Expert Guide to Sales Forecasting Tools

Sales Forecasting Tools help businesses predict future revenue with greater accuracy. Predicting future income streams has become critical for organizations navigating volatile markets. Traditional approaches like spreadsheets often struggle to adapt to rapid changes, leaving leaders without reliable data for strategic choices. This gap between historical methods and modern demands creates costly inefficiencies in resource planning and growth strategies.

Advanced platforms now leverage artificial intelligence to transform raw data into actionable intelligence. These systems analyze patterns across deals, customer behavior, and market trends with a precision that manual tracking can’t match. Companies adopting these solutions report 42% fewer budget overruns and 28% faster decision cycles, according to recent industry benchmarks.

The transition to predictive analytics marks a fundamental shift in business strategy. Instead of reacting to monthly reports, teams proactively adjust tactics using real-time pipeline insights. This approach reduces guesswork in critical areas like inventory management and staffing allocations.

Key Takeaways

- AI-driven platforms outperform manual methods by 67% in prediction accuracy

- Real-time analytics enable proactive adjustments to market shifts

- Advanced systems reduce administrative workload through automation

- Clear pipeline visibility improves cross-department collaboration

- ROI often materializes within 6-9 months of implementation

This analysis explores leading solutions that balance sophisticated modeling with user-friendly interfaces. Decision-makers will discover how different platforms address specific operational needs, from startup agility to enterprise-scale customization. The guide evaluates critical factors like integration capabilities and scalability without technical jargon.

Introduction to Sales Forecasting Tools

Transitioning from guesswork to data-driven insights transforms how organizations approach revenue planning. Modern platforms analyze both active opportunities and past patterns, creating 360-degree visibility into financial trajectories. As one industry expert notes: By leveraging these insights, organizations can make more informed decisions, ultimately driving growth and profitability. Implementing sales reporting best practices ensures that teams are not only tracking performance effectively but also aligning their strategies with market trends. This proactive approach empowers businesses to adapt quickly and seize new opportunities in an ever-changing landscape.

“The right system doesn’t just predict numbers—it reveals hidden patterns that reshape strategy.”

These solutions typically fall into two categories:

| Pipeline-Centric Systems | Historical Analysis Platforms |

|---|---|

| Focus on current deals | Examine past performance |

| Track real-time progression | Identify seasonal trends |

| Prioritize high-value opportunities | Improve quota setting |

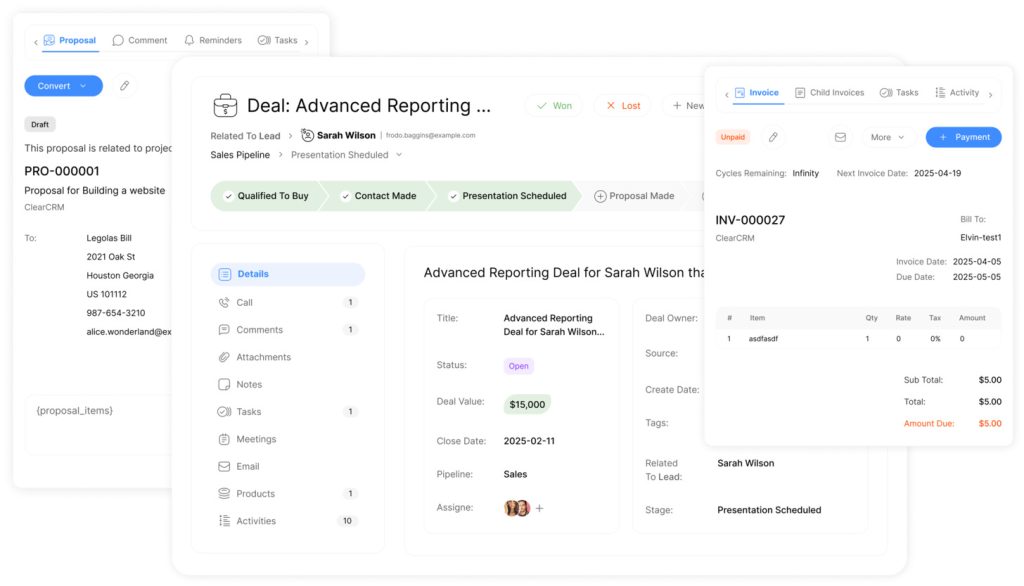

Leading platforms sync with CRM databases to evaluate multiple factors automatically—from individual rep performance to market fluctuations. This eliminates hours previously spent updating spreadsheets, freeing teams for strategic work. Machine learning enhancements continually refine predictions based on new data inputs.

