CRM System For Insurance Agents

The Daily Challenges Insurance Agents Face

Running an insurance agency without specialized tools creates numerous pain points that directly impact your bottom line. Let’s look at what’s holding back many insurance professionals:

Manual Policy Tracking Nightmares

Tracking hundreds of policies across spreadsheets leads to errors and oversights. When a renewal date slips by unnoticed, it’s not just a missed opportunity—it’s a client relationship damaged and revenue lost.

Scattered Client Information

When client data is fragmented across emails, notes, and files, you waste precious time hunting for information during client calls. This disorganization creates a frustrating experience for both you and your clients.

Inefficient Lead Management

Without a system to prioritize and follow up with leads, potential clients fall through the cracks. Insurance agents report that leads requiring more than 5 minutes to respond have a 10x drop in conversion rate.

Limited Growth Capacity

As your client base grows, manual systems quickly become unmanageable. Many agencies hit a growth ceiling simply because their processes can’t scale with their success.

“I was losing at least 3-4 policy renewals every month before implementing a proper CRM system. That translated to thousands in lost commissions annually.”

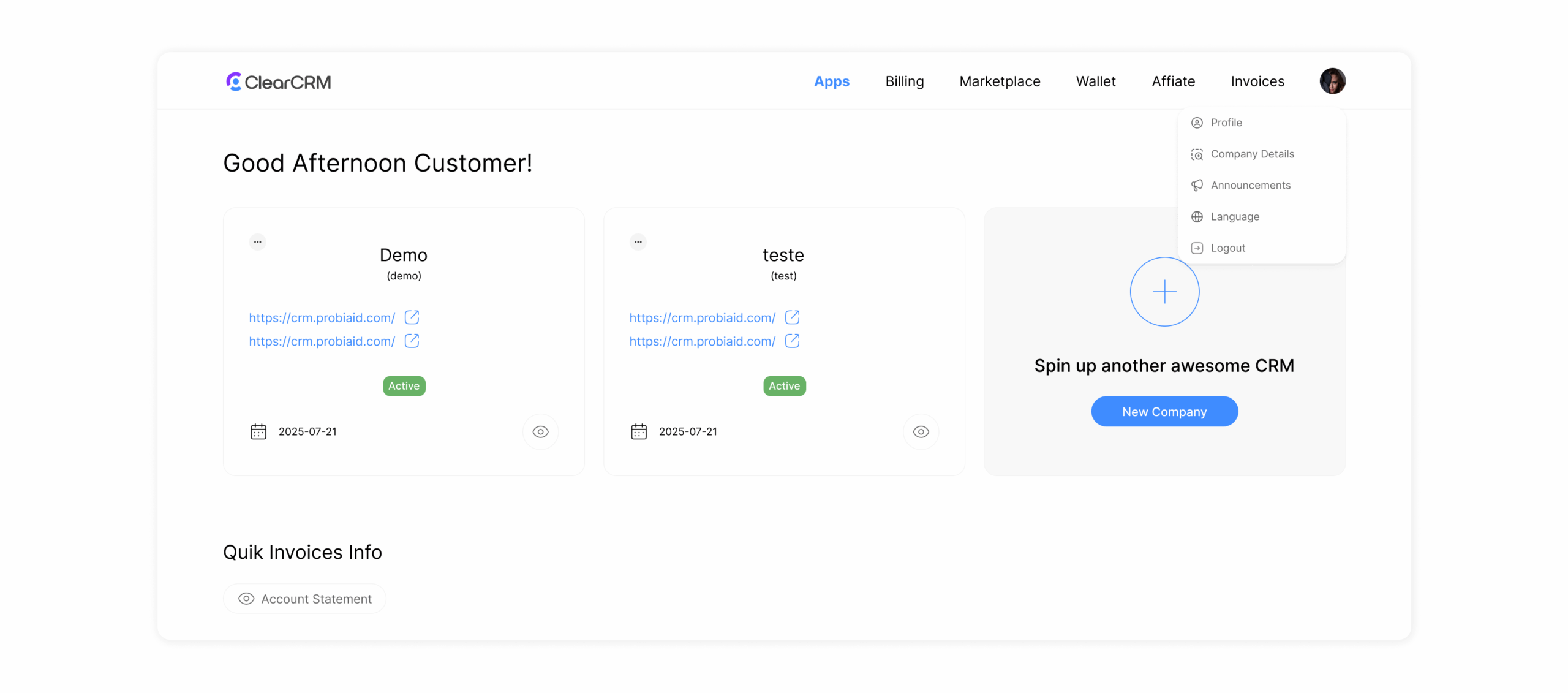

How ClearCRM Solves These Insurance Agent Challenges

ClearCRM was designed specifically for insurance professionals, with features that address the unique challenges of policy management, client relationships, and lead conversion.

