The Ultimate Guide to Revenue Tracking for Business Success

Revenue tracking helps businesses monitor their income streams in real time. Every thriving organization relies on systematic processes to monitor financial health and drive growth. By analyzing core metrics like income streams, customer behavior, and market trends, companies gain actionable insights to refine strategies and boost efficiency. Experts emphasize that success begins with identifying the right performance indicators—whether activity-based measurements or direct financial outcomes.

Modern enterprises face complex challenges managing diverse income sources. Subscription models, one-time sales, and recurring payments demand precise monitoring tools. This approach helps teams spot patterns, allocate resources effectively, and maintain profitability across departments. Businesses mastering these techniques often achieve improved forecasting and stronger customer relationships.

Cross-department alignment is critical for meaningful results. Sales, marketing, and finance teams must collaborate to ensure consistent data collection and interpretation. Clear objectives guide tool selection and methodology development, creating a foundation for sustainable expansion. When done right, revenue tracking becomes a strategic asset—not just a reporting task.

Key Takeaways

- Systematic financial analysis fuels sustainable growth and operational clarity

- Data-driven insights help optimize pricing and customer retention strategies

- Modern income streams require tailored monitoring approaches

- Cross-department alignment ensures accurate data interpretation

- Clear objectives should guide tool selection and implementation

By analyzing revenue tracking data, businesses can optimize pricing and sales strategies.

Measuring financial performance starts with understanding core metrics. These indicators reveal growth patterns and operational efficiency. Companies must select measurements aligned with their operational structure and strategic goals.

Identifying Key Performance Metrics

Essential metrics vary by business model. Subscription-focused organizations prioritize monthly recurring income and customer lifetime value. Transaction-based enterprises track sales volume and average deal size. Cross-department collaboration ensures accurate data collection across all income streams.

| Business Type | Primary Metrics | Growth Opportunities |

|---|---|---|

| Subscription-Based | Monthly Recurring Income | Diversified Income Sources |

| Transaction-Based | Sales Volume | Frequency of Transactions |

Evaluating Pipeline Speed and Customer Loss

Evaluating pipeline velocity shows how quickly prospects convert to paying clients. Slow movement may indicate bottlenecks or resource gaps. Customer attrition rates highlight retention challenges directly affecting profitability.

Establishing baseline measurements enables progress tracking. Teams regularly analyzing these metrics spot trends faster and adjust strategies proactively. Cross-department collaboration ensures consistent interpretation and action.

Building a Consistent Revenue Tracking Process

Creating reliable financial insights requires structured data collection methods. Organizations gain clarity by mapping all income streams and standardizing evaluation cycles. This transforms raw numbers into strategic assets guiding operational decisions.

Establishing Evaluation Rhythms

Teams establish reporting frequencies based on operational tempo. Fast-paced enterprises often benefit from weekly check-ins, while stable organizations might prefer monthly reviews. Regular intervals enable pattern recognition and timely strategy adjustments.

Seasonal businesses could implement quarterly comparisons to account for market fluctuations. The key lies in maintaining uniform methodologies across reporting periods. This consistency allows for meaningful performance comparisons over extended durations.

Optimizing Data Capture Systems

Modern organizations use standardized templates to document earnings from diverse channels. These include subscription renewals, partnership commissions, and service fees. Automated validation checks reduce human error during information entry.

Comprehensive documentation ensures continuity during staff transitions. It also simplifies compliance audits and investor updates. Regular system reviews help adapt processes to new market conditions or expanded service offerings.

“Standardized financial documentation acts as both compass and anchor—it guides decisions while stabilizing operations during market shifts.”

Effective protocols help identify emerging trends in customer spending habits. These insights inform inventory planning and staffing needs. When paired with historical data, teams can predict future performance with greater accuracy.

Leveraging Tools and Strategies for Revenue Growth

Modern businesses thrive by combining analytical tools with strategic execution. Organizations that master this balance often outperform competitors through smarter resource allocation and agile decision-making.

