Streamlining the Invoice Approval Workflow: A Step-by-Step Guide for Modern Accounts Payable Processes

Modern businesses face mounting pressure to optimize financial processes like the invoice approval process and reduce delays in accounts payable operations. Outdated methods slow operations, inflate costs, and strain partnerships, especially when relying on manual invoice approvals instead of automated workflows. Traditional approaches often involve stacks of paperwork, misplaced documents, and endless email chains. These inefficiencies hurt cash flow and create friction with suppliers.

Automated systems replace error-prone manual tasks with precision. They cut processing timelines dramatically while ensuring compliance. Companies adopting these solutions report fewer payment disputes and stronger vendor trust. Real-time tracking also empowers teams to monitor transactions at every stage.

This guide delivers actionable steps to overhaul legacy systems. Decision-makers learn how to eliminate bottlenecks without disrupting daily operations. Strategies include configuring role-based access, setting escalation protocols, and integrating audit trails. Each phase prioritizes scalability to support long-term growth.

Organizations gain more than speed—they build resilience. Transparent processes reduce duplicate payments and strengthen financial oversight. The result? A leaner, more adaptable accounts payable framework ready for tomorrow’s challenges.

Key Takeaways

- Automation slashes processing time from days to hours while minimizing human error

- Digital systems provide full visibility into financial transactions for better accountability

- Scalable solutions adapt to business growth without requiring constant manual adjustments

- Clear audit trails simplify compliance and reduce legal risks

- Faster approvals improve cash flow management and vendor relationships

Understanding the Fundamentals of Invoice Approval Workflows

At the core of financial management lies a well-organized system for processing vendor payments. These frameworks transform chaotic paper trails into structured digital pathways. Businesses transition from error-prone manual methods to precision-driven systems that enforce accountability.

Defining the Validation Sequence

Every payment request follows a standardized journey. First, teams verify details against purchase orders and delivery records. Next, the request moves through predefined authorization levels based on amount thresholds. Digital platforms like SharePoint and Power Automate eliminate physical document shuffling by centralizing communication.

Traditional paper-based methods often caused week-long delays. Staff wasted hours tracking down signatures or correcting data entry mistakes. Modern solutions automatically route requests, flag discrepancies, and enforce spending policies.

Automation’s Impact on Financial Operations

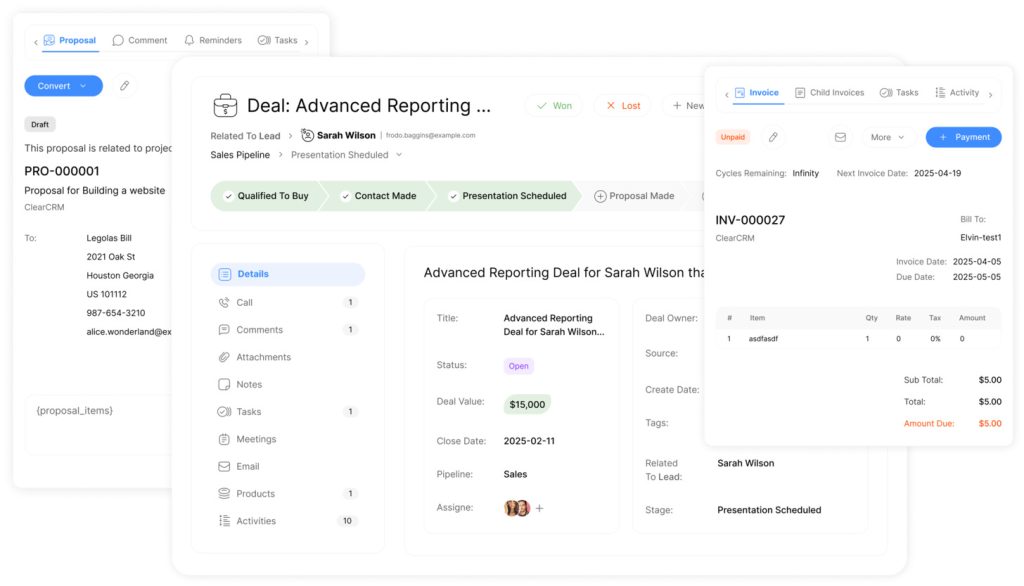

Integration with tools like Dynamics 365 and Salesforce creates seamless data flow. Systems cross-check entries against contracts and budgets in real time. Approval centers within Power Automate let managers respond via email or mobile app—no desk required.

