Best CRM for Financial Services in 2025: Top Solutions Compared

Why Financial Services Firms Need Specialized CRM Solutions

Financial services professionals face unique challenges that generic CRM solutions often fail to address. From compliance to complex relationships, the right CRM streamlines operations and ensures regulatory compliance.

An effective financial services CRM should provide:

- Centralized client data management for comprehensive relationship views

- Robust security features to protect sensitive financial information

- Workflow automation to reduce administrative work

- Compliance tools to maintain regulatory adherence

- Integration capabilities with financial planning and accounting software

Key Features to Look for in Financial Services CRM

When evaluating CRM options for your financial services business, prioritize these essential capabilities that directly impact your team’s efficiency and client satisfaction:

Lead Tracking & Management

Capture, organize, and nurture prospects through your sales pipeline with automated routing and scoring features.

Client Data Management

Maintain comprehensive client profiles with financial history, preferences, and interaction records in one secure location.

Quotes & Invoicing

Create professional quotes and invoices directly within your CRM to streamline the sales process and improve cash flow.

Scheduling & Dispatching

Coordinate client meetings and team tasks using built-in calendars and automated reminders.

Mobile Accessibility

Access client information and perform critical tasks from anywhere using mobile apps or responsive web interfaces.

Automated Follow-ups

Set up triggered communications based on client actions or milestones to maintain consistent engagement.

