Simplify Expense Tracking for Your Business Operations

Manual financial processes consume time and drain resources, so it’s crucial to simplify expense tracking with smarter, automated workflows. Today’s businesses need efficient tools to transform scattered workflows into streamlined systems. By connecting to over 17,000 financial institutions, advanced platforms centralize transactions in real time—eliminating spreadsheets and creating a single source of truth.

AI-powered systems automate receipt categorization, syncing directly to accounting tools like QuickBooks or NetSuite. This automation reduces manual errors, saves hours of data entry, and provides real-time visibility into spending patterns for faster decision-making.

Month-end closes are faster and more accurate with integrated platforms. Detailed reports highlight cost-saving opportunities across travel, vendors, and departmental budgets. With digital trails replacing paper receipts, audits become easier.

Key Takeaways

- Centralized systems connect to thousands of banks for instant transaction visibility

- AI automation reduces manual work by processing receipts in seconds

- Direct software integrations maintain error-free financial records

- Real-time dashboards help control budgets and prevent overspending

- Digital workflows cut operational costs by up to 40% in some cases

Understanding the Importance of Efficient Expense Management and How to Simplify Expense Tracking

Outdated processes create bottlenecks. Research shows teams waste up to 18 hours a month chasing receipts and correcting errors. This inefficiency delays financial decisions and creates compliance risks.

The Impact on Business Operations When You Simplify Expense Tracking

Manual systems slow approvals and increase the risk of costly mistakes. One retail chain lost $12,000 due to spreadsheet duplication. Automated tools flag duplicate payments, ensure timely reimbursements, and maintain morale.

Saving Time and Reducing Costs

Automnting digital tools. Real-time dashboards help leaders spot wasteful patterns before budgets spiral.With automation, one manufacturer reduced receipt reconciliation from two hours to two minutes. Businesses that digitize expense tracking report 40% fewer compliance issues and faster budget insights.

Simplify Expense Tracking: Benefits and Key Features

Scattered financial records create operational blind spots. Leading platforms solve this by merging bank feeds, corporate cards, and receipts into unified hubs. This approach transforms how businesses handle monetary flows.

Centralized Data in One Place

Top platforms combine bank feeds, receipts, and cards into a single dashboard. This eliminates departmental silos and provides real-time access to spending data. One healthcare organization reduced audit prep time by 60% using a unified hub.

| Traditional Approach | Modern Solution | Time Saved |

|---|---|---|

| Manual spreadsheet updates | Auto-synced transactions | 14 hrs/week |

| Paper receipt storage | OCR-powered digital capture | 83% faster |

| Email approval chains | Mobile workflow automation | 92% quicker |

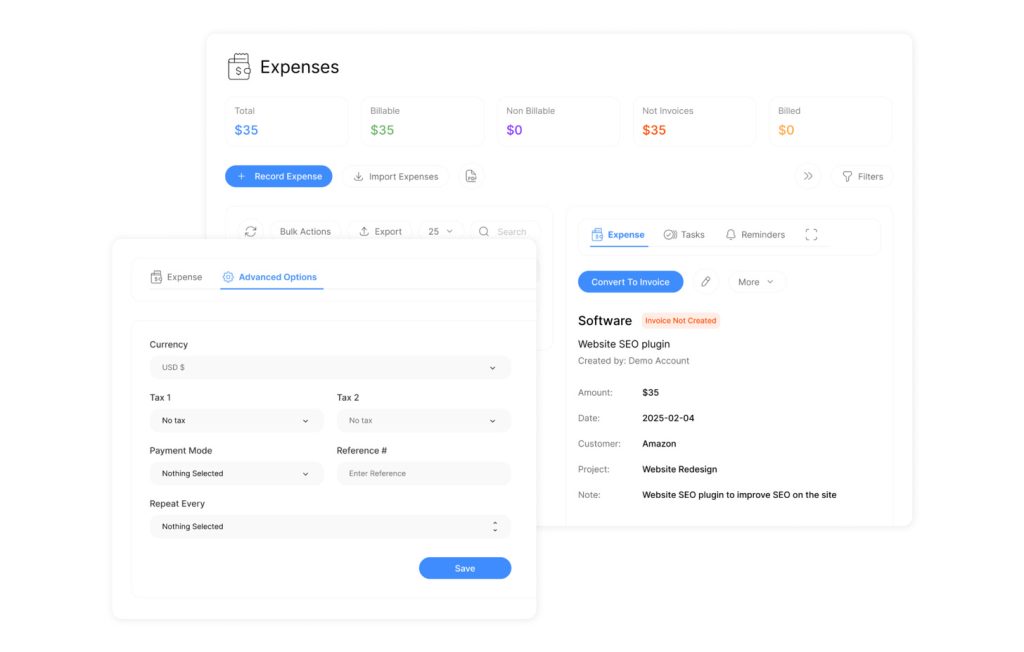

Automated Receipt Matching and Coding to Simplify Expense Tracking

Advanced systems extract key details using machine learning. One platform processes receipts 5X faster than manual entry by analyzing merchant data and amounts automatically. Finance teams receive pre-coded transactions ready for review.

AI-driven categorization adapts to company-specific accounting rules. This reduces classification errors by 78% compared to human input. Real-time sync ensures all systems display updated records instantly.

How Our Expense Tracking Solutions Work

Modern financial management demands instant access to transaction details. Our platform bridges banking systems and accounting tools through secure automation, creating frictionless workflows for growing enterprises.

Linking Your Financial Institutions Seamlessly

The system establishes direct connections with 17,000+ banks and credit providers. Users sync corporate cards, checking accounts, and loan platforms in three clicks. Secure APIs maintain encrypted data transfer while eliminating manual uploads.

| Connection Type | Setup Time | Security Level |

|---|---|---|

| Business Credit Cards | Under 90 seconds | 256-bit encryption |

| Bank Accounts | 2 minutes | SOC 2 certified |

| Accounting Software | Auto-linked | OAuth 2.0 protocols |

Real-Time Data Sync Across Transactions

Every purchase triggers instant alerts via SMS or app notifications. Machine learning matches receipts to transactions within seconds, while dashboards update automatically. Teams view live spending patterns across departments without manual refreshes.

Continuous synchronization prevents version conflicts in financial records. A construction firm recently reduced reconciliation errors by 68% using this method. Policy violations trigger immediate flags, letting managers address issues before approvals.

Seamless Integrations with Leading Accounting Platforms

Modern businesses require interconnected systems to maintain financial accuracy. Professional platforms bridge gaps between spending oversight and accounting workflows through intelligent synchronization.

Powerful Connections for Modern Finance Teams

Two-way data flows eliminate manual transfers between systems. Solutions like Fyle sync with QuickBooks, NetSuite, and Xero in real time. This ensures receipts, tax details, and custom fields update simultaneously across platforms.

| Accounting Platform | Sync Speed | Key Features |

|---|---|---|

| QuickBooks Online | Instant | GL code mapping |

| NetSuite | Project allocation tags | |

| Xero | Real-time | Multi-currency support |

One user reported:

“Fyle connected to NetSuite faster than our IT team could make coffee. Everything just worked.”

Native integrations preserve existing workflows while adding automation. Teams maintain preferred accounting tools while gaining advanced data handling. Custom field transfers ensure compliance with company-specific requirements.

Implementation specialists guide businesses through setup processes. This reduces transition delays and ensures error-free connections. Monthly close cycles shorten as systems share updated records automatically.

Customization and Flexibility in Expense Management

Adaptable financial systems drive modern business success. Unlike rigid platforms, leading solutions let organizations mold tools to their workflows. This approach ensures every team works with interfaces and classifications that match their operational reality.

Tailored Categories for Precise Oversight

Customizable rainbow categories transform how companies organize spending data. Users modify classification names, colors, and hierarchies through simple dropdown menus. A construction firm might create “Equipment Rental” and “Safety Gear” subcategories, while a marketing agency adds “Influencer Partnerships.”

Dynamic systems automatically generate visual reports based on these personalized groupings. Monthly budget graphs highlight spending trends per category, while annual comparisons reveal seasonal patterns. One user reported:

“Changing our category structure took three clicks. Now our reports actually reflect how we operate.”

| Standard Feature | Customization Option | Business Impact |

|---|---|---|

| Fixed Categories | Unlimited Custom Fields | Matches industry needs |

| Generic Reports | Role-Specific Dashboards | Faster decision-making |

| Basic Alerts | Multi-Level Budget Triggers | Prevents cost overruns |

Color-coded systems improve data recognition speed by 40% in user tests. Finance teams spot anomalies faster when “Travel” appears red and “Software” shows as blue. Approval workflows adapt too – some departments require two signatures for expenses over $500, others $5,000.

Real-time gross savings calculations empower strategic adjustments. The platform compares monthly income against categorized spending, highlighting potential reinvestment areas. This flexibility future-proofs operations as companies scale or shift priorities.

Empowering Your Team with Intuitive User Experience

Adoption drives success in financial tools. Systems that frustrate users often fail, regardless of technical capabilities. Leading platforms prioritize human-centered design, enabling teams to focus on strategic work rather than software navigation.

Simplified Onboarding and 24/7 Support

Fyle’s implementation specialists guide companies through setup in under 48 hours. Teams achieve full operational readiness faster than assembling IKEA furniture – one client reported live usage within three hours. Continuous assistance ensures smooth transitions:

- Dedicated account managers for personalized guidance

- Interactive tutorials adapted to different learning styles

- Round-the-clock support resolving 89% of issues in first contact

“The onboarding felt like having a GPS for financial systems – clear, constant, and impossible to get lost.”

User-Friendly Mobile App and Text Features

Modern work happens everywhere except desks. Fyle’s mobile solution lets employees text a photo of receipts to auto-process claims. No app downloads or password resets – just three taps from camera to submission.

Key mobile advantages:

- Auto-cropping and enhancement for blurry receipt images

- Instant policy violation alerts during submission

- Offline functionality for flights or remote sites

This approach boosts compliance rates by 62%, as employees no longer “forget” to file reports. Managers approve expenses during coffee breaks through push notifications, cutting reimbursement cycles from weeks to hours.

Real-Time Monitoring and Mobile Accessibility

Today’s workforce operates in motion, demanding financial tools that match their pace. Modern platforms deliver instant visibility into monetary flows through any device, transforming how teams manage company resources. This mobile-first approach ensures decision-makers stay informed wherever business happens.

Instant Notifications and Compliance Checks

Real-time alerts prevent policy violations before they escalate. Systems automatically flag unusual transactions – like a $2,500 hotel charge exceeding travel budgets – triggering instant manager review. One logistics company reduced compliance issues by 55% using these proactive alerts.

Credit card activity syncs to dashboards within seconds, not days. Employees receive SMS confirmations when receipts upload successfully, eliminating guesswork. Automated checks cross-reference spending against project codes, vendor contracts, and approval chains.

Notably, mobile access empowers teams to address issues immediately, helping them simplify expense tracking on the go. In addition, managers approve exceptions during airport layovers via secure apps, which allows them to simplify expense tracking even when traveling. Consequently, accountants resolve coding errors before end-of-day cutoffs, proving how mobile tools simplify expense tracking and maintain accuracy. Ultimately, this responsiveness builds trust across departments and accelerates financial workflows, underscoring the need to simplify expense tracking company-wide. Equally important, centralized data hubs provide 24/7 oversight without spreadsheet hunting, designed specifically to simplify expense tracking through seamless access. What’s more, customizable dashboards highlight credit utilization trends, vendor spending patterns, and real-time budget updates, all of which simplify expense tracking for decision-makers. Finally, teams identify cost-saving opportunities faster through AI-driven insights delivered to their pockets, another way to simplify expense tracking and optimize budgets.

FAQ

How does this solution help businesses reduce manual work?

Can the platform integrate with existing accounting software?

What security measures protect financial data?

Is customization available for spending categories?

How accessible is the tool for mobile users?

Does the system handle multi-currency transactions?

What support options exist for new users?

Outdated methods for handling company spending create ripple effects across organizations; by contrast, modern tools simplify expense tracking and improve overall efficiency. Moreover, research shows teams waste 18 hours monthly chasing receipts and fixing errors when using manual systems, which is why companies now simplify expense tracking to reclaim time and reduce mistakes. As a result, this inefficiency delays critical choices about budgets, vendor contracts, and growth strategies — but you can simplify expense tracking to make faster, data-driven decisions. Furthermore, disorganized financial workflows stall approvals and create compliance risks, yet organizations that simplify expense tracking experience smoother operations and fewer bottlenecks. For example, a retail chain recently discovered $12,000 in duplicate payments due to spreadsheet errors; however, businesses that simplify expense tracking through automation prevent such losses with real-time policy checks and centralized data.

Delayed reimbursements also hurt employee morale. Workers wait weeks for repayment when paper receipts get lost. Mobile-first solutions solve this – 84% of submissions now happen via app, with 70% approved in half a day.ation slashes administrative work dramatically. One manufacturer cut reconciliation from two hours per receipt to two minutes using AI coding. Teams redirect saved time toward analyzing spending trends or negotiating supplier discounts.

Cost control improves when systems flag policy violations instantly. Businesses report 40% fewer compliance issues after impleme