Automated tracking in an invoice approval workflow provides crystal-clear visibility into every step of the accounts payable process, allowing teams and approvers to act swiftly. Teams monitor each request’s status through dashboards while audit logs capture every decision. This transparency reduces compliance risks and builds trust with suppliers through predictable timelines.

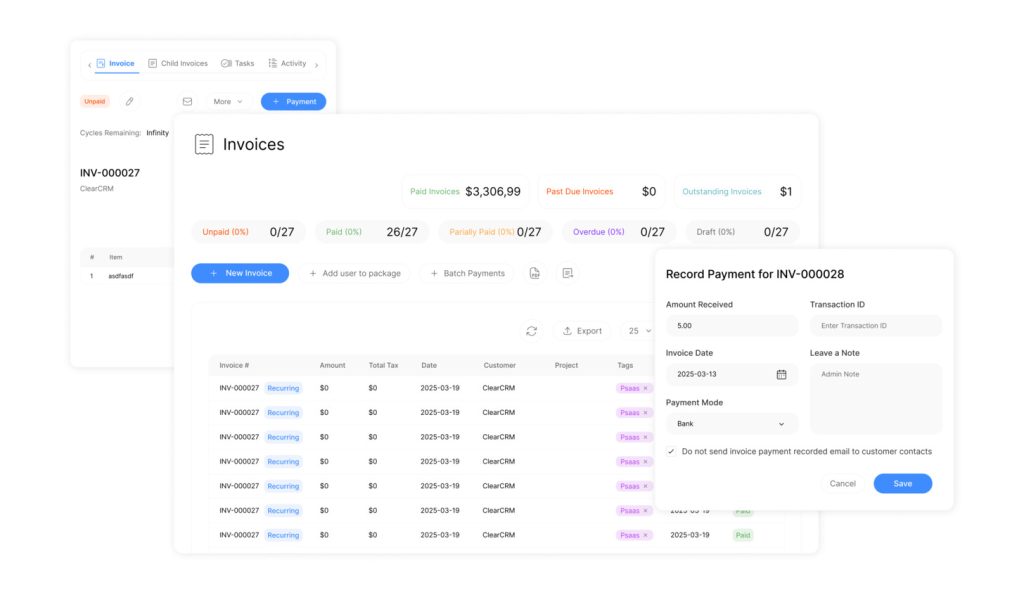

Companies using these platforms report 63% faster processing cycles compared to manual invoice approval methods, with significant reductions in duplicate payments and delayed invoice sent notifications.

Key Benefits of Streamlined Invoice Approval Workflows

Financial operations gain momentum when organizations replace manual systems with intelligent automation. These upgrades transform how teams handle vendor transactions, delivering measurable improvements across departments.

Accelerating Cycle Durations and Error Prevention

Automated systems slash review timelines from weeks to days. Digital routing eliminates bottlenecks caused by misplaced paperwork or delayed responses. Duplicate payment detection algorithms scan records instantly, flagging mismatches before funds leave accounts.

