Best CRM for Consumer Finance Services in 2025

Finding the right CRM for your consumer finance business can transform how you manage client relationships and streamline operations. In 2025, financial service providers face unique challenges—from maintaining compliance to managing complex client relationships and sales pipelines. The perfect CRM solution needs to balance powerful features with ease of use while remaining affordable for small to medium-sized businesses.

This comprehensive comparison examines ClearCRM alongside other leading options in the consumer finance sector. We’ll analyze essential features like lead tracking, client management, automation capabilities, and industry-specific tools to help you make an informed decision for your financial services business.

Why Consumer Finance Services Need Specialized CRM Solutions

Consumer finance businesses operate in a highly regulated environment with unique client relationship dynamics. Generic CRM solutions often fall short in addressing industry-specific requirements:

Regulatory Compliance

Financial services must maintain detailed records of client interactions and transactions to meet regulatory requirements. A specialized CRM helps track and document these interactions while ensuring data security and privacy compliance.

Complex Client Relationships

Consumer finance clients often have multiple products and services with varying terms, rates, and renewal dates. A proper CRM system needs to track these relationships comprehensively while providing clear visibility into each client’s financial situation.

Specialized Sales Processes

The sales cycle for financial products often involves multiple touchpoints, detailed needs analysis, and compliance checks. Your CRM should support these specialized workflows while helping track opportunities through each stage.

Field and Remote Work

Financial advisors frequently meet clients outside the office, requiring mobile-friendly CRM solutions that allow for efficient data capture, document management, and scheduling while on the go.

CRM Comparison: Features That Matter for Consumer Finance

We’ve evaluated the top CRM solutions based on features most relevant to consumer finance services. Here’s how ClearCRM compares to other leading options:

| Features | ClearCRM | HubSpot | Zoho CRM | Salesforce |

| Starting Price | $19/user/month Free plan available |

$20/user/month Free plan available |

$20/user/month Free plan available |

$25/user/month |

| Lead Management | Excellent | Excellent | Excellent | Excellent |

| Unlimited Pipelines | Yes | Paid plans only | Paid plans only | Paid plans only |

| Quotes & Invoicing | Included | Premium add-on | Via Zoho Books | Premium add-on |

| Email Marketing | Included in Growth | Separate Marketing Hub | Via Zoho Campaigns | Via Marketing Cloud |

| Document Management | Included in Scale | Premium plans only | Via Zoho WorkDrive | Premium add-on |

| eSignature | Included in Scale | Via integrations | Via Zoho Sign | Premium add-on |

| Workflow Automation | All paid plans | Limited in free plan | Limited in free plan | All plans |

| Mobile App | Yes | Yes | Yes | Yes |

| AI Tools | All paid plans | Premium plans only | Via Zia (AI assistant) | Via Einstein (premium) |

| Ease of Setup | Simple | Moderate | Moderate | Complex |

| Learning Curve | Low | Moderate | Moderate | Steep |

Ready to streamline your financial services with a powerful, easy-to-use CRM?

ClearCRM offers the perfect balance of features, affordability, and simplicity for consumer finance businesses.