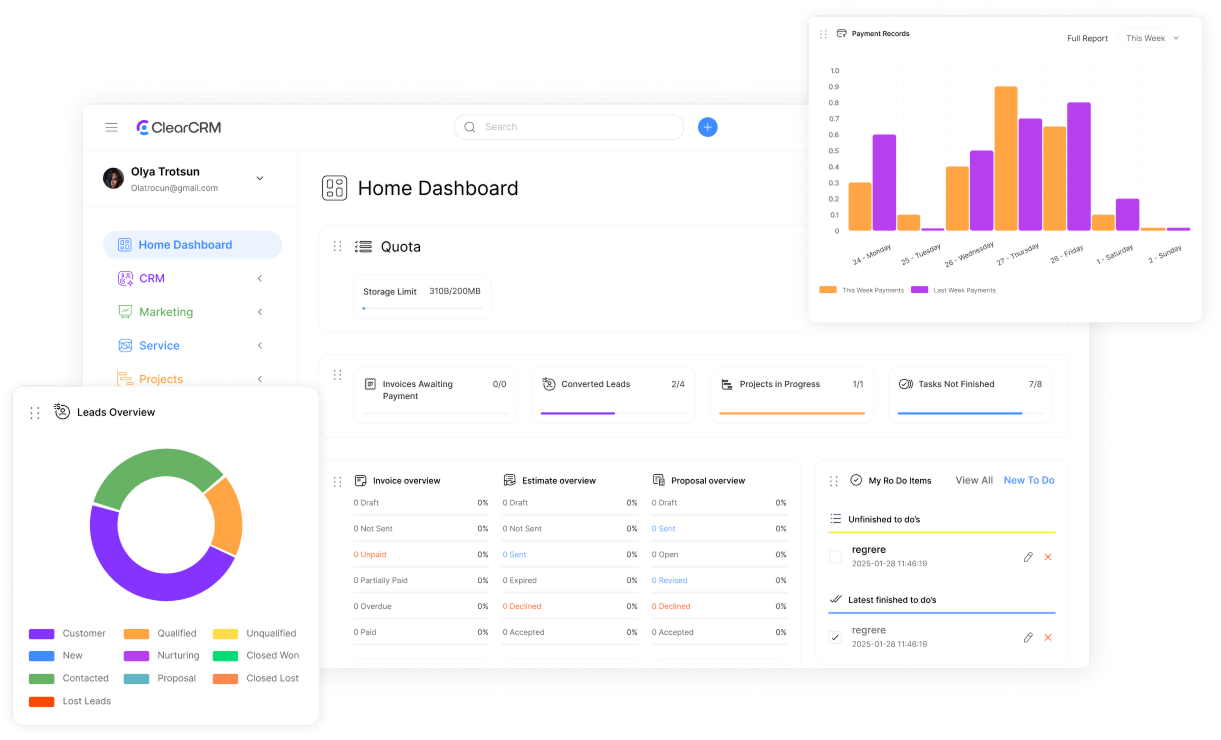

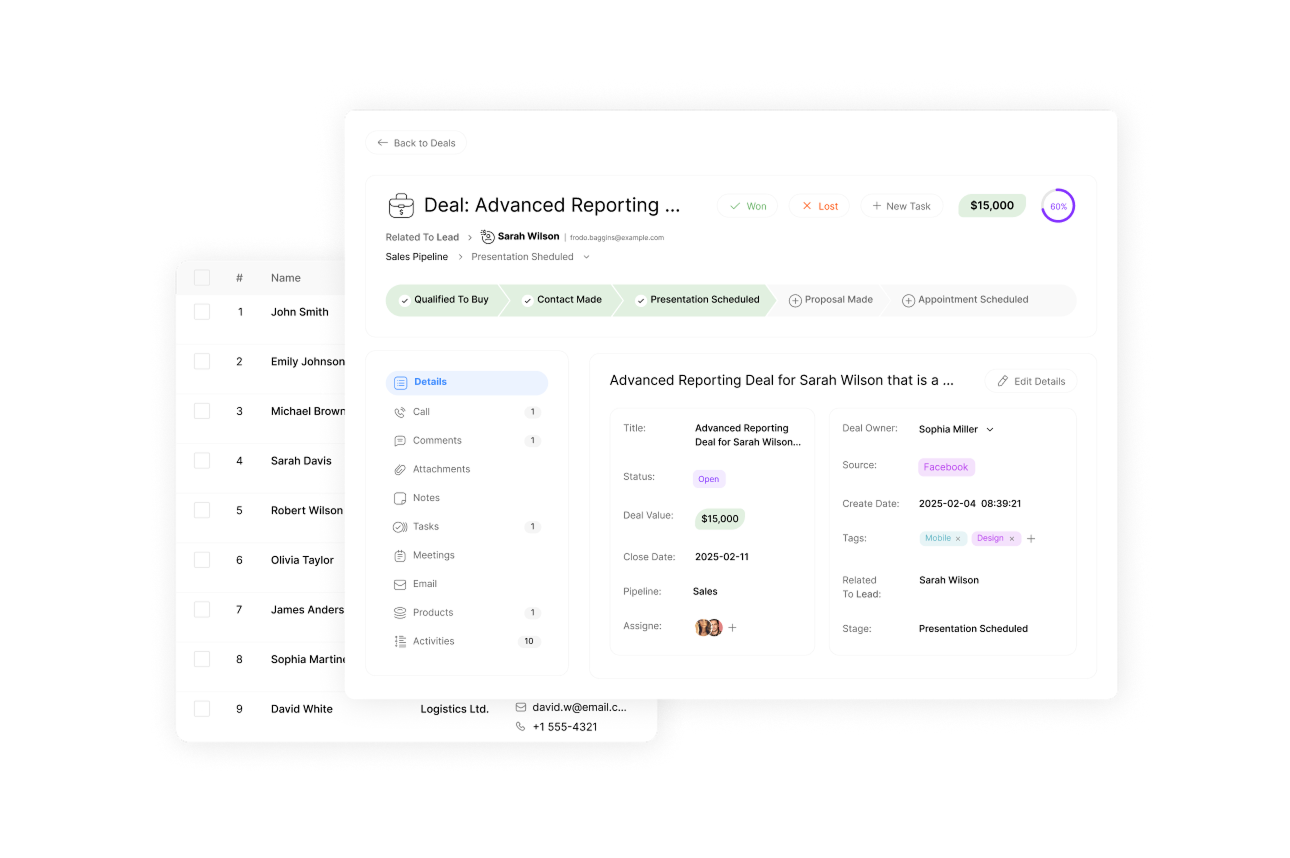

Centralized Client Profiles

Store all client information, policy details, documents, and interaction history in one place. Access everything you need during client calls with just a few clicks.

Automated Renewal Alerts

Never miss a policy renewal again. Set up automated reminders for you and your clients 30, 60, or 90 days before renewal dates to ensure timely follow-ups and higher retention rates.