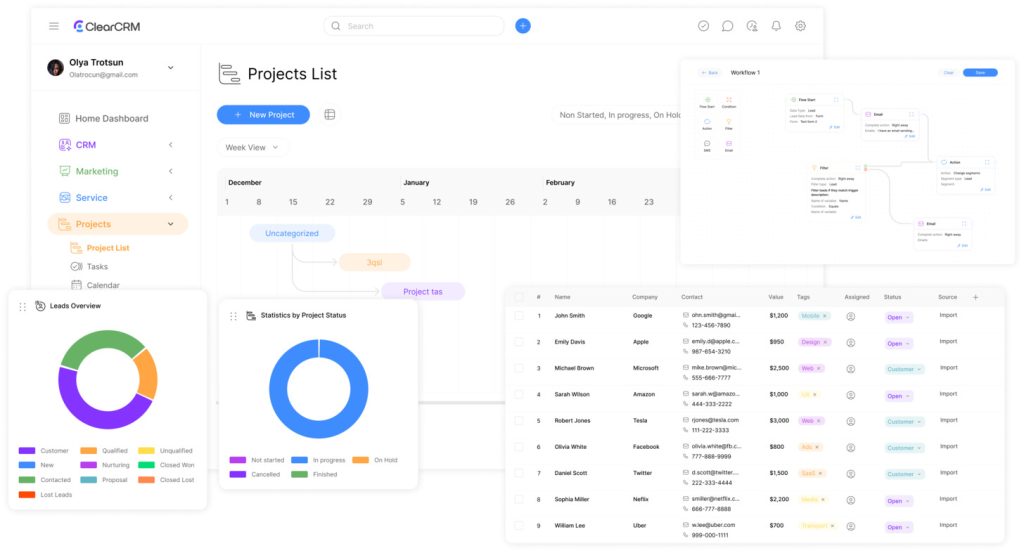

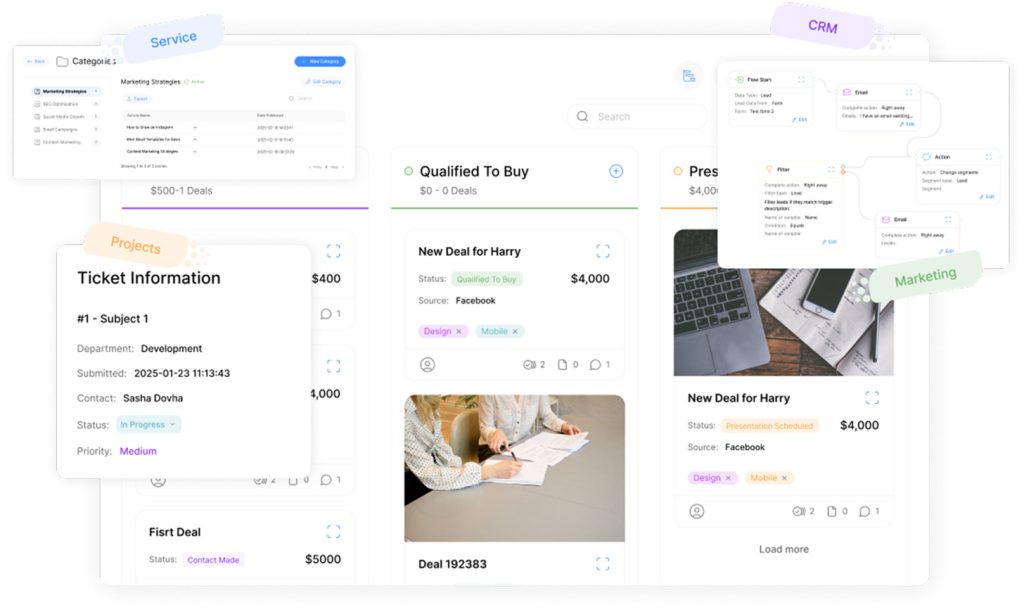

ClearCRM: The Ideal Solution for Financial Services

ClearCRM stands out as a powerful yet affordable solution tailored to the financial sector. With its intuitive interface and powerful automation capabilities, ClearCRM helps advisors and firms improve client management while maintaining compliance.

Key Features of ClearCRM for Financial Services

- Unlimited Pipelines: Create custom sales processes for different financial products and services

- Advanced Lead Assignment: Route leads to the right financial advisor based on expertise or client needs

- Workflow Automation: Reduce manual tasks with triggers and automated emails

- Document Management: Securely store and share financial documents with clients

- Time Tracking & Invoicing: Track billable hours and generate professional invoices

- Custom Fields: Tailor your CRM to capture financial-specific client data

- White Label Branding: Present a professional image with your own logo

Experience ClearCRM’s Financial Services Tools

Start managing your client relationships more effectively today with all the features you need at an affordable price.

CRM Comparison for Financial Services

How does ClearCRM stack up against other popular CRM solutions for financial services? This detailed comparison highlights the key differences in features, pricing, and overall value.

| Features | ClearCRM | Salesforce | HubSpot | Zoho CRM |

| Starting Price | $19/user/month | $25/user/month | $45/user/month | $14/user/month |

| Unlimited Pipelines | Yes (all plans) | Limited in basic plans | Limited in basic plans | Limited in basic plans |

| Lead Capture Forms | Yes | Yes (higher tiers) | Yes | Yes |

| Invoicing & Quotes | Yes | Requires add-on | Requires add-on | Yes (via Zoho Books) |

| Email Automation | Yes | Yes (higher tiers) | Limited in basic plans | Yes |

| Document Management | Yes (Scale plan) | Yes (higher tiers) | Limited | Yes (via integration) |

| Mobile App | Yes | Yes | Yes | Yes |

| AI Tools | Yes | Yes (premium) | Yes (premium) | Yes (Zia) |

Why ClearCRM Stands Out for Financial Services

ClearCRM offers a unique combination of affordability, powerful features, and ease of use that makes it particularly well-suited for financial services professionals.

Affordable Pricing Without Feature Limitations

Unlike many competitors that reserve essential features for premium tiers, ClearCRM provides comprehensive functionality at every price point. The Starter plan at $19/user/month includes unlimited deals, contacts, and sales pipelines—features that often require expensive upgrades with other providers.

Customization Without Complexity

Financial services firms can tailor ClearCRM to their specific needs without requiring technical expertise. Create unlimited custom fields, design multiple sales pipelines for different financial products, and set up automated workflows that match your exact business processes.

Built-In Tools That Others Charge Extra For

ClearCRM includes invoicing, time tracking, and document management capabilities that many competitors offer only as paid add-ons or through third-party integrations.

Ready to Streamline Your Financial Services Practice?

Join financial professionals who are saving time and growing their business with ClearCRM.

Salesforce Financial Services Cloud

Salesforce is a powerful enterprise-level CRM with a specialized Financial Services Cloud offering. While comprehensive, it comes with a steeper learning curve and higher price point than many alternatives.

Pros

- Extensive customization options

- Robust reporting and analytics

- Large ecosystem of integrations

- Strong security and compliance features

Cons

- Significantly higher cost than alternatives

- Complex implementation requiring specialized expertise

- Steep learning curve for users

- Many features locked behind higher-tier plans

HubSpot CRM for Financial Services

HubSpot offers a popular CRM with strong marketing capabilities. While it provides a free tier, financial services firms typically need the paid plans to access essential features.

Pros

- User-friendly interface

- Strong marketing automation tools

- Free starter tier available

- Good educational resources

Cons

- Essential features require expensive upgrades

- Limited customization in lower tiers

- Financial services-specific features lacking

- Pricing increases significantly with additional users

Zoho CRM for Financial Services

Zoho CRM offers an affordable option with a wide range of features. While cost-effective, financial services firms may find some industry-specific capabilities lacking without additional customization.

