Financial Services CRM With Comprehensive CRM

The Challenge for Financial Services Firms

Small and medium-sized financial services businesses face unique challenges that generic tools simply can’t address. These pain points can severely impact your ability to grow and provide exceptional service.

Disorganized Client Management

Consider Sarah, a financial advisor who lost a major client because she couldn’t quickly access their portfolio history during an urgent call. With client information scattered across emails, spreadsheets, and paper notes, financial advisors waste precious hours searching for data instead of building relationships.

Inefficient Workflows

For wealth management firms, tracking follow-ups and managing compliance documentation manually leads to costly errors. One missed deadline or overlooked regulatory requirement can result in penalties or lost business opportunities.

Poor Lead Tracking

Many financial services businesses struggle to nurture prospects effectively. Without a systematic approach to lead management, potential clients fall through the cracks, and conversion rates suffer dramatically.

Limited Scalability

As your client base grows, managing relationships becomes exponentially more complex. The systems that worked for 10 clients break down completely at 50 or 100, creating a ceiling on your potential growth.

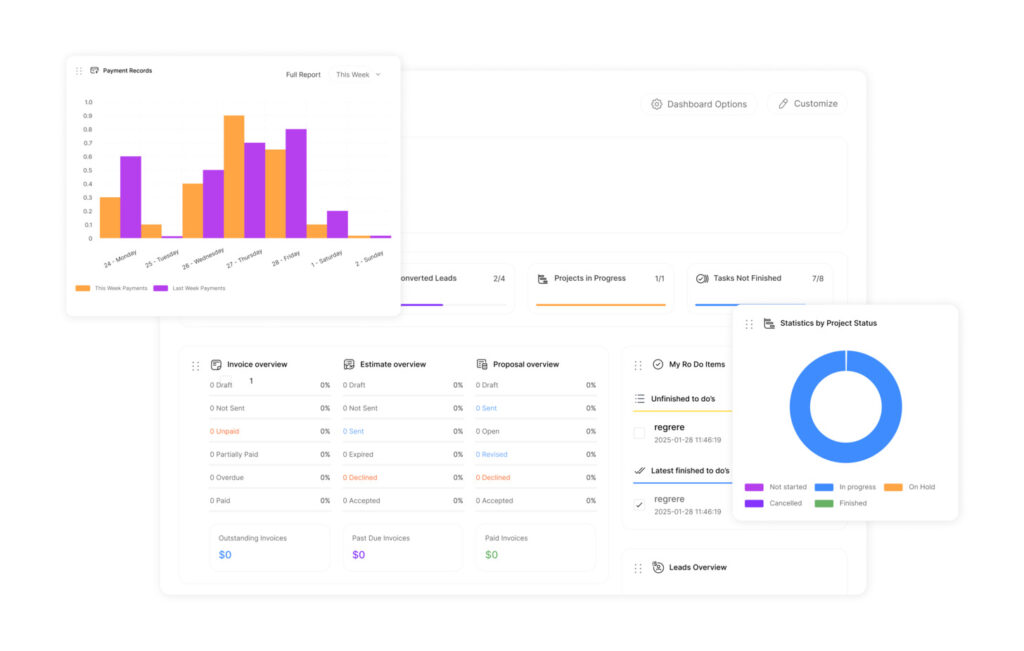

How ClearCRM Solves Your Financial Services Challenges

ClearCRM was built specifically for financial services professionals who need to manage complex client relationships while maintaining compliance and driving growth. Unlike generic CRM tools, our solution addresses the unique needs of financial advisors and wealth management firms.

Centralized Client Management

Store all client information in one secure location – from contact details and meeting notes to portfolio performance and risk preferences. Access complete client histories instantly, even on mobile devices during client meetings.

Automated Financial Workflows

Set up automated reminders for portfolio reviews, compliance deadlines, and client birthdays. ClearCRM’s workflow automation ensures nothing falls through the cracks, freeing your team to focus on high-value client interactions.