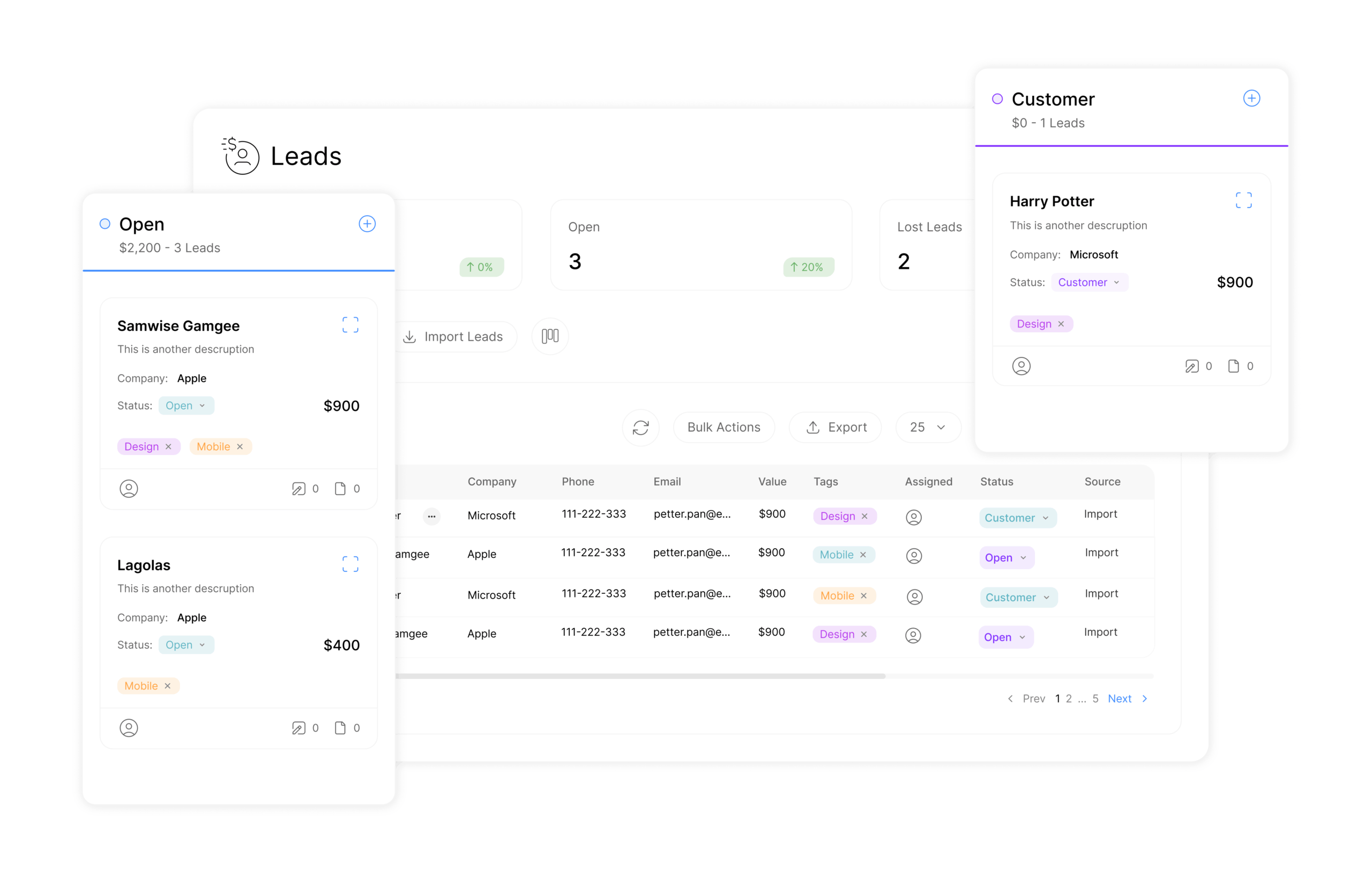

Intelligent Lead Scoring

Prioritize your leads based on likelihood to convert. ClearCRM automatically scores prospects based on their behavior and profile, helping you focus on the most promising opportunities.

Stop Losing Clients to Disorganization

Join hundreds of insurance agents who have transformed their business with ClearCRM. No credit card required to start your free trial.

Real-World Success: How ABC Insurance Transformed Their Business

ABC Insurance, a 5-agent firm in Colorado, was struggling with client retention and managing their growing book of business. Here’s how ClearCRM helped them turn things around:

The Challenge

ABC Insurance was losing an average of 8 policy renewals per month due to missed follow-ups. Their team was spending 25+ hours weekly just maintaining spreadsheets and manually tracking client information.

The Solution

After implementing ClearCRM, ABC Insurance centralized all client data and set up automated renewal reminders. Their team created customized workflows for different insurance products and integrated their email communication.

The Results

- Reduced missed renewals by 78% in the first 90 days

- Saved 15+ hours per week on administrative tasks

- Increased lead response time by 65%, leading to 22% higher conversion

- Grew their client base by 34% within 6 months without adding staff

- Improved client satisfaction scores from 7.2 to 9.1 out of 10

“ClearCRM didn’t just organize our data—it transformed how we operate. We’re closing more business with less effort and our clients notice the difference in our service quality.”