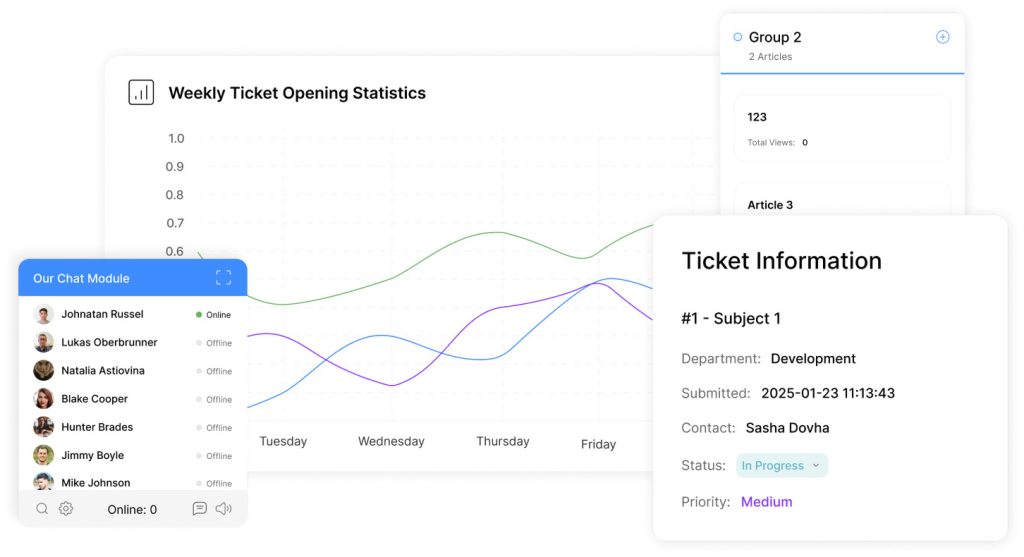

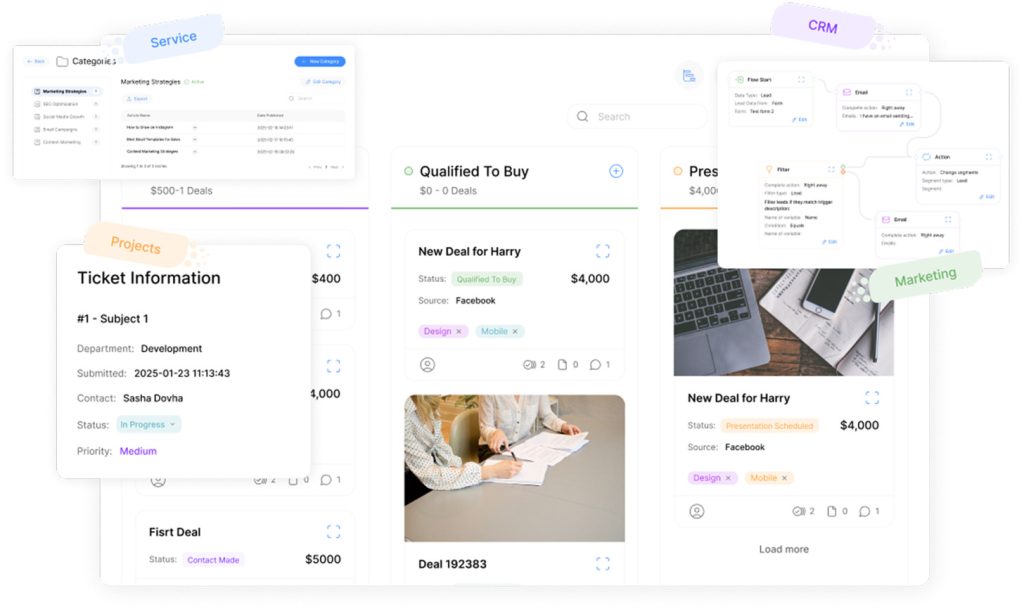

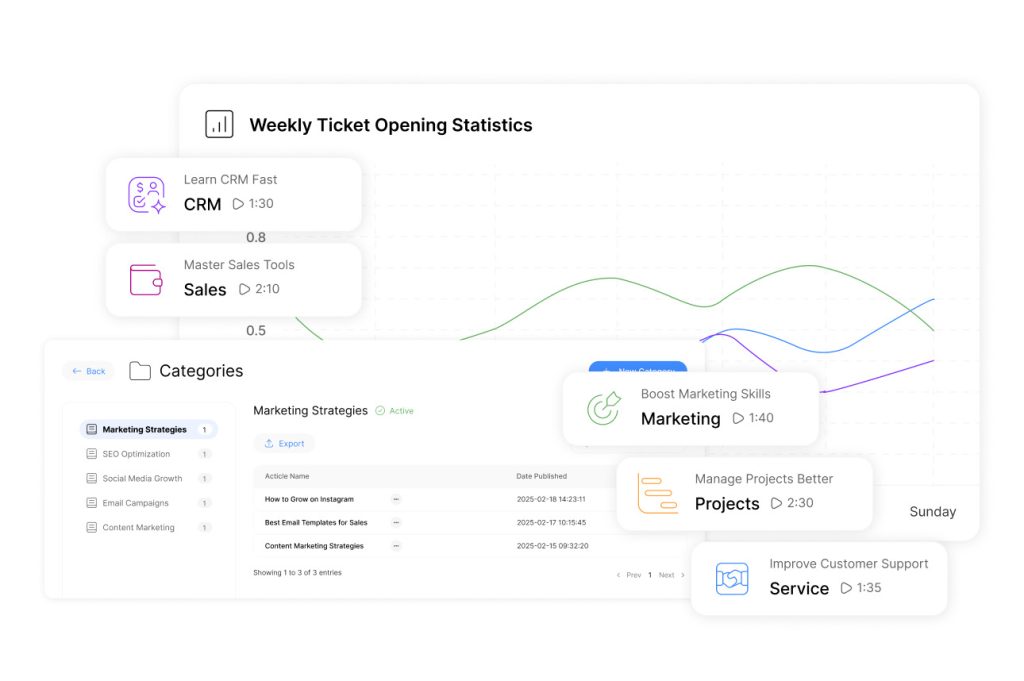

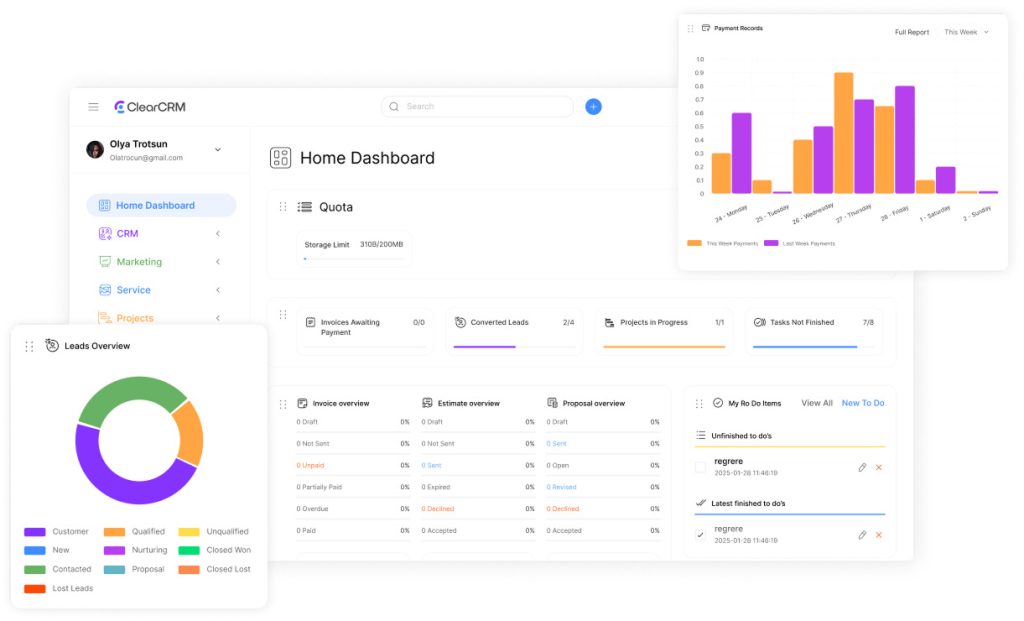

ClearCRM: Designed for Consumer Finance Success

ClearCRM stands out as the ideal solution for consumer finance services with its perfect balance of powerful features and user-friendly design. Built to address the unique challenges of financial businesses, ClearCRM offers comprehensive client management tools at an affordable price point.

