Mastering Consolidated Invoicing and Optimizing Your Billing Cycles: A Step-by-Step Guide for Modern Businesses

Managing multiple vendor payments and tracking expenses across departments often creates financial chaos for growing organizations. Businesses handling numerous accounts face time-consuming processes, scattered records, and increased risk of errors. A unified billing approach solves these challenges by merging transactions into a single, organized system.

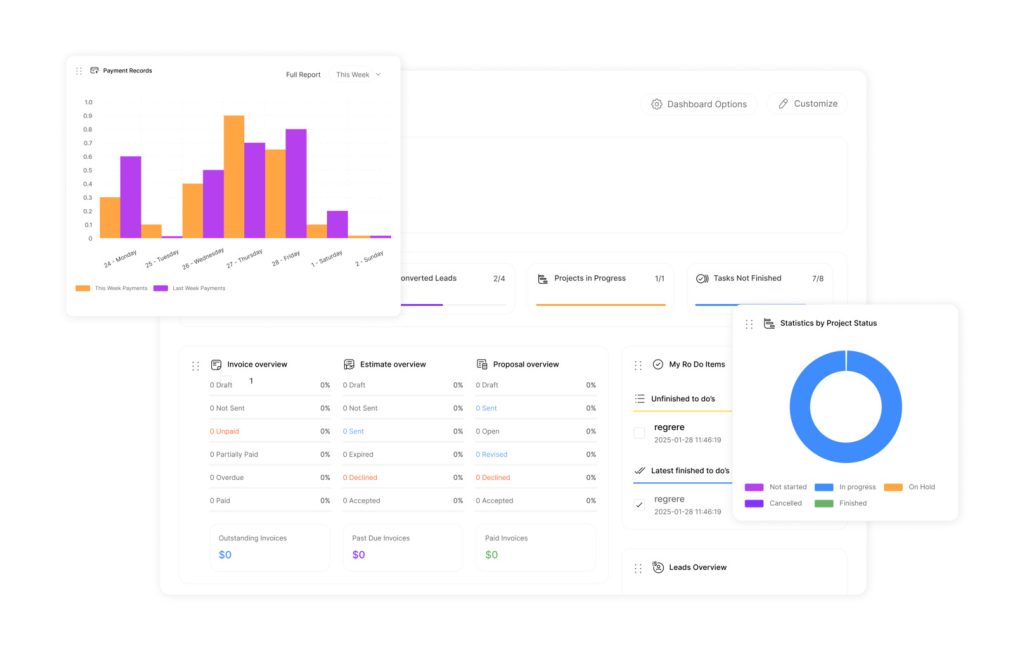

This method simplifies how companies monitor spending and interact with vendors. It replaces fragmented payment cycles with centralized tracking, giving financial teams real-time visibility into cash flow. The system works through five stages: enrollment, usage monitoring, data aggregation, invoice creation, and payment execution.

Companies adopting this strategy report 30% faster reconciliation times and improved vendor relationships. Professional service providers and subscription-based enterprises see particularly strong results, as unified systems enhance client transparency. Decision-makers gain clearer insights into operational costs while reducing paperwork bottlenecks.

The transition demands careful planning but delivers measurable returns. Organizations cut administrative workloads by up to 45% through automated reporting features. Financial leaders can then redirect resources toward strategic growth initiatives rather than manual data entry.

Key Takeaways

- Simplifies expense tracking across multiple departments or subsidiaries

- Reduces operational costs through automated billing workflows

- Minimizes payment errors with centralized transaction records

- Follows five core steps from enrollment to final payment

- Particularly effective for service firms and subscription businesses

- Improves vendor trust through transparent financial interactions

Understanding Consolidated Invoicing

Scattered billing documents create operational headaches for modern businesses. A unified approach merges multiple transactions into streamlined records, transforming how companies handle financial data. This method replaces chaotic payment tracking with organized systems that improve accuracy.

What Is a Combined Billing Document?

This system combines charges from multiple vendors into one statement. Suppliers submit individual bills, which undergo approval checks before merging. Centralized platforms then generate a single document showing all transactions, due dates, and payment terms.

Core Principles and Vocabulary

Mastering these terms ensures smooth implementation:

| Feature | Traditional Method | Unified Approach |

|---|---|---|

| Document Volume | 20+ monthly invoices | 1 comprehensive statement |

| Payment Tracking | Manual cross-referencing | Automated dashboards |

| Error Detection | Post-payment audits | Real-time alerts |

Key concepts include charge aggregation (combining fees) and cycle alignment (syncing due dates). Financial teams use prorated adjustments to fairly distribute costs across departments. Automated reconciliation tools then match payments to original charges, slashing error rates.

Adopting this strategy requires understanding these operational shifts. Businesses gain clearer financial visibility while strengthening vendor partnerships through transparent interactions.

How Consolidated Billing Works

Modern finance teams require systems that turn payment complexity into operational clarity. This approach combines multiple transactions through a structured five-phase workflow, replacing fragmented records with organized financial oversight.

Account Linking and Activity Monitoring

The first step connects separate accounts under one agreement. Businesses define service terms and permissions during setup. Three critical components ensure success:

- Centralized access: Authorized users view all linked services

- Real-time tracking: Automated tools monitor usage metrics 24/7

- Data validation: Systems flag discrepancies before charges accumulate

Charge Compilation and Document Creation

At each cycle’s end, platforms merge fees using preset rules. Adjustments for prorated services or discounts occur automatically. The system then produces clear statements showing:

- Itemized costs per department or project

- Payment deadlines and approved methods

- Historical comparisons for budget analysis

This method reduces late fees by 37% through standardized schedules. “Automated compilation eliminates 90% of manual entry errors,” notes a leading financial software report. Teams gain extra time to analyze spending patterns rather than chase paperwork.