Measurable Benefits That Deliver Real Results

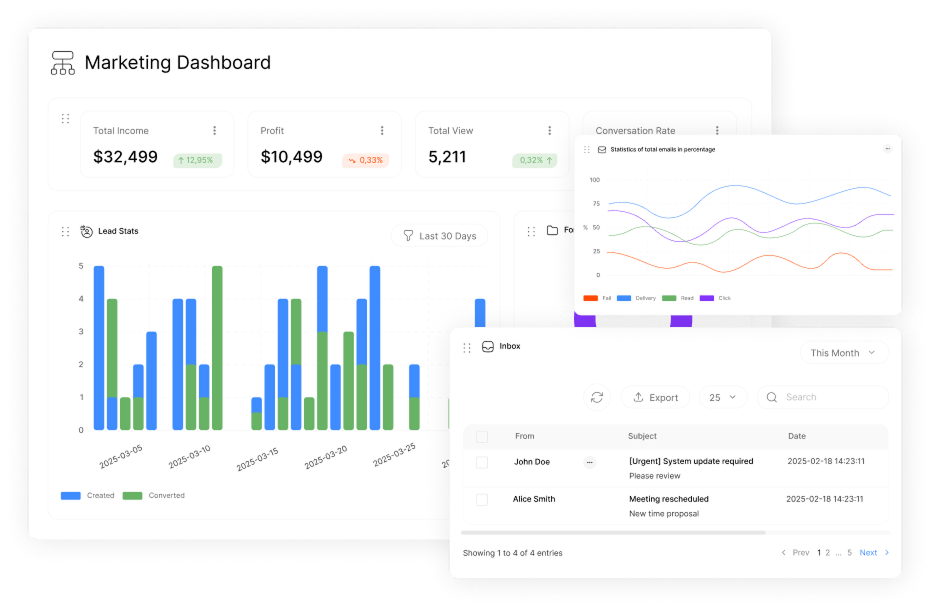

Insurance agents using ClearCRM report significant improvements across their business operations. Here’s what you can expect:

Save 20+ Hours Monthly

Automate repetitive tasks like data entry, follow-up reminders, and policy tracking. Insurance agents report saving an average of 5 hours per week with ClearCRM’s automation features.

Increase Client Retention by 45%

Never miss a renewal opportunity again. Automated alerts and streamlined communication tools help you stay connected with clients and address their needs proactively.

Grow Without Adding Staff

Handle twice the client load without hiring additional team members. ClearCRM’s efficiency tools let you scale your insurance business without proportionally increasing overhead.

See ClearCRM in Action

Watch how ClearCRM can transform your insurance agency with our guided demo. No commitment required.

Why ClearCRM Outperforms Other Insurance CRM Solutions

Not all CRM systems are created equal, especially for the unique needs of insurance agents. Here’s how ClearCRM compares to other popular options:

| Features | ClearCRM | Generic CRM X | Insurance Tool Y |

| Insurance-Specific Templates | ✓ (15+ templates) | ✗ (Generic only) | ✓ (Limited options) |

| Policy Renewal Tracking | ✓ (Automated) | ✗ (Manual setup) | ✓ (Basic) |

| Client Communication Tools | ✓ (Email, SMS, calls) | ✓ (Email only) | ✓ (Limited) |

| Document Management | ✓ (Policy-specific) | ✓ (Basic) | ✓ (Advanced) |

| Setup Time | Under 1 hour | 3-5 days | 1-2 days |

| Price (per user/month) | $19 | $35 | $29 |

ClearCRM Advantages

- Purpose-built for insurance agents

- Intuitive interface with minimal learning curve

- Affordable pricing with no hidden fees

- Unlimited clients and policies

- Free migration from your current system

Competitor Limitations

- Generic templates requiring extensive customization

- Steep learning curves slowing adoption

- Higher costs with add-on fees for essential features

- Limited insurance-specific functionality

- Complex implementation requiring technical support

Key Features of ClearCRM for Insurance Agents

ClearCRM combines powerful functionality with ease of use, delivering the tools insurance agents need without unnecessary complexity.

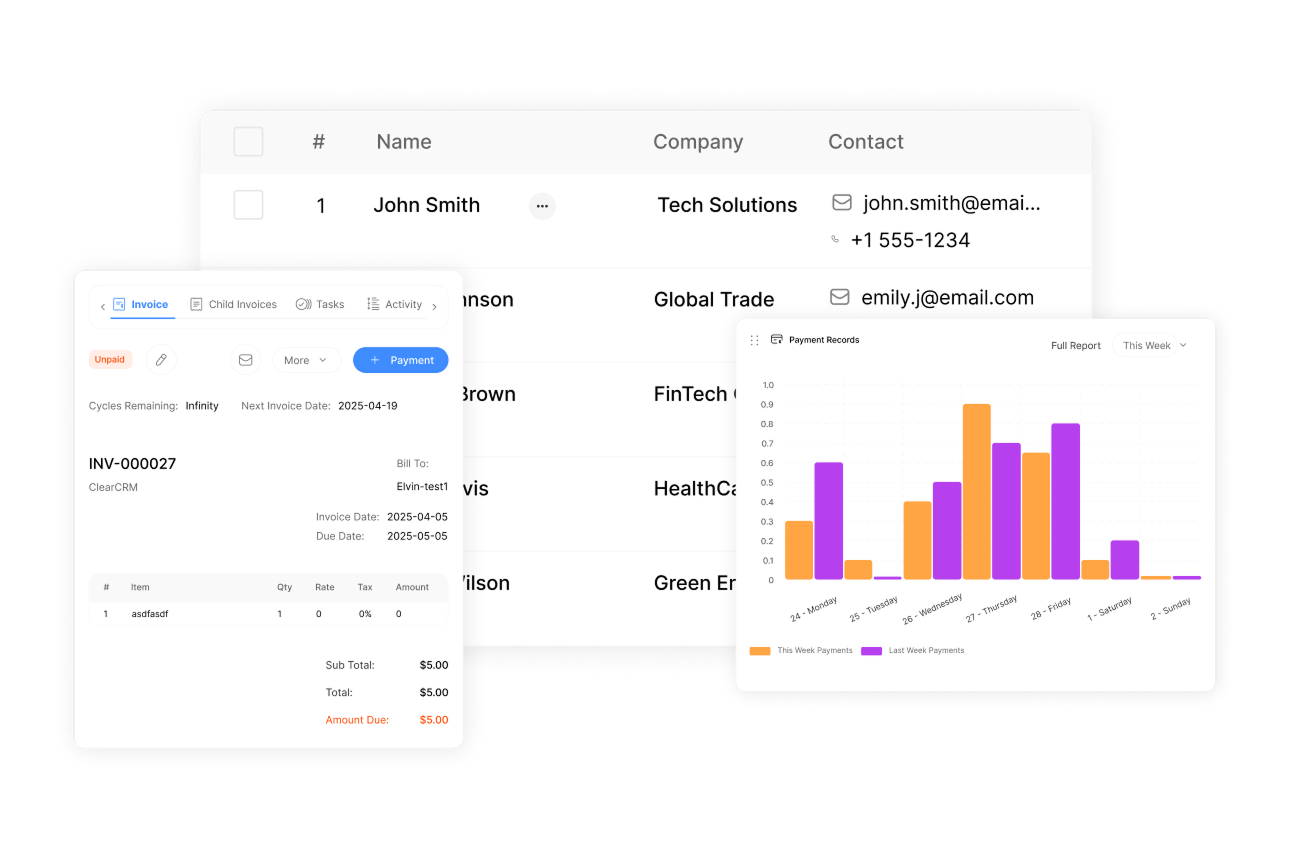

Policy Management

Track all policies in one place with custom fields for different insurance types. Set automated renewal reminders and policy review schedules.