Key Strengths for Financial Services

- Unlimited sales pipelines to track different financial products and services

- Built-in invoicing and estimates to streamline financial transactions

- Advanced lead assignment and routing for efficient team management

- Comprehensive document management and eSignature capabilities (Scale plan)

- AI tools to automate repetitive tasks and enhance client communications

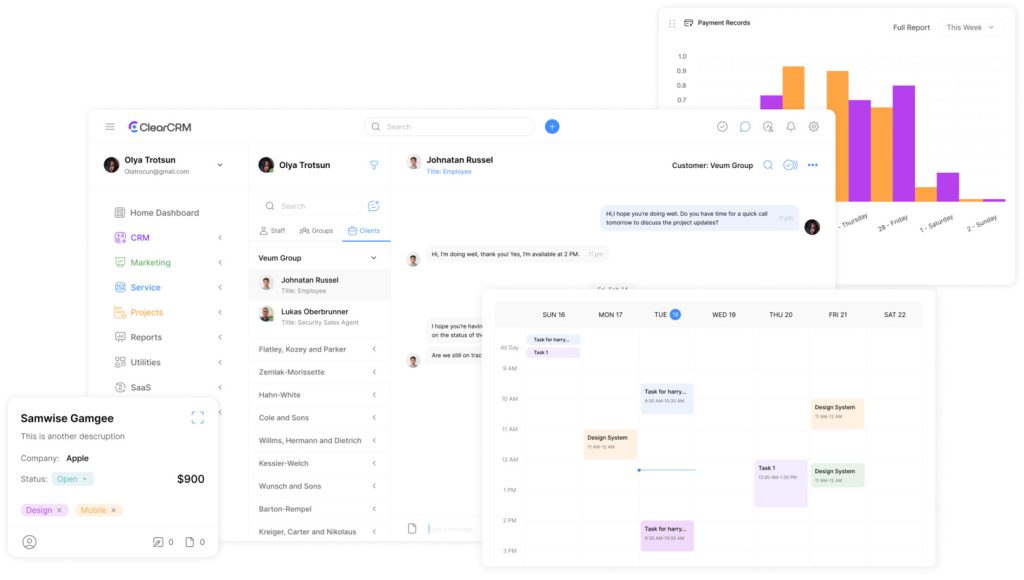

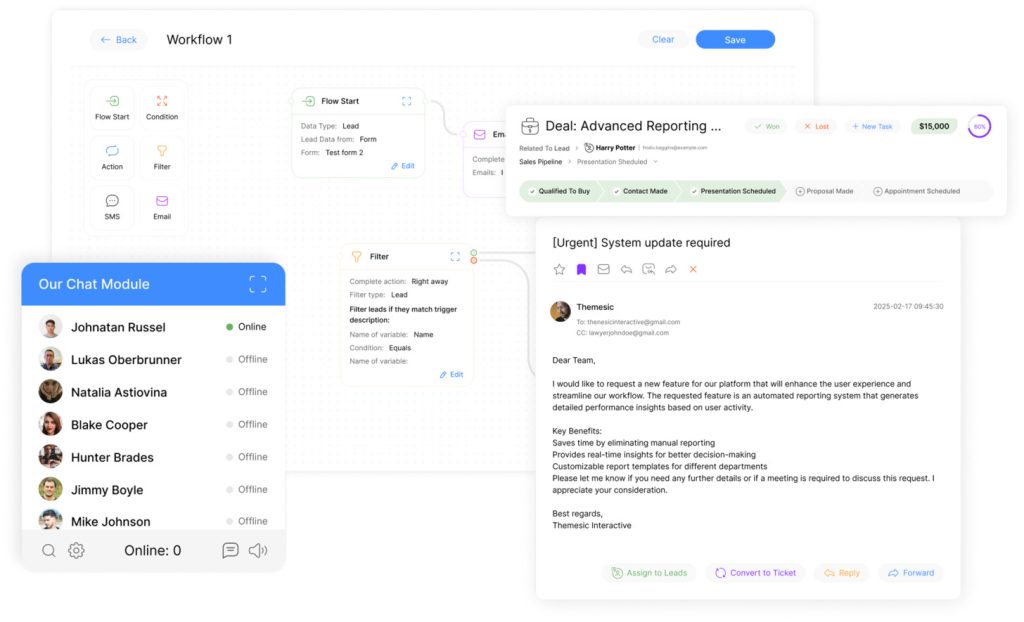

With ClearCRM, financial advisors and teams can manage the entire client journey—from initial lead capture through service delivery and ongoing relationship management—all from a single, intuitive platform.