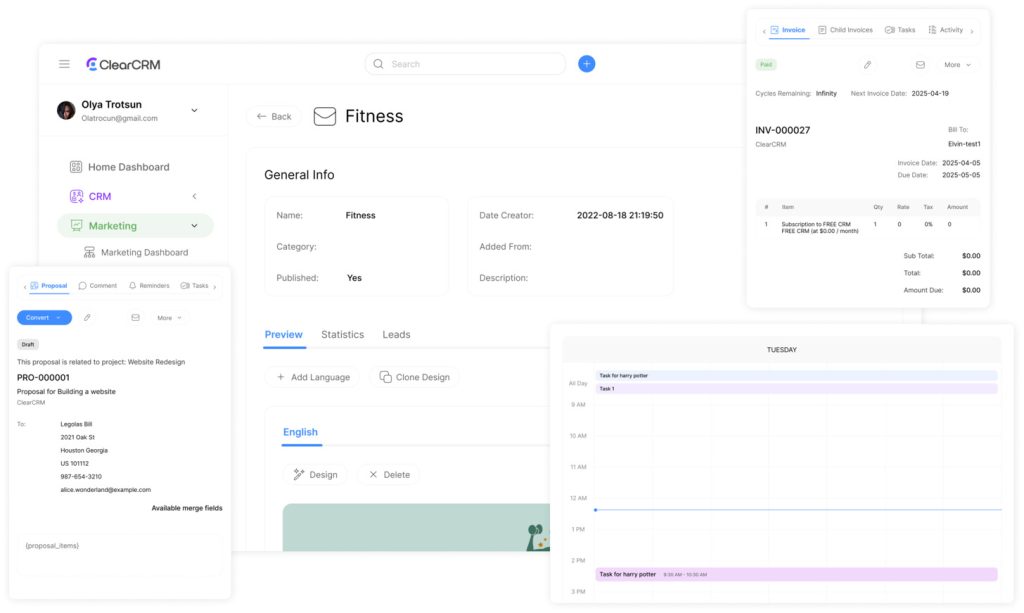

Real-time alerts notify approvers via email or mobile devices. This prevents stalled requests and keeps cash flow predictable. Suppliers receive payments faster, strengthening partnerships through reliability. Additionally, incorporating the best CRM solutions for approvals further streamlines the process, enabling better tracking and management of requests. With enhanced visibility into approval workflows, teams can identify bottlenecks and optimize performance. This leads to improved decision-making and greater overall efficiency in financial operations.

Centralized Oversight and Record Integrity

Modern platforms give finance teams a unified view of obligations. Role-based dashboards display pending actions alongside budget thresholds. Every decision leaves a digital footprint, creating audit-ready trails for compliance reviews.

Paperless documentation reduces storage costs and retrieval delays. Teams track version histories effortlessly, minimizing disputes over contract terms or delivery confirmations. One manufacturing firm cut reconciliation errors by 78% after implementing these controls.

Organizations also gain flexibility to scale operations. Automated rules adapt to new subsidiaries or regulations without manual reconfiguration. This agility becomes critical during mergers or market expansions.

Setting Up Your Automated Invoice Approval Process

Transitioning to automated systems demands strategic alignment between tools and organizational needs. Companies must evaluate existing infrastructure while prioritizing scalability and security. This critical phase lays the groundwork for sustained operational efficiency and error reduction.

Platform Evaluation and Compatibility Checks

Selecting the right technology starts with compatibility assessments. Solutions should integrate seamlessly with current accounting software and data storage systems. Power Automate stands out for its prebuilt connectors with services like SharePoint, reducing deployment time by 40% in some cases.

Businesses using Salesforce or Zendesk can extend these platforms’ capabilities through automation. Key factors include encryption standards, mobile access, and permission hierarchies. A healthcare provider, for example, might pair SharePoint’s document control with Gmail alerts for HIPAA-compliant communication.

Seamless System Integration Techniques

Effective automation relies on triggers within SharePoint lists that activate cloud flows upon new submissions. These workflows cross-reference purchase orders, route requests based on amount thresholds, and apply conditional logic for exceptions.

Security remains paramount during integration. Teams configure role-based access controls and multi-factor authentication before testing data accuracy across platforms. One logistics company reduced payment errors by 62% after implementing these protocols.

Post-deployment, automated alerts keep stakeholders updated through preferred channels—whether email or collaboration apps. Regular system audits ensure adaptability to regulatory changes or organizational growth, future-proofing the entire operation.

Implementing Core Elements of Invoice Approval Workflows

Building efficient financial systems requires precise configuration of digital triggers and role-based protocols. Successful implementations transform chaotic processes into structured sequences that enforce accountability while adapting to organizational needs.

Configuring Triggers and Automated Cloud Flows

Workflow triggers activate when new entries appear in designated SharePoint lists. These automated cloud flows apply conditional logic—routing documents based on amount thresholds or vendor categories. Teams set parameters like list names and site addresses to ensure accurate data capture.

Dynamic content integration personalizes requests by pulling details from connected systems. Profile actions automatically retrieve approver emails and roles, eliminating manual data entry. This precision reduces errors and accelerates response times across departments.

Establishing Approval Roles and Communication Guidelines

Clear authorization hierarchies prevent bottlenecks. Finance leaders define escalation protocols for high-value transactions and recurring payments. Each role receives specific permissions aligned with organizational policies and compliance requirements.

Standardized email templates maintain consistent messaging while including critical fields like due dates and vendor IDs. Automated alerts through preferred channels keep stakeholders informed without overwhelming inboxes. One retail chain reduced follow-up queries by 55% after implementing these communication rules.

Regular audits of flow steps ensure systems adapt to regulatory changes or company growth. This proactive approach future-proofs operations while maintaining audit-ready documentation.

Invoice Approval Workflows: Best Practices and Process Optimization

Operational excellence hinges on maintaining rigorous standards across financial systems. Companies that implement structured protocols see fewer errors and faster resolution cycles. These methods transform fragmented tasks into cohesive, repeatable sequences.

Guaranteeing System Harmony and Accountability

Real-time data synchronization acts as the backbone of reliable operations. Automated checks between platforms flag mismatches before they escalate. This prevents payment delays caused by conflicting records or outdated vendor details.