Intelligent Lead Tracking

Convert more prospects with ClearCRM’s lead management system. Track every interaction, set follow-up tasks, and identify your most promising opportunities with built-in lead scoring based on financial industry metrics.

Ready to transform your client relationships?

Join hundreds of financial advisors who’ve streamlined their practice with ClearCRM.

Real-World Success: How Financial Advisors Use ClearCRM

Let’s look at how Meridian Wealth Advisors, a growing financial planning firm, transformed their operations with ClearCRM.

The Challenge

Meridian was struggling with client management as they grew from 3 to 8 advisors. Their team was missing follow-ups, spending hours preparing for client meetings, and struggling to track compliance requirements. Client onboarding took weeks, creating a poor first impression.

The ClearCRM Solution

After implementing ClearCRM, Meridian centralized all client data and automated their financial planning workflows. Client onboarding time decreased by 40%, and advisors saved an average of 12 hours per week on administrative tasks. The automated compliance tracking eliminated regulatory concerns, while lead tracking improved conversion rates by 35%.

“ClearCRM transformed how we manage client relationships. We’ve reduced administrative work by 70% while providing more personalized service. Our clients notice the difference, and our business has grown 45% since implementation.”

Benefits That Deliver Measurable Results

When financial services firms implement ClearCRM, they experience tangible improvements across their business. Here’s what you can expect:

Time Savings

Financial advisors save an average of 15+ hours per month on administrative tasks through automated workflows and centralized client data. That’s nearly two full workdays you can redirect to revenue-generating activities.

Improved Client Retention

ClearCRM users report a 28% increase in client retention rates. By tracking important client milestones and preferences, you’ll deliver more personalized service that keeps clients loyal for years.

Faster Growth

With streamlined lead management and improved conversion rates, financial services firms using ClearCRM grow their client base 40% faster than competitors. Our lead nurturing tools ensure no opportunity is missed.

Ready to experience these benefits in your practice?

Join financial advisors who are growing their business with ClearCRM.

Why ClearCRM Outperforms Other Financial Services CRM Solutions

Not all CRM systems are created equal, especially when it comes to the specialized needs of financial services. Here’s how ClearCRM compares to other popular options:

ClearCRM

- Purpose-built for financial services with compliance tracking

- Unlimited projects and client records at all pricing tiers

- Built-in marketing campaigns with financial services templates

- Intuitive interface requiring minimal training

- Automated workflow builder with financial planning templates

- Comprehensive client management with portfolio tracking

- Industry-leading security and compliance features

Generic CRM A

- General-purpose CRM lacking financial services features

- Limited records at lower pricing tiers

- Basic marketing tools requiring separate add-ons

- Complex interface with steep learning curve

- Limited workflow automation capabilities

- Basic contact management without portfolio insights

- Standard security features

Financial Tool B

- Financial planning tools without robust CRM features

- Project limitations at most pricing tiers

- No integrated marketing capabilities

- Technical interface designed for specialists

- No workflow automation

- Strong portfolio management but weak relationship tracking

- Financial security without comprehensive compliance tools

“After trying three different CRM systems, we found ClearCRM to be the only solution that truly understands the needs of financial advisors. The compliance tracking alone has saved us countless hours and potential headaches.”