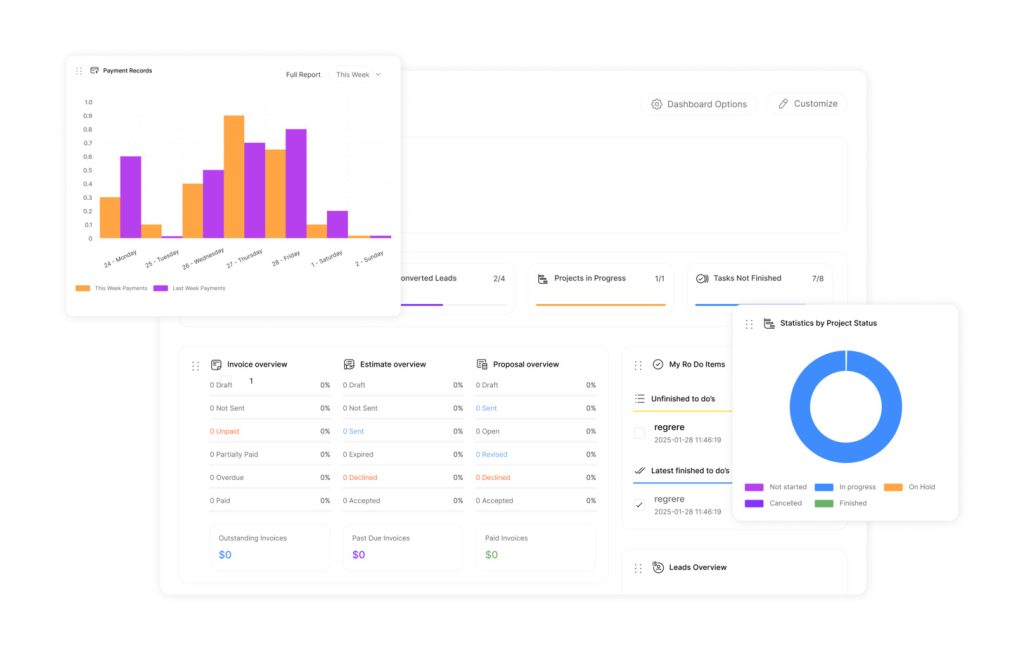

Automated revenue tracking reduces errors and provides clear insights into business growth.

Analytics platforms reveal patterns in sales cycles and customer preferences. Teams using these insights can refine deal structures or reallocate budgets within days. For example, seasonal businesses might adjust staffing based on historical transaction data to maximize profits.

Optimizing Marketing and Sales Alignment

Integrated campaigns reduce duplicated efforts between departments. A shared dashboard helps both teams prioritize high-value leads and track deal progress. This approach is particularly effective for restaurant groups managing multiple locations with varied customer bases.

| Strategy | Key Actions | Impact |

|---|---|---|

| Dynamic Pricing | Adjust rates based on demand | 15-20% profit increase |

| Cross-Selling | Bundle complementary services | 30% higher deal size |

| Client Segmentation | Prioritize high-value accounts | 45% faster conversions |

Revenue tracking allows teams to measure performance against targets and goals.

Additionally, with accurate revenue tracking, companies can identify trends and make informed financial decisions. Finally, regular price audits ensure offerings match market realities. Also, many companies now use tiered pricing – basic, premium, and enterprise packages – to capture value across customer segments. So, this method increases deal closure rates while maintaining service quality.

However, “The most successful businesses treat pricing as living strategy, not set-it-and-forget-it policy.”

Similarly, CRM solutions help track which services generate the most repeat business. Likewise, teams can then focus resources on high-performing offerings while phasing out underutilized options. Indeed, this strategic pruning often leads to leaner operations and improved margins.

Conclusion

Clearly, mastering financial insights transforms raw data into strategic assets. Undoubtedly, businesses achieve this through integrated systems that analyze deal types, recurring payment patterns, and client behavior. Nevertheless, platforms like HubSpot’s analytics tool demonstrate how categorizing new business, renewals, and churn events sharpens monthly forecasts.

Still, effective systems capture essential details—monthly amounts, inactive dates, and reasons for account changes. Yet, this approach builds accurate reports that reveal growth opportunities. Therefore, teams using these systems categorize transactions by type—new acquisitions, renewals, or upgrades—to pinpoint growth opportunities.

Consequently, for lasting success, tools must align with existing sales workflows. Ultimately, a CRM solution that auto-updates deal stages ensures real-time visibility across services and products. Thus, regular analysis of purchase trends helps teams adjust strategies quickly, maintaining competitive momentum.

Namely, organizations prioritizing these methods gain two advantages: precise forecasting and stronger client relationships. Next, the result? Sustainable growth powered by data-driven decisions rather than guesswork.