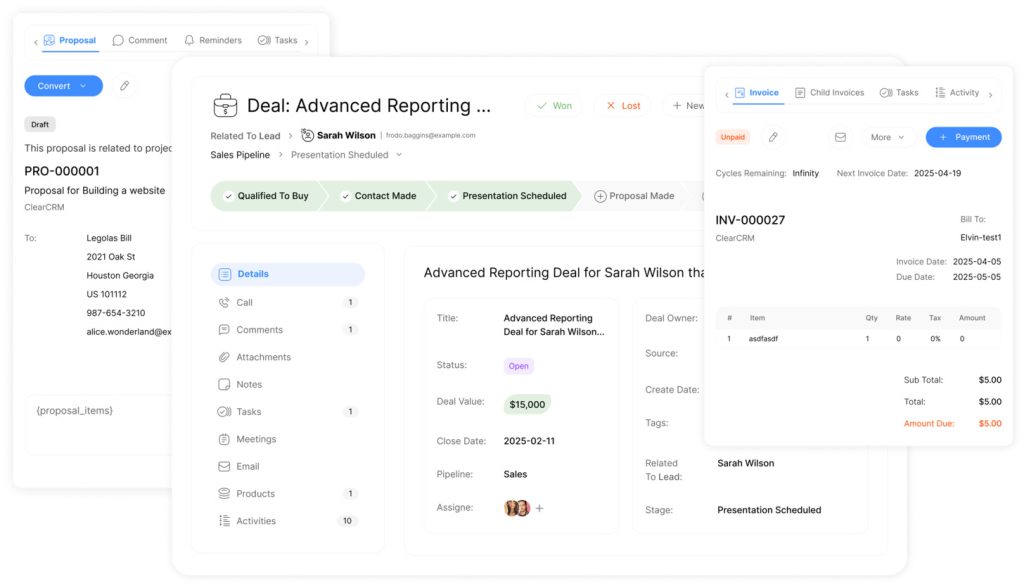

Unlimited Pipelines for Different Financial Products

ClearCRM allows you to create unlimited custom pipelines for different financial products and services. Track mortgage applications, personal loans, insurance policies, and investment opportunities through tailored stages that match your specific sales processes.