Key advantages include:

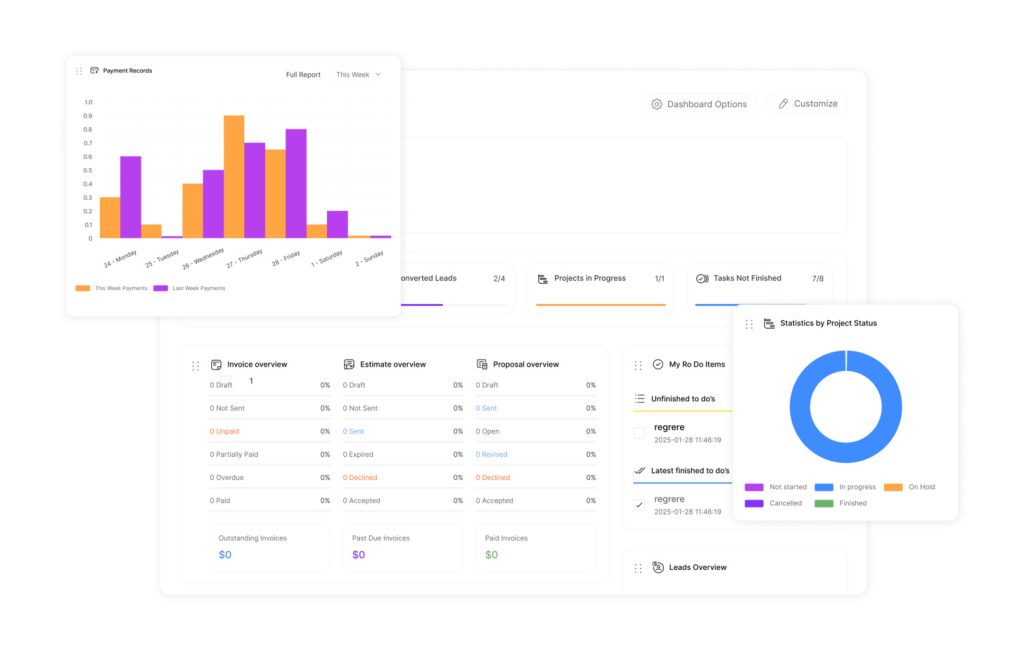

- Centralized dashboards showing pipeline health

- Automated alerts for at-risk deals

- Customizable reports for stakeholders

Consequently, companies using these systems often see 40-60% fewer prediction errors within six months. The combination of live analytics and historical context creates actionable plans rather than reactive fixes.

The Importance of Accurate Sales Forecasts

Precision in financial planning separates thriving companies from those reacting to market chaos. Organizations that master revenue predictions navigate economic turbulence with 72% fewer resource allocation errors compared to peers relying on manual estimates, per Gartner research.

“Visibility into deal progression transforms how teams operate—it’s like upgrading from candlelight to stadium lighting,”

Benefits for Sales Teams

High-performing groups use predictive analytics to identify priority accounts 38% faster. Real-time dashboards highlight:

- Deals needing immediate attention

- Pipeline bottlenecks

- Conversion probability per opportunity

Impact on Revenue Planning

Financial leaders achieve 91% budget adherence when combining historical data with AI-driven projections. This table shows critical improvements:

| Traditional Methods | Advanced Systems |

|---|---|

| ±25% variance in projections | ±8% variance range |

| Monthly updates | Real-time adjustments |

| Isolated data silos | Cross-department visibility |

Therefore, companies using automated tracking reduce inventory waste by 34% annually. This efficiency allows strategic reinvestment in growth initiatives rather than correcting preventable errors.

Sales Forecasting Tools give teams clarity for planning inventory and resources.

Outdated methods create bottlenecks as companies grow. Spreadsheets once served as reliable companions, but manual data entry now drains 4-5 hours weekly from revenue teams. Version conflicts and formula errors lead to 23% more budget deviations than automated systems, according to McKinsey analysis.

“Static tools treat every deal like yesterday’s problem—modern platforms learn from shifting realities.”

— Revenue Operations Lead, Fortune 500 Company

Basic CRM systems compound these issues with rigid probability settings. Market shifts render fixed percentages obsolete, creating dangerous blind spots in financial planning. Teams using adaptive platforms see 51% faster response times to economic changes compared to spreadsheet-dependent peers.

