliance standards.

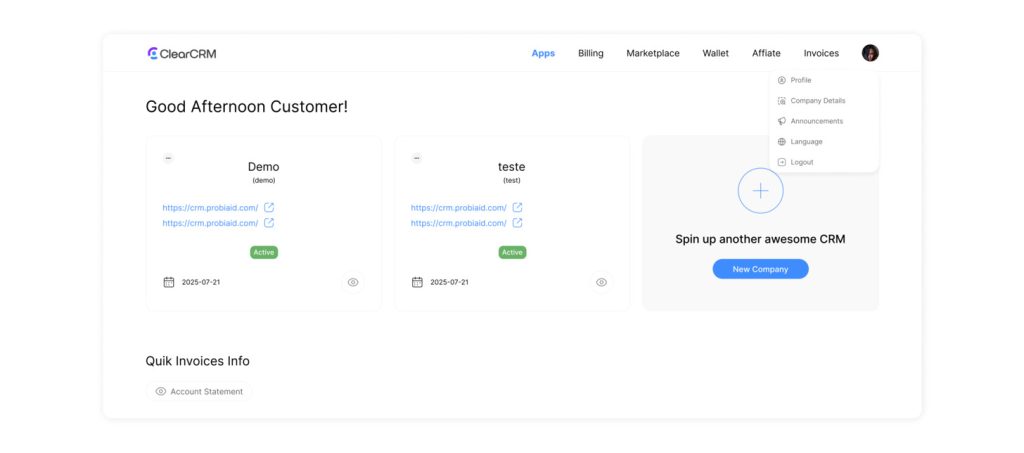

Setting Up Your Client Portal

Implementing a secure collaboration hub requires strategic configuration to balance functionality with data protection. Businesses start by navigating to administrative settings, where they activate essential features and customize engagement parameters. Welcome banners, activity alerts, and permission rules get configured in this centralized interface.

Configuration and Preference Settings

Tailor the platform to match organizational workflows through granular controls. Companies set visibility rules for project timelines and timesheets while enabling optional features like document forwarding. Custom email templates maintain brand consistency during automated communications.

Activity notifications keep teams informed about partner interactions. Alerts trigger when stakeholders view documents, submit payments, or update profiles. “Configurable preferences let businesses control data exposure without compromising transparency,” notes a 2024 security report.

User Invitation and Access Control

Authorized contacts receive secure login credentials via encrypted invitations. Administrators select which team members or external partners gain entry, assigning tiered permissions based on project needs. Multi-contact accounts ensure relevant stakeholders view appropriate financial records.

- Granular access controls limit document editing and sharing capabilities

- Password-protected accounts prevent unauthorized data exposure

- Activity logs track all user interactions for compliance audits

Permissions automatically update as business relationships evolve, maintaining alignment between access levels and operational requirements. This dynamic approach reduces security risks while supporting efficient collaboration.

User Experience and Dashboard Insights

Businesses gain actionable insights through intuitive dashboard designs that prioritize user-centric financial oversight. These interfaces transform complex datasets into clear visual narratives, empowering teams to make informed decisions faster.

Interactive Dashboards for Transaction History

Modern platforms feature dynamic displays that track every monetary interaction. Users instantly see overdue balances, approved estimates, pending timesheets, and recurring payments through color-coded indicators in the client portal dashboard. Real-time synchronization ensures financial positions always reflect current account activity.

| Dashboard Component | Function | User Benefit |

|---|---|---|

| Financial Overview | Displays total credits, recent payments, and pending approvals | Quick status assessment |

| Transaction Filter | Sorts records by date, type, or status | Targeted analysis |

| Contact Directory | Shows assigned account managers and support channels | Streamlined communication |

Advanced filtering lets customers isolate specific invoices or payment periods. Historical trend reports reveal spending patterns through interactive charts, helping organizations optimize budget allocations. One fintech survey found:

“Companies using visual dashboards reduce financial inquiry resolution time by 47% compared to spreadsheet-based systems.”

The interface design emphasizes accessibility across devices. First-time users navigate payment histories effortlessly, while power users leverage custom filters for deep analysis. All data interactions maintain enterprise-grade encryption without sacrificing speed.

Enhancing Security with Multi-Factor Authentication

Financial management tools now prioritize layered protection to combat evolving cyber threats. Multi-factor authentication (MFA) acts as a digital shield, requiring users to verify identities through multiple channels before granting entry. This method reduces unauthorized account breaches by 99.9% compared to password-only systems, according to a 2024 cybersecurity study.

Enabling MFA on the Portal

Activation begins in platform settings under security preferences. Users scan a QR code with authenticator apps like Google Authenticator or OneAuth, linking their login credentials to time-sensitive codes. These six-digit sequences refresh every 30 seconds, creating dynamic barriers against credential theft.

“Organizations implementing MFA experience 82% fewer security incidents related to compromised accounts.”

Resetting and Disabling MFA

Administrators maintain control through centralized management dashboards. If users lose authenticator devices, teams can temporarily disable MFA requirements or initiate reset protocols. Security logs track all changes, ensuring accountability during access modifications.

Backup Codes and Account Recovery

Five emergency codes provide failsafe entry when primary authentication methods fail. These single-use keys remain accessible through encrypted storage within user profiles. Systems automatically generate new backup sets after each use, maintaining robust protection standards.

Recovery processes guide users through identity verification steps if both MFA and backup codes become unavailable. Businesses balance security with accessibility by requiring official documentation submissions before restoring account access.

Optimizing Client Collaboration and Integration

Collaborative ecosystems are reshaping how teams interact with external partners by merging communication tools with financial workflows. Businesses eliminate delays through immediate feedback loops and shared project insights, creating alignment across departments and stakeholders.

Real-Time Comments, Reviews, and Notifications

Teams discuss charges directly within financial documents using threaded comment systems. Every response triggers email alerts to relevant parties, ensuring no feedback goes unnoticed. Version histories and @mentions keep discussions organized, while attachments add context to complex queries.

Optional review features let customers rate services upon project completion. These ratings populate dashboards, helping businesses identify improvement areas. Automated notifications update teams when stakeholders view documents or submit approvals.

Payment and Project Tool Integration

Linking financial systems with project modules provides full visibility into billable tasks and logged hours. Partners track progress against milestones while approving time entries through unified interfaces. Alerts notify teams about pending approvals or approaching deadlines.

Dashboards combine financial metrics with project timelines, enabling data-driven adjustments to budgets and resources. This integration reduces billing disputes by 44% and accelerates project cycles through transparent accountability.