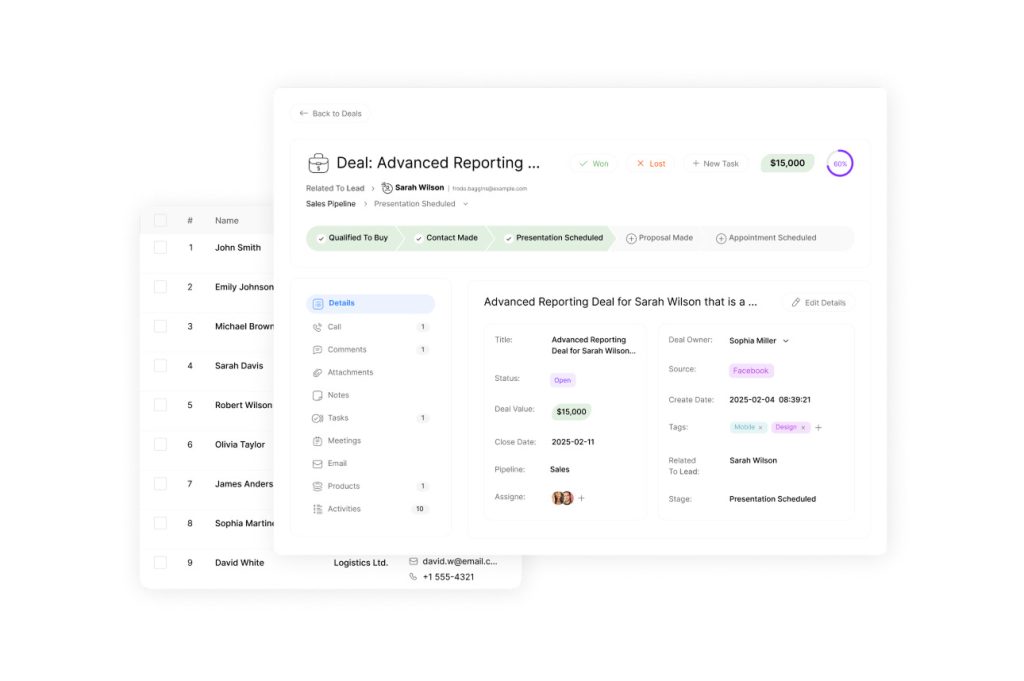

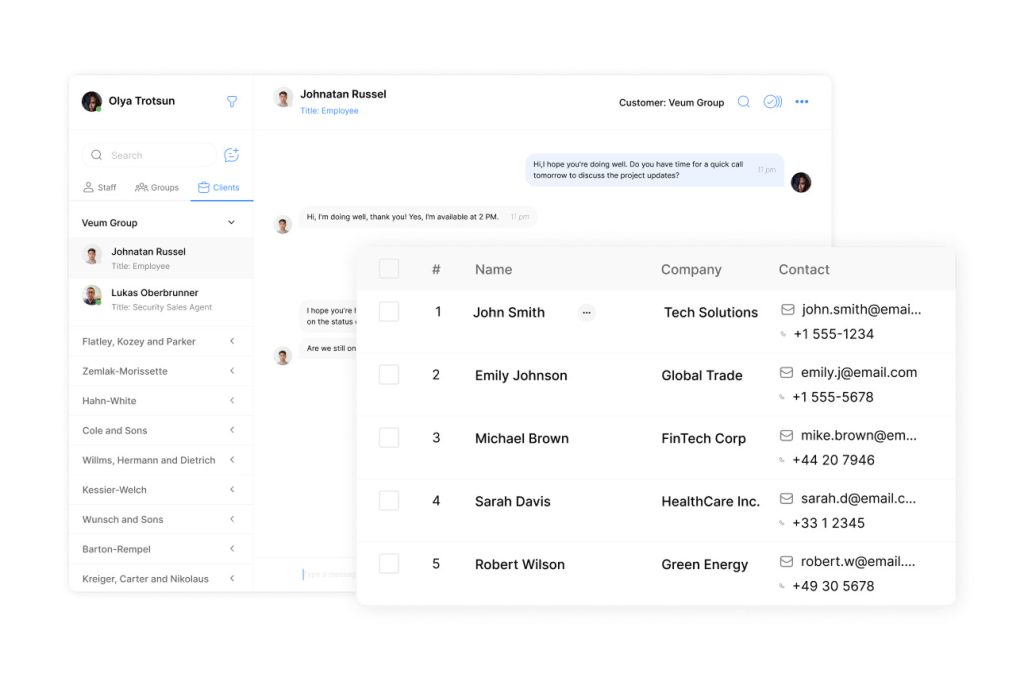

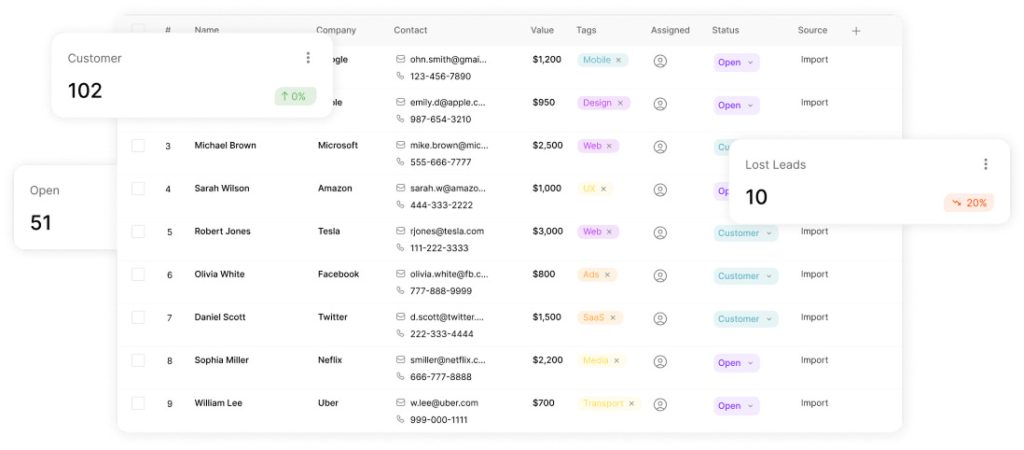

Comprehensive Client Management

Maintain detailed client profiles with complete financial histories, document storage, and interaction tracking. ClearCRM’s centralized contact management ensures you have all client information at your fingertips, enabling more personalized service and cross-selling opportunities.

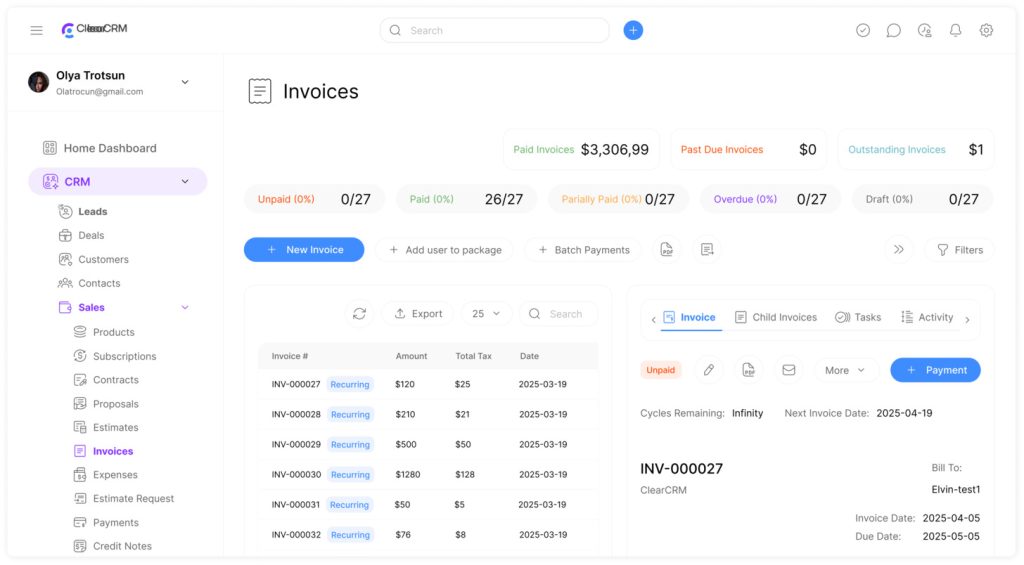

Streamlined Quotes and Invoicing

Create professional quotes and invoices directly within ClearCRM. Track time, manage expenses, and generate financial documents that reflect your brand. The built-in invoicing system eliminates the need for separate billing software, saving you time and reducing potential errors.