Comprehensive audit trails capture every action—from initial submission to final authorization. Timestamps, decision notes, and version histories create ironclad documentation. Teams resolve disputes faster while meeting compliance requirements effortlessly.

Regular process reviews identify bottlenecks like stalled requests or repetitive manual checks. One logistics firm reduced cycle durations by 34% after analyzing approval patterns. Continuous improvement turns occasional gains into sustained efficiency.

Clear escalation protocols keep transactions moving. Designated supervisors receive alerts when responses exceed set timeframes. This prevents backlog buildup and preserves supplier trust through predictable timelines.

Stress-testing workflows uncovers vulnerabilities before they disrupt operations. Simulated scenarios validate system resilience during peak volumes or staff absences. Documentation standards ensure every decision includes contextual details for audits or internal reviews.

Troubleshooting, Rejections, and Updates in the Approval Process

Effective financial systems require seamless error resolution mechanisms to maintain operational flow. When transactions hit roadblocks, structured protocols ensure swift corrections without disrupting cash cycles. Modern platforms automate these resolutions while preserving audit integrity.

Streamlining Rejection Protocols

Conditional logic routes declined requests through predefined false branches. Automated emails notify submitters instantly, detailing missing data or policy violations. Teams customize templates to include resubmission deadlines and correction checklists.

SharePoint updates trigger automatically when requests get rejected. Systems log comments in designated status fields, creating searchable records for future audits. This eliminates manual data entry errors and ensures consistent documentation.

Common issues like email delivery failures get resolved through embedded validation checks. Platforms verify recipient addresses against active directories before sending notifications. Routing errors are minimized through predefined approval hierarchies that adapt to team structures.

Field-level validations prevent incomplete resubmissions. Required boxes must contain specific formats—dates, amounts, or vendor codes—before systems accept revised entries. One healthcare provider reduced correction rounds by 41% after implementing these checks.

Regular system audits identify bottlenecks in rejection handling. Teams analyze response times and update frequency to refine escalation rules. This proactive approach keeps financial operations aligned with evolving business needs.

Optimizing Email Communication and Response Management

Effective communication drives successful financial operations. Modern platforms transform scattered email chains into structured decision pathways. Teams maintain control while accelerating authorization cycles through intelligent message design.

Customizing Email Templates for Authorization Requests

Dynamic fields personalize each message with vendor details and payment terms. Systems auto-populate subject lines using project codes or department names. Branded templates ensure consistency while reducing formatting errors across teams.

Markdown support lets teams highlight deadlines or budget limits visually. Automated triggers insert approver names and action buttons directly into messages. This eliminates confusion about next steps or required documentation.

| Feature | Impact | Example |

|---|---|---|

| Dynamic Fields | Reduces manual data entry by 74% | Auto-filled vendor IDs |

| Response Tracking | Cuts follow-up time by 50% | Color-coded status indicators |

| Mobile Optimization | Accelerates responses by 3.2x | One-click action buttons |

Leveraging Automated Notifications for Seamless Updates

Real-time alerts keep stakeholders informed without inbox overload. Systems send reminders only when action is required, using smart escalation protocols. Approvers receive deadline countdowns through preferred channels—email, SMS, or collaboration apps.

Integrated dashboards track response patterns to identify bottlenecks. Teams resolve issues before delays occur, maintaining cash flow predictability. Payment authorization updates cascade automatically to accounting systems and requesters.

One manufacturing firm reduced email queries by 68% after implementing these protocols. Their finance team now processes 92% of requests within 24 hours through direct email actions.

Conclusion

Adopting automated financial systems marks a strategic leap forward for organizations seeking operational excellence. These solutions transform clunky paper trails into agile digital pathways, cutting processing times by over 60% in most implementations. Companies using modern platforms report stronger vendor partnerships through predictable payment cycles and error-free transactions.

Small businesses particularly benefit from enterprise-grade tools that scale with growth. Cloud-based systems enable real-time tracking across departments while maintaining strict compliance standards. Features like three-way matching automatically align purchase orders with delivery records, reducing reconciliation headaches.

Platforms like Power Automate extend capabilities further through Microsoft Dataverse integration. This allows extended review timelines for complex contracts and secure external collaborator access via Entra ID. Decision-makers gain flexibility to cancel or modify requests through intuitive interfaces.

The shift from manual data entry to intelligent automation delivers measurable ROI within months. Organizations free teams to focus on strategic initiatives rather than chasing signatures or correcting typos. As financial processes evolve, these systems become the backbone of resilient, future-ready operations.