Best Practices for Implementing Consolidated Invoicing

Organizations transform financial operations through strategic planning and technology alignment. Successful adoption requires evaluating current processes while preparing teams for operational shifts. These steps ensure smooth transitions while maximizing system capabilities.

Pre-Implementation Planning Essentials

Businesses must audit existing payment workflows before deployment. Three critical factors determine readiness:

- Infrastructure compatibility: 67% of failed implementations stem from outdated software conflicts

- Staff adaptability: Training programs reduce transition friction by 42%

- Cost-benefit analysis: Average ROI reaches 200% within 18 months for prepared teams

| Evaluation Metric | Traditional Setup | Optimized System |

|---|---|---|

| Compliance Checks | Manual quarterly reviews | Automated real-time monitoring |

| Data Migration | 3-6 month timelines | 4-week cloud transfers |

| Error Resolution | 14-day average | 48-hour SLA guarantees |

Technical Alignment and Regulatory Adherence

Integration demands careful mapping of legacy systems to new platforms. Financial institutions prioritize GDPR-compliant data handling, while healthcare providers focus on HIPAA audit trails. “Cross-department collaboration prevents 80% of compliance issues,” states a FinTech compliance officer report.

Ongoing technical support proves vital during scaling phases. Businesses using API-first solutions experience 55% fewer service interruptions. Regular system updates maintain security protocols while adapting to evolving payment regulations.

Benefits of Consolidated Invoicing for Your Business

Handling dozens of separate bills strains resources and creates financial blind spots. Unified billing systems transform this chaos into clarity, delivering measurable improvements across operations. Organizations adopting this approach unlock seven core advantages that strengthen fiscal health and client relationships.

Streamlined Billing and Reduced Administrative Costs

Combined statements slash paperwork burdens. Automated systems merge charges from multiple vendors into single documents, cutting manual data entry by 72%. Staff redirect saved hours toward strategic tasks like vendor negotiations or budget analysis.

| Metric | Traditional Billing | Combined System |

|---|---|---|

| Monthly Invoices Processed | 48 | 1 |

| Average Processing Time | 14 hours | 2.5 hours |

| Error Rate | 9% | 1.2% |

Dispute resolution accelerates through centralized records. Finance teams resolve billing conflicts 58% faster using unified audit trails. “Single-source documentation prevents 80% of payment disagreements,” confirms a 2023 AP automation study.

Enhanced Cash Flow and Improved Revenue Tracking

Predictable payment cycles stabilize budgets. Clients pay 22% faster when managing one bill instead of tracking multiple due dates. Real-time dashboards show earnings patterns across departments, enabling smarter resource allocation.

Key financial improvements include:

- 37% fewer late payments from simplified schedules

- 15% higher forecasting accuracy through trend analysis

- 28% faster tax prep using categorized transaction data

Unified systems also strengthen client trust. Transparent billing builds credibility, with 67% of customers reporting higher satisfaction in payment surveys. Businesses gain competitive edges while maintaining lean accounting teams.

Strategies for Providers and Optimizing Customer Experience

Enhancing client satisfaction requires strategic tools that simplify financial interactions. Service providers achieve this through platform design and data-driven refinements, creating frictionless payment experiences.

User-Friendly Platform and Multiple Payment Options

Intuitive interfaces transform how customers engage with billing systems. Dashboards should display charges, due dates, and usage metrics at a glance. Single-view portals reduce confusion by merging subscriptions and one-time fees into unified records.

Flexible payment methods boost completion rates. Leading platforms support:

- Credit/debit card processing with instant confirmation

- Digital wallets like Apple Pay and Google Pay

- Automated ACH transfers for recurring charges

“Businesses offering 4+ payment options see 31% faster settlements,” states a 2023 customer experience report. Clear statements with tax breakdowns and service descriptions further minimize disputes.

Performance Monitoring and Iterative Improvements

Tracking key metrics ensures systems meet evolving needs. Finance teams monitor:

- Payment success rates across channels

- Average resolution time for billing inquiries

- Customer retention linked to billing satisfaction

Real-time analytics reveal friction points in the payment cycle. Support teams use this data to streamline processes – 68% of companies update their platforms quarterly based on user feedback.

Dynamic pricing models reward loyal clients while maintaining profitability. Volume discounts and subscription incentives strengthen relationships. Continuous upgrades keep systems aligned with emerging technologies and regulatory changes.

Conclusion

Streamlined financial operations have become non-negotiable in competitive markets. Businesses leveraging unified billing systems reduce payment cycle complexity while strengthening client relationships through transparent interactions. These platforms transform chaotic records into organized workflows, cutting administrative burdens by over 40% according to industry benchmarks.

Adoption requires strategic planning but delivers immediate returns. Companies gain real-time cash flow visibility and reduce errors through automated reconciliation tools. Subscription-based models and multi-department enterprises particularly benefit from centralized tracking that simplifies tax preparation and budget forecasting.

Forward-thinking organizations prioritize transparent pricing models to maintain trust while scaling operations. Regular system audits ensure compliance with evolving regulations, protecting both revenue streams and professional reputations.

The path to sustainable growth lies in operational efficiency. By merging scattered transactions into cohesive records, businesses unlock resources for innovation rather than manual data management. Those embracing this approach position themselves as industry leaders in financial clarity and client service excellence.