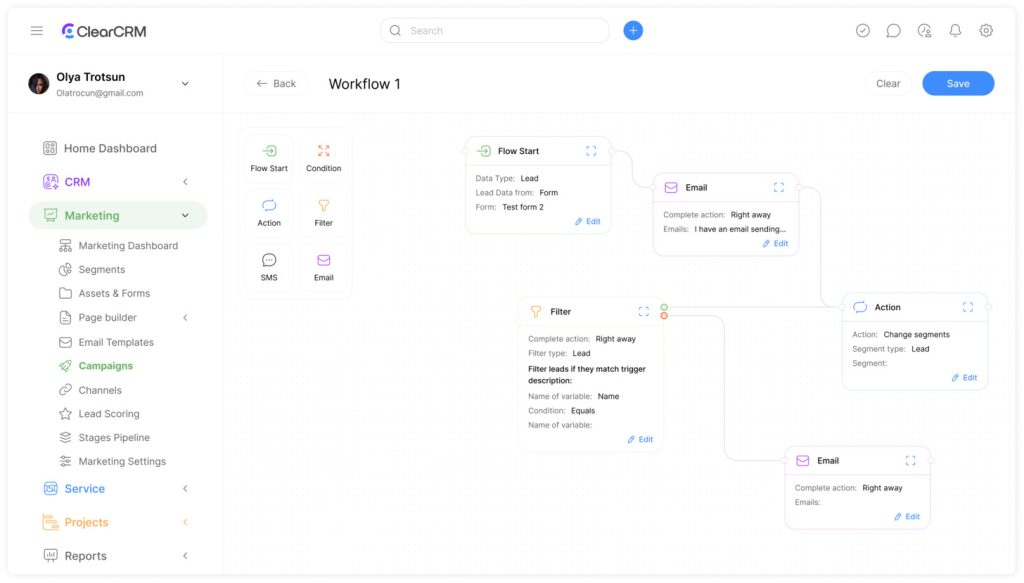

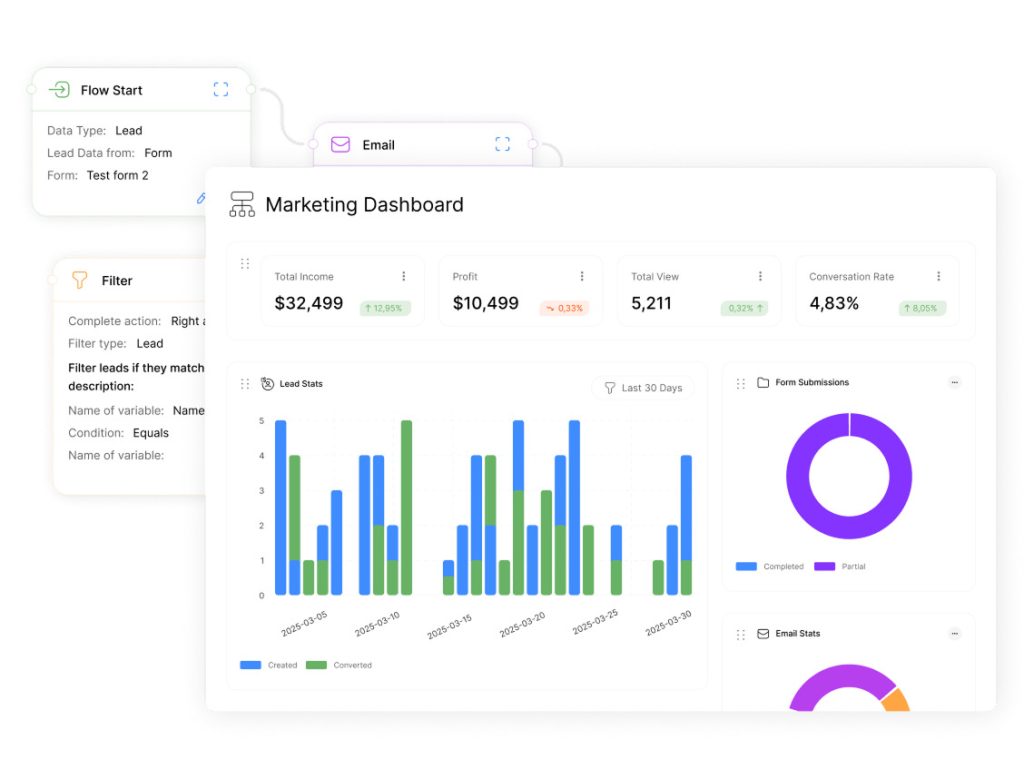

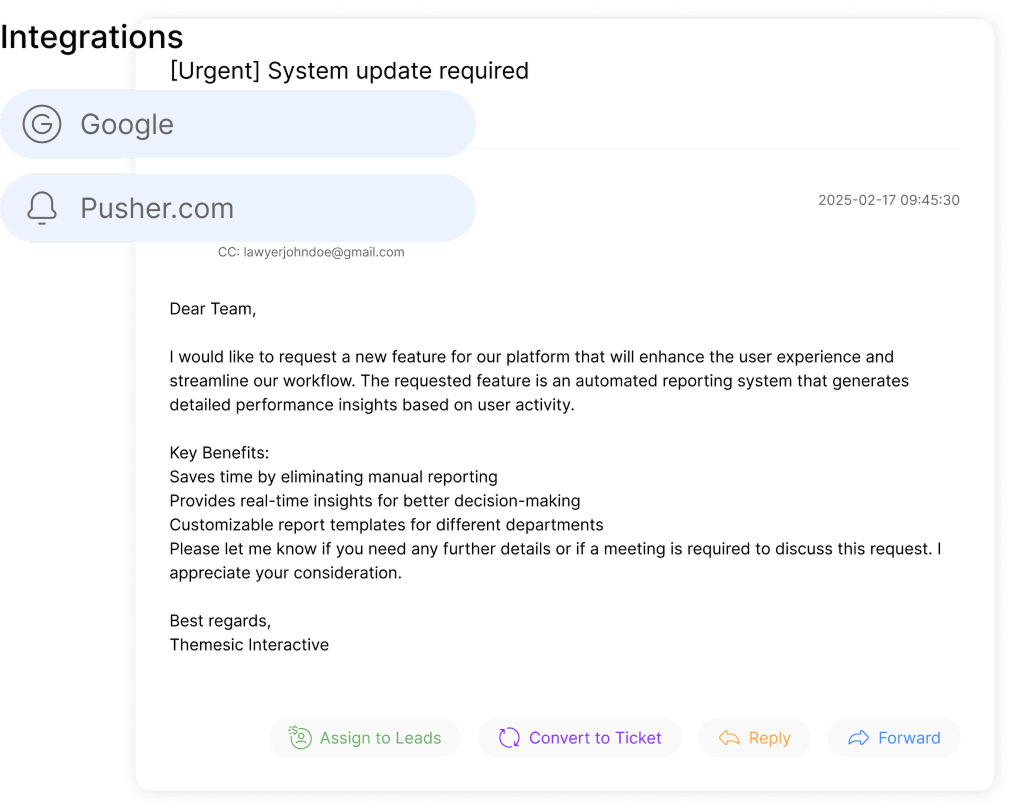

Powerful Automation Capabilities

Automate routine tasks like follow-up emails, appointment reminders, and document requests. ClearCRM’s workflow automation tools help ensure consistent client communication while freeing your team to focus on high-value activities like financial advising and relationship building.