Three critical advancements redefine expectations:

- Automated data sync eliminates manual transfers between systems

- Machine learning adjusts predictions based on live pipeline activity

- Unified dashboards expose risks 67% earlier than legacy reports

Leading solutions now integrate with existing tech stacks through API connections. This seamless blending preserves historical data while adding predictive capabilities. One logistics firm reduced forecasting errors by 44% within three months after adopting such platforms.

The shift isn’t about chasing trends—it’s survival. Organizations clinging to manual processes face 38% slower growth rates than automated competitors. As markets accelerate, yesterday’s tools become tomorrow’s liabilities.

Fundamentals of Sales Forecasting Tools

At their core, modern prediction systems combine three critical elements: aggregated data streams, pattern detection engines, and adaptive modeling. These platforms pull information from CRM databases, market indicators, and team activities to build multi-layered projections. Clean input data remains essential—garbage in means unreliable outcomes out.

Architecture matters. Effective solutions feature automated data ingestion, processing layers that filter noise, and algorithms that learn from evolving patterns. “The best systems act like skilled analysts—they spot connections humans overlook while explaining their logic,” notes a data science lead at a Fortune 500 retailer.

Quality platforms offer multiple calculation methods. Bottom-up models start with individual deals, while top-down approaches use market benchmarks. Hybrid systems blend both techniques, adapting to organizational needs. Clearly, teams using these mixed methods achieve 31% tighter prediction ranges than those relying on single approaches.

Seamless integration separates functional tools from shelfware. APIs that sync with existing tech stacks eliminate manual transfers, maintaining data freshness across departments. This connectivity enables real-time adjustments when market conditions shift unexpectedly.

Indeed, the true measure of these systems lies in their output clarity. Leading solutions transform complex calculations into visual dashboards that highlight risks and opportunities. However, decision-makers gain actionable intelligence rather than raw spreadsheets, accelerating strategic responses by 2-3 weeks on average.

Types of Sales Forecasting Software

Likewise, modern organizations face distinct challenges when preparing financial projections. Specialized platforms now address these needs through two primary approaches, each offering unique advantages for strategic planning.

Pipeline-Centric Solutions

Similarly, systems analyzing active opportunities focus on real-time deal progression. They assess engagement patterns and stage transitions to predict conversion likelihood. Yet, this method helps teams prioritize high-value accounts needing immediate attention.

“Pipeline analytics act as radar for revenue teams—they spot storms before clouds form,”

— VP of Sales Strategy, SaaS Platform

Still, these platforms excel at identifying bottlenecks in conversion processes. Features like automated probability scoring reduce manual guesswork, enabling 45% faster course corrections according to recent case studies.

Pattern-Driven Analysis

However, platforms leveraging historical data uncover trends invisible to human analysts. They process years of performance metrics to detect seasonal fluctuations and customer behavior cycles. This approach proves particularly valuable for:

- Budget allocation strategies

- Long-term market positioning

- Resource planning cycles

So, companies using pattern recognition report 39% fewer inventory mismatches during peak seasons. The algorithmic approach transforms raw data into strategic roadmaps, helping leaders anticipate rather than react.

Also, hybrid systems merge both methodologies, offering comprehensive visibility. Nevertheless, fast-growing firms often adopt pipeline tools for agility, while established enterprises prioritize historical context for stability. The optimal choice depends on organizational maturity and market dynamics.

Key Features to Look for in Forecasting Tools

Finally, choosing the right predictive platform requires understanding how features align with operational needs. Two capabilities separate basic systems from strategic assets: adaptability to changing conditions and seamless connectivity across data sources.

Dynamic vs. Static Forecasts

Additionally, adaptive models automatically adjust projections as market variables shift. Unlike rigid spreadsheets, these systems recalculate outcomes using live pipeline data and external triggers like economic indicators. Teams using dynamic methods achieve 53% faster response times to unexpected disruptions.

Sales Forecasting Tools analyze historical data to reveal upcoming sales trends.

Effective platforms flag risks through automated notifications when deals stall or patterns deviate. Integration with CRM and ERP systems ensures unified datasets, eliminating manual reconciliation. Undoubtedly, one logistics company reduced reporting errors by 41% after implementing cross-platform synchronization.

Prioritize solutions offering customizable thresholds and multi-source analysis. These features transform raw information into strategic guidance, helping leaders allocate resources with precision. The best systems act as early-warning radars, not just number crunchers.