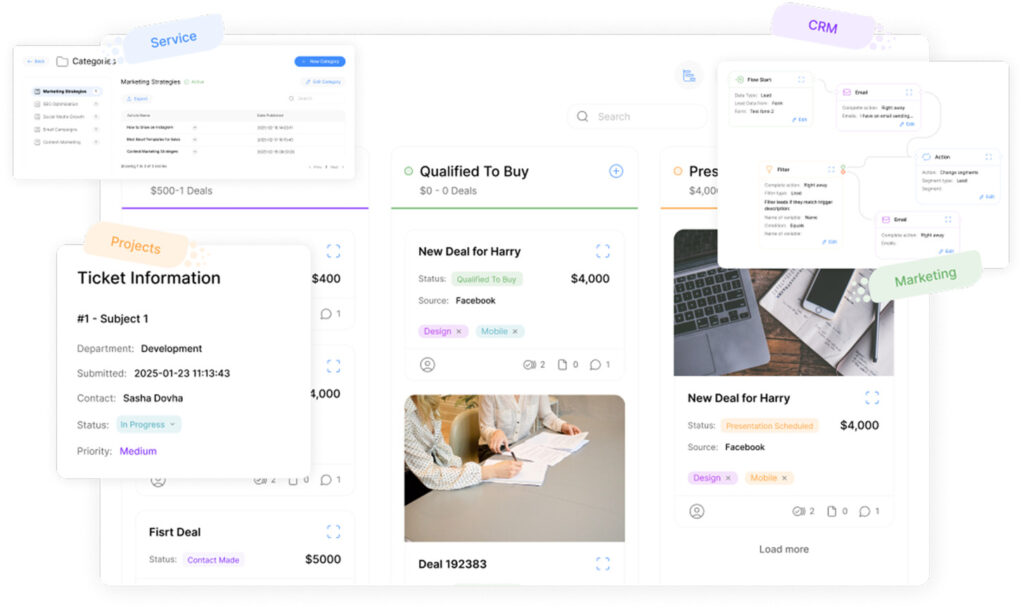

Key Features of ClearCRM for Financial Services

ClearCRM combines powerful client management capabilities with specialized tools for financial services professionals. Here’s what makes our platform the preferred choice for advisors and wealth management firms:

Client Relationship Management

- 360-degree client profiles with financial history

- Household relationship mapping

- Communication tracking across all channels

- Secure document storage and sharing

- Client portal for two-way collaboration

Financial Planning Tools

- Portfolio tracking and performance reporting

- Goal-based planning frameworks

- Risk assessment tools

- Asset allocation modeling

- Financial milestone tracking

Compliance and Security

- Automated regulatory compliance tracking

- Audit-ready documentation

- Role-based access controls

- End-to-end encryption

- Secure client data management

Business Growth Tools

- Lead scoring and qualification

- Marketing campaign management

- Referral tracking and management

- Business analytics and reporting

- Client segmentation for targeted services

Seamless Implementation for Financial Services Teams

Worried about the complexity of switching to a new CRM? ClearCRM makes the transition smooth and straightforward, with minimal disruption to your practice.

Data Migration

Our team handles the migration of your existing client data, ensuring nothing is lost in the transition. We’ve developed specialized tools to import from spreadsheets, legacy systems, and other CRMs commonly used in financial services.

Training & Support

Every ClearCRM subscription includes comprehensive training for your team. Our financial services specialists provide personalized onboarding to ensure you’re leveraging all the features relevant to your practice.

Integration

ClearCRM seamlessly connects with the tools you already use, including financial planning software, portfolio management systems, email platforms, and calendar applications. No more jumping between disconnected systems.

What Financial Advisors Say About ClearCRM

“ClearCRM has transformed how we manage client relationships. The financial planning integration and compliance tracking save us hours each week, and our clients appreciate the more personalized service we can now provide.”

“As a small wealth management firm, we needed a CRM that could grow with us without breaking the bank. ClearCRM delivers enterprise-level features at a price point that works for our business. The ROI has been incredible.”

Transform Your Financial Services Practice with ClearCRM

In today’s competitive financial services landscape, the right CRM isn’t just a nice-to-have – it’s essential for growth and client retention. ClearCRM provides the specialized tools financial advisors need to streamline operations, strengthen client relationships, and drive business growth.

With centralized client management, automated workflows, powerful financial planning tools, and robust compliance features, ClearCRM delivers everything you need to take your practice to the next level. Our platform is designed specifically for the unique challenges and opportunities in financial services.

Ready to revolutionize your client relationships?

Join hundreds of financial advisors who have transformed their practice with ClearCRM.