ClearCRM Advantages

- Affordable pricing with a generous free plan

- Unlimited pipelines, contacts, and deals on all paid plans

- Built-in invoicing and time tracking

- User-friendly interface with minimal learning curve

- Comprehensive AI tools included in all paid plans

- White-label branding capabilities

ClearCRM Limitations

- Newer to the market compared to established competitors

- Some advanced features only available in higher-tier plans

- Third-party integrations still expanding

Experience ClearCRM’s powerful features for yourself

Start managing your financial service clients more effectively today with unlimited pipelines, automation, and more.

HubSpot CRM for Financial Services

HubSpot is a well-established CRM platform with a comprehensive suite of marketing, sales, and service tools. While not specifically designed for financial services, its versatility makes it adaptable to various industries, including consumer finance.

Key Features for Financial Services

- Robust contact and company management

- Marketing automation capabilities

- Email tracking and templates

- Meeting scheduling tools

- Customizable dashboards and reporting

HubSpot’s strength lies in its integrated approach to marketing, sales, and customer service, making it suitable for financial services businesses looking to align these functions under one platform.

HubSpot Advantages

- Comprehensive free plan to get started

- Strong marketing automation capabilities

- Excellent content management system

- Robust ecosystem of integrations

- Extensive educational resources

HubSpot Limitations

- Costs escalate quickly with premium features

- Limited financial service-specific features

- Advanced automation requires higher-tier plans

- Can be complex to fully implement

- Limited customization in lower-tier plans

Zoho CRM for Financial Services

Zoho CRM offers a balance of affordability and functionality that appeals to many financial service providers. As part of the broader Zoho ecosystem, it integrates seamlessly with other Zoho applications for accounting, document management, and more.

Key Features for Financial Services

- AI-powered assistant (Zia) for data analysis

- Process management tools for loan and application tracking

- Territory management for financial advisors

- Custom modules for financial products

- Extensive reporting capabilities

Zoho CRM’s strength is its flexibility and integration with other financial tools, making it a solid choice for consumer finance businesses already using other Zoho products.

Zoho CRM Advantages

- Competitive pricing

- Strong AI capabilities with Zia

- Extensive customization options

- Seamless integration with other Zoho apps

- Robust mobile application

Zoho CRM Limitations

- User interface can be less intuitive

- Advanced features distributed across multiple Zoho products

- Limited third-party integrations compared to competitors

- Customer support can be inconsistent

- Steeper learning curve for non-technical users

Salesforce for Financial Services

Salesforce is the industry giant in CRM solutions, offering its Financial Services Cloud specifically designed for the finance industry. It provides enterprise-level capabilities with extensive customization options and powerful analytics.

Key Features for Financial Services

- Purpose-built financial services data model

- Client relationship mapping

- Comprehensive compliance tools

- Advanced analytics and AI with Einstein

- Extensive third-party integration marketplace

Salesforce Financial Services Cloud is designed for larger organizations with complex needs and the resources to implement and maintain a sophisticated CRM system.

Salesforce Advantages

- Comprehensive financial services features

- Highly customizable platform

- Robust security and compliance capabilities

- Extensive third-party app ecosystem

- Advanced AI and analytics

Salesforce Limitations

- Highest cost among competitors

- Complex implementation requiring specialists

- Steep learning curve

- Can be overwhelming for small businesses

- Requires significant ongoing administration

Essential CRM Features for Consumer Finance Services

When selecting a CRM for your consumer finance business, prioritize these critical features to ensure you’re getting the functionality you need:

Lead Management

Capture, track, and nurture leads through your sales funnel. Look for features like lead scoring, assignment rules, and source tracking to optimize your acquisition efforts.

Document Management

Store and organize client documents securely. Financial services require extensive documentation—from loan applications to compliance forms—so robust document handling is essential.

Workflow Automation

Automate repetitive tasks and standardize processes to ensure consistency and compliance. This saves time while reducing the risk of human error in critical financial processes.

Mobile Accessibility

Access client information and perform key actions from anywhere. Financial advisors often work in the field, making mobile functionality crucial for productivity and client service.

Reporting & Analytics

Gain insights into your sales performance, client acquisition costs, and team productivity. Look for customizable dashboards that highlight the metrics most relevant to your financial business.

Integration Capabilities

Connect your CRM with other essential tools like accounting software, payment processors, and compliance platforms to create a seamless workflow across your technology stack.

Implementing a CRM in Your Consumer Finance Business

Best Practices for Successful Implementation

- Define clear objectives for your CRM implementation

- Involve key stakeholders from different departments

- Clean and organize your existing data before migration

- Start with core features and expand gradually

- Provide comprehensive training for all users

- Establish standard operating procedures for CRM usage

- Regularly review and optimize your CRM processes

Measuring CRM Success in Financial Services

Track these key metrics to evaluate your CRM’s impact:

- Lead Conversion Rate: Percentage of leads that become clients

- Client Acquisition Cost: Resources spent to acquire new clients

- Client Retention Rate: Percentage of clients maintained over time

- Cross-Selling Success: Additional products sold to existing clients

- Time to Close: Duration from lead to closed deal

- Team Productivity: Activities and outcomes per team member

- Client Satisfaction: Feedback and satisfaction scores

CRM Implementation Tip

Start with a pilot group of users before rolling out your CRM to the entire organization. This allows you to identify and address potential issues on a smaller scale, refine your processes, and create internal champions who can help with the broader implementation.

Why ClearCRM Stands Out for Consumer Finance Services

After comparing the leading CRM options for consumer finance services, ClearCRM emerges as the optimal choice for most financial service providers, particularly small to medium-sized businesses. Here’s why:

Affordability

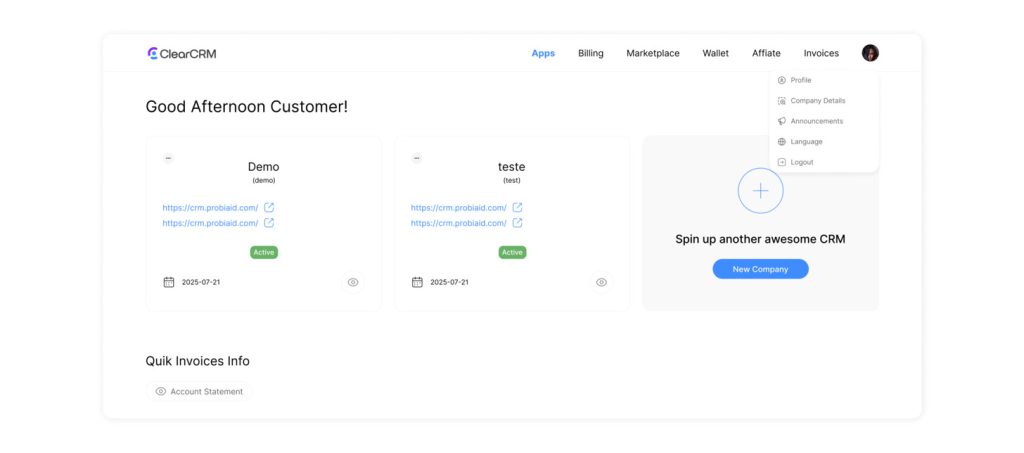

ClearCRM offers comprehensive features at a significantly lower price point than competitors. With plans starting at just $19/user/month and a capable free option, it provides exceptional value for financial businesses of all sizes.

Ease of Use

ClearCRM’s intuitive interface requires minimal training, allowing your team to become productive quickly. This is particularly valuable for financial advisors who need to focus on client relationships rather than complex software.

All-in-One Solution

Unlike competitors that require multiple add-ons or separate products, ClearCRM includes essential financial service tools—like invoicing, document management, and automation—in a single platform.

“After evaluating several CRM options, we chose ClearCRM for our mortgage brokerage. The unlimited pipelines and built-in invoicing have streamlined our operations significantly, while the automation features have reduced our administrative workload by nearly 40%. The affordability compared to other options was the deciding factor.”

Transform Your Consumer Finance Business with ClearCRM

In the competitive landscape of consumer finance services, having the right CRM can be the difference between struggling to keep up and confidently scaling your business. ClearCRM offers the perfect balance of powerful features, ease of use, and affordability that financial service providers need.

With ClearCRM, you can:

- Manage unlimited pipelines for different financial products

- Create professional quotes and invoices directly in your CRM

- Automate follow-ups and routine tasks

- Access client information from anywhere via mobile

- Securely manage documents and collect e-signatures

- Leverage AI tools to enhance productivity

Whether you’re a solo financial advisor or managing a team of professionals, ClearCRM scales to meet your needs without the complexity and cost of enterprise solutions.

Ready to elevate your consumer finance business?

Get started with ClearCRM today and experience the difference a purpose-built CRM can make for your financial services practice.

No credit card required. Free forever plan available.

Frequently Asked Questions About CRM for Consumer Finance

How does a CRM specifically help consumer finance businesses?

A CRM helps consumer finance businesses by centralizing client information, tracking interactions, managing documents, automating workflows, and ensuring compliance. This enables financial advisors to provide more personalized service, identify cross-selling opportunities, and maintain detailed records for regulatory purposes. The right CRM also streamlines operations by automating routine tasks like follow-ups and document collection.

Is ClearCRM compliant with financial regulations?

ClearCRM provides the tools needed to maintain compliance with financial regulations, including secure document storage, detailed activity logging, and permission-based access controls. The platform helps you organize and track client information and interactions in accordance with regulatory requirements. However, it’s important to configure your CRM processes to align with specific regulations relevant to your financial services business.

Can I migrate my existing client data to ClearCRM?

Yes, ClearCRM supports data migration through CSV imports, making it straightforward to transfer your existing client information, deal records, and other data from your current system. The platform provides tools to map your data fields appropriately during import. For larger or more complex migrations, ClearCRM’s support team can provide guidance to ensure a smooth transition.

How does ClearCRM compare to industry-specific financial service software?

While industry-specific financial software often excels at specialized functions like loan processing or portfolio management, ClearCRM offers a more comprehensive approach to client relationship management with greater flexibility. ClearCRM provides the core CRM functionality needed by financial services while being more adaptable, user-friendly, and affordable than many specialized solutions. Many businesses find that ClearCRM complements their industry-specific tools rather than replacing them.

What kind of support does ClearCRM offer during implementation?

ClearCRM provides multiple support options during implementation, including detailed documentation, video tutorials, and responsive customer service. The platform’s intuitive design minimizes the need for extensive training, but help is available when needed. Higher-tier plans include additional onboarding assistance and access to dedicated success managers who can help tailor the system to your specific financial service workflows.

Conclusion: The Best CRM for Consumer Finance Services in 2025

Selecting the right CRM is a critical decision for consumer finance businesses looking to enhance client relationships, streamline operations, and drive growth. While each platform we’ve reviewed offers valuable features, ClearCRM stands out as the best overall solution for most financial service providers in 2025.

With its combination of affordable pricing, comprehensive features, and user-friendly design, ClearCRM delivers exceptional value without the complexity and high costs associated with enterprise solutions. The platform’s unlimited pipelines, built-in invoicing, document management, and automation capabilities address the specific needs of consumer finance professionals.

Whether you’re a mortgage broker, financial advisor, insurance agent, or consumer lender, ClearCRM provides the tools you need to manage client relationships effectively while maintaining compliance and operational efficiency.

Take the next step in optimizing your financial services business

Join thousands of financial professionals who have transformed their business with ClearCRM.

No credit card required. Free forever plan available.