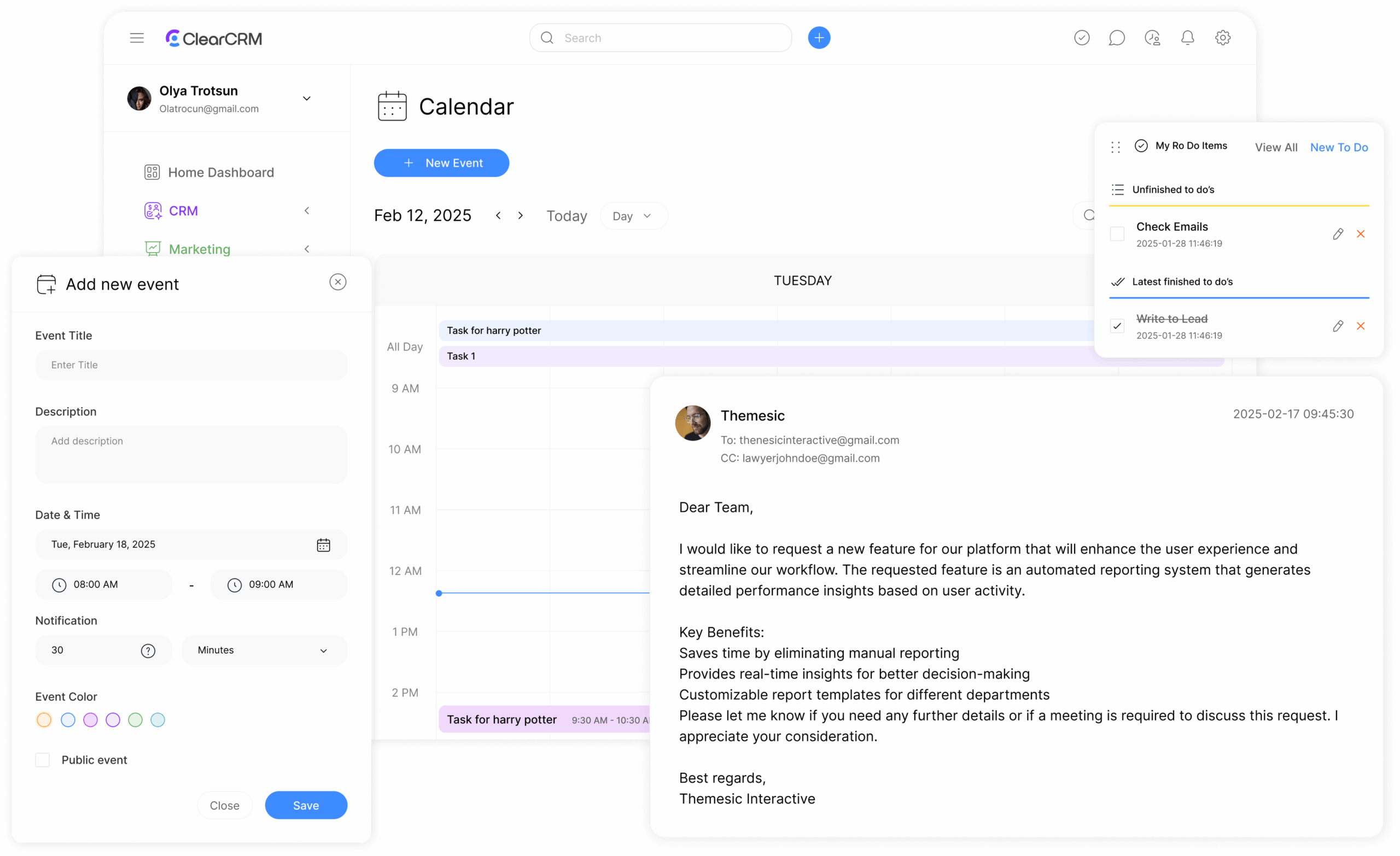

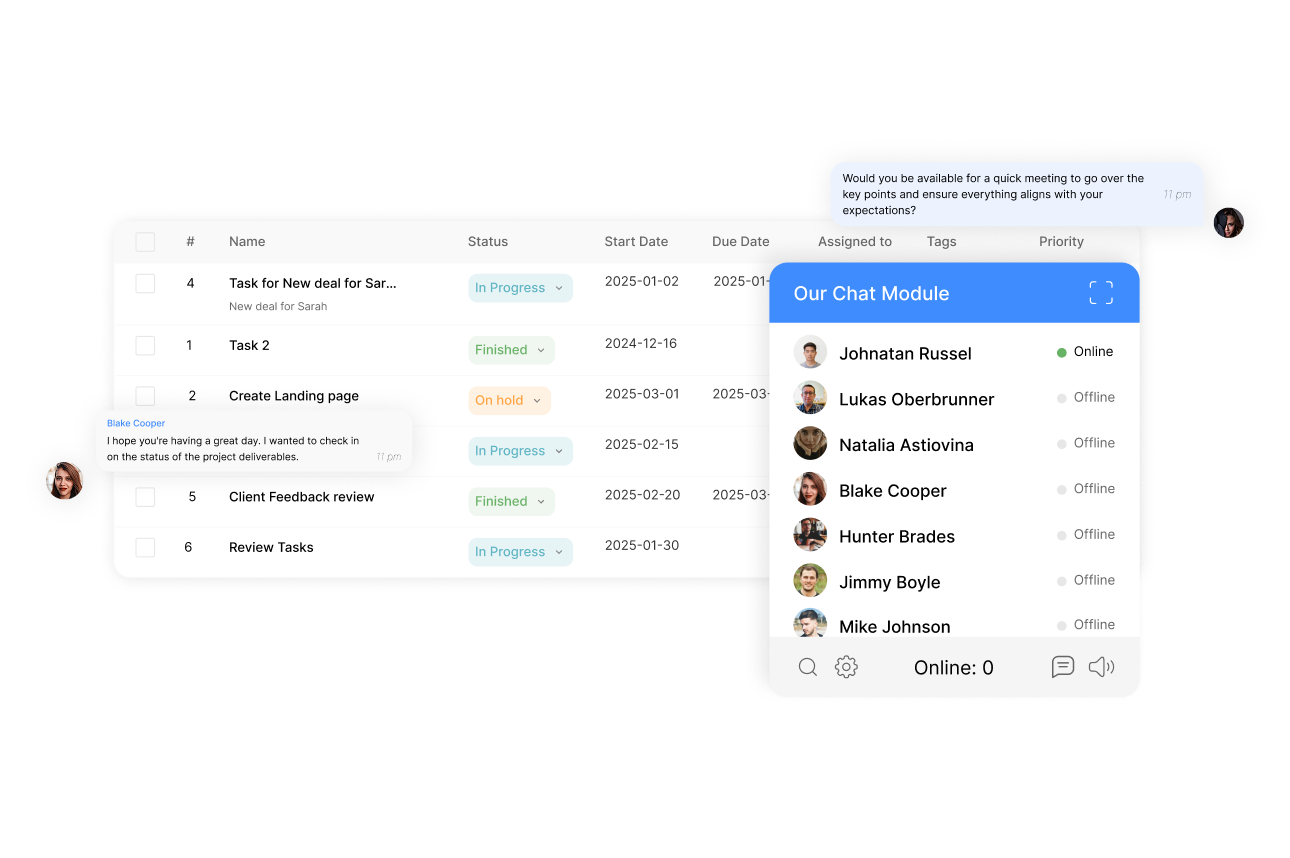

Client Communication

Send personalized emails, text messages, and automated follow-ups. Track all client interactions in one unified timeline.

Sales Pipeline

Visualize your sales process from lead to policyholder. Drag-and-drop interface makes it easy to track progress and prioritize opportunities.

Document Management

Store and organize policy documents, applications, and claims forms. Quick retrieval when clients call with questions.

Mobile Access

Access your entire client database from anywhere. Perfect for agents who meet clients outside the office.

Reporting & Analytics

Track key performance metrics like renewal rates, lead conversion, and revenue per client to optimize your business.

What Insurance Agents Say About ClearCRM

“After trying three different CRM systems, ClearCRM was the only one that truly understood the insurance business. The policy renewal tracking alone saved my agency thousands in potential lost commissions.”

“The ease of use is what sold me. I had my entire team up and running in less than a day, and we saw immediate improvements in our client follow-up process.”

“As a new agent, ClearCRM helped me build my book of business faster than I thought possible. The lead management tools keep me focused on the right prospects.”

Frequently Asked Questions

How long does it take to set up ClearCRM?

Most insurance agents are up and

in less than an hour. Our guided setup process and pre-built insurance templates make implementation quick and painless. We also offer free data migration services if you’re switching from another system.

Can I integrate ClearCRM with my existing tools?

Yes! ClearCRM integrates seamlessly with popular email platforms (Gmail, Outlook), calendar apps, document storage solutions, and insurance quoting software. Our open API also allows for custom integrations with agency management systems.

Is my data secure with ClearCRM?

Absolutely. ClearCRM uses bank-level encryption for all data, both in transit and at rest. We’re fully HIPAA compliant for health insurance agents and maintain strict data protection protocols that exceed industry standards.

What if I need help using ClearCRM?

Our support team is available via chat, email, and phone. All plans include unlimited support access, and our average response time is under 2 hours. We also provide comprehensive video tutorials and documentation.

Simple, Transparent Pricing

No hidden fees, no complicated tiers. Just straightforward pricing that scales with your business.

Starter

$19 per user/month

- Unlimited clients & policies

- Policy renewal tracking

- Email & SMS integration

- Basic reporting

- Mobile access

Professional

$29 per user/month

- Everything in Starter

- Automated workflows

- Document management

- Advanced reporting

- Team collaboration tools

Enterprise

$49 per user/month

- Everything in Professional

- Custom integrations

- White-label client portal

- Priority support

- Dedicated account manager

All plans include: Free data migration, unlimited storage, regular updates, and 24/7 security monitoring. No long-term contracts required – cancel anytime.

Transform Your Insurance Business Today

Stop losing clients to disorganization and missed follow-ups. With ClearCRM, you can streamline your workflow, never miss a renewal, and grow your business without adding overhead.

Join hundreds of successful insurance agents who have transformed their practice with the right Insurance Agent CRM. ClearCRM offers the perfect balance of powerful features and ease of use, all at an affordable price.

Get Started with ClearCRM Today

15-day free trial. No credit card required. Free data migration included.