Pros

- Competitive pricing

- Strong integration with other Zoho products

- Customizable workflows

- AI assistant (Zia) included

Cons

- Interface can feel dated compared to alternatives

- Limited third-party integrations

- Advanced features require higher tiers

- May require technical expertise for customization

Implementing a CRM for Your Financial Services Business

Successful CRM implementation requires careful planning and execution. Follow these steps to ensure a smooth transition and maximize adoption among your team:

- Define Your Objectives: Identify specific goals you want to achieve with your CRM, such as improving client retention or streamlining compliance documentation.

- Map Your Client Journey: Document each touchpoint in your client relationships to ensure your CRM supports every stage.

- Clean Your Data: Prepare existing client information for migration by standardizing formats and removing duplicates.

- Configure Custom Fields: Set up fields specific to financial services, such as account types, risk tolerance, and compliance status.

- Establish Workflows: Create automated processes for common tasks like follow-ups after client meetings or periodic portfolio reviews.

- Train Your Team: Provide comprehensive training to ensure everyone understands how to use the system effectively.

- Monitor and Optimize: Regularly review CRM usage and refine processes to improve efficiency and adoption.

Pro Tip: Start with a pilot group of power users who can test the system and help train others. This creates internal champions who can drive adoption throughout your organization.

Measuring ROI from Your Financial Services CRM

Investing in a CRM should deliver measurable returns for your financial services business. Track these key metrics to evaluate the impact of your CRM implementation:

Client Acquisition Cost

Measure how your CRM reduces the resources needed to convert prospects into clients through improved lead management and automation.

Client Retention Rate

Track improvements in client retention resulting from better relationship management and proactive service.

Revenue Per Client

Monitor increases in cross-selling and upselling success facilitated by comprehensive client insights.

Time Savings

Calculate hours saved through automation of routine tasks and improved information access.

Compliance Efficiency

Measure reductions in time spent on compliance documentation and decreased regulatory issues.

Team Productivity

Assess improvements in advisor productivity through better task management and prioritization.

What Financial Professionals Say About ClearCRM

“After trying several CRM solutions, we found ClearCRM to be the perfect balance of functionality and ease of use. The unlimited pipelines allow us to track different financial products separately, and the automation features have reduced our administrative work by nearly 40%. The affordability compared to enterprise solutions was the deciding factor for our firm.”

“The document management and e-signature features in ClearCRM have transformed our client onboarding process. What used to take days now happens in hours, and clients appreciate the streamlined experience. The customization options let us capture exactly the information we need for compliance without overwhelming our team with unnecessary fields.”

Frequently Asked Questions About CRM for Financial Services

How does a CRM improve client relationships in financial services?

A CRM centralizes client information, allowing advisors to access comprehensive profiles including financial goals, risk tolerance, and interaction history. This enables more personalized service, timely follow-ups, and proactive engagement based on client milestones or market changes. Automation features ensure consistent communication, while analytics help identify opportunities for additional services that align with client needs.

What security features should I look for in a financial services CRM?

Financial services firms should prioritize CRMs with robust security features including data encryption (both in transit and at rest), multi-factor authentication, role-based access controls, audit trails for all user actions, and compliance with relevant regulations like GDPR or CCPA. Additionally, look for regular security updates, penetration testing, and SOC 2 compliance certification.

How long does it typically take to implement a CRM for a financial services firm?

Implementation timelines vary based on firm size and complexity. Small practices can be operational with a cloud-based CRM like ClearCRM in 2-4 weeks, including data migration and basic training. Mid-sized firms typically require 1-3 months for full implementation, while enterprise-level solutions may take 3-6 months or longer. Phased implementations often yield better results than attempting to launch all features simultaneously.

Can ClearCRM integrate with financial planning and portfolio management software?

ClearCRM offers integration capabilities that allow connection with many financial planning and portfolio management tools. While specific integrations are continuously being developed, the platform’s open architecture supports custom connections through APIs. This allows financial advisors to maintain a unified view of client information across different systems without duplicate data entry.

Conclusion: Choosing the Best CRM for Your Financial Services Business

With unlimited pipelines, robust automation, and financial services-specific tools, ClearCRM delivers the functionality you need without the complexity and cost of larger systems. The intuitive interface ensures quick adoption by your team, while the scalable pricing model allows you to start small and grow as your needs evolve.

Transform Your Financial Services Practice Today

Join financial professionals who are streamlining their operations and enhancing client relationships with ClearCRM.

No credit card required